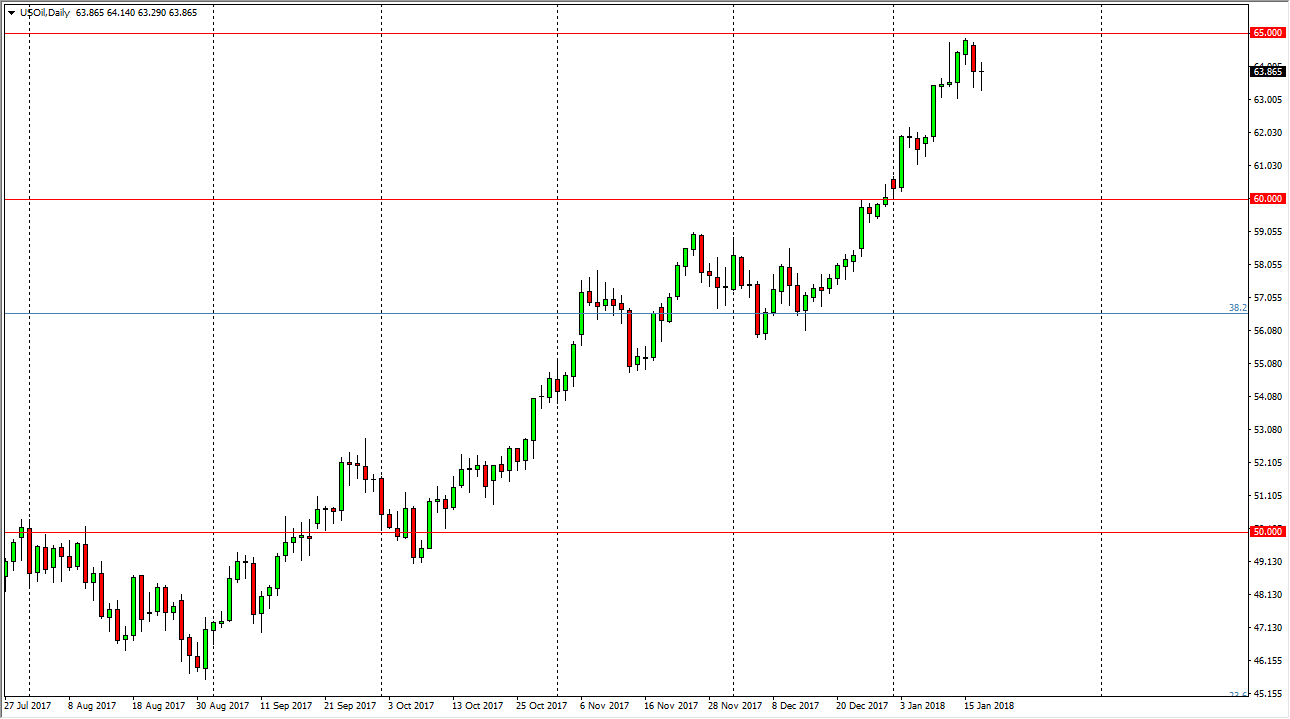

WTI Crude Oil

The WTI Crude Oil market drifted a bit lower during the trading session on Wednesday, but turned around to form a hammer. The hammer of course is a very supportive candle, so I think that we are going to see another run towards the $65 level. That’s an area that should be a significant barrier, but once we break above there, the market should then go even higher. A breakdown below the $63 level should send this market down to lower levels, perhaps being an opportunity to pick up value. If we do break down below the $63 level, I would expect that the $60 level would be targeted next. A break above the $65 level should send this market to the $67.50 level. This is a market that will continue to be very noisy, but at this point I think that the volatility is the only thing you can count on.

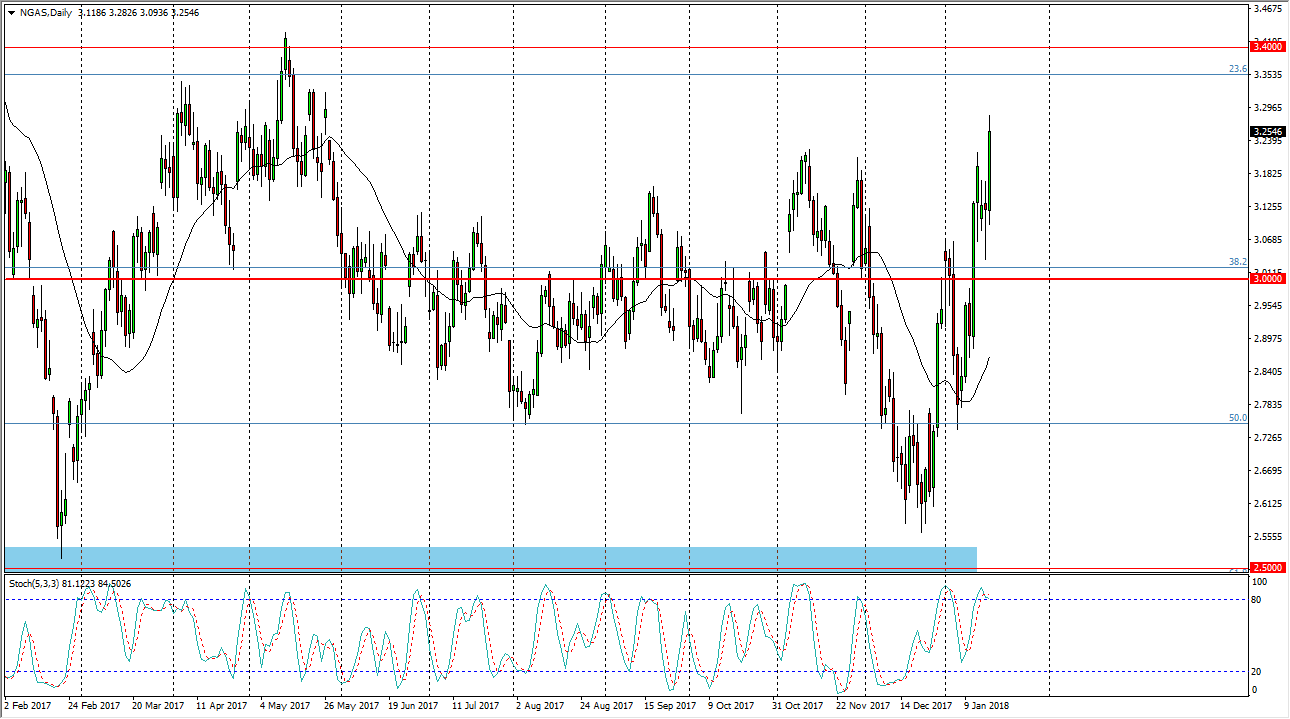

Natural Gas

The natural gas markets initially drifted lower during the trading session on Wednesday, but then exploded higher yet again to make a fresh, new high. A break above the top of the hammer from the previous session is a bullish sign, and the $3.28 above should be the beginning of significant resistance yet again. Ultimately, the $3.40 level above is massively resistive, and that is an area that should be a massive barrier. Ultimately, I’m looking for some type of exhaustive candle that I can take advantage of, as we should then continue the overall volatility that we have seen over the last couple of years. This is typically the peak of the bullish season for natural gas, which is normally followed by extremely negative pressure. The cold weather as of late has kept some drillers from supplying the marketplace, but given enough time the oversupply issue continues.