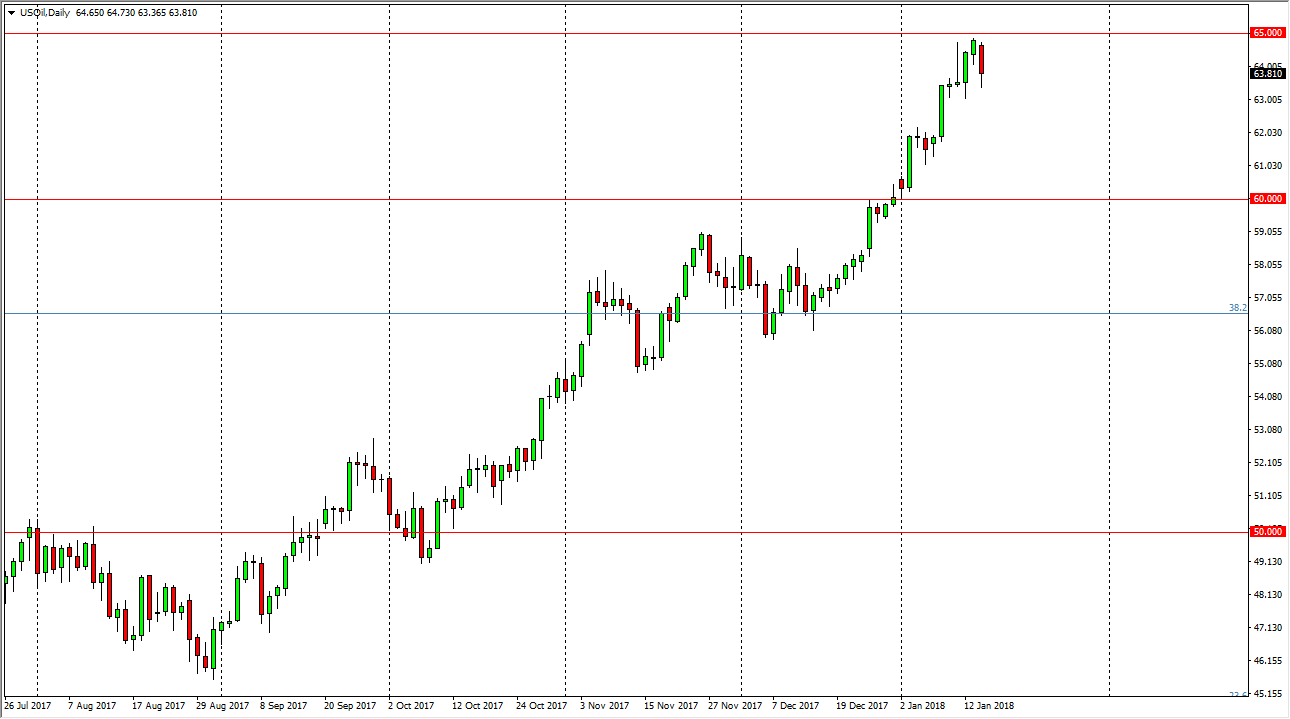

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the day, reaching towards the $63.50 level. There is a significant amount of structural importance to this level, so I think it’s only a matter of time before the buyers get involved. I would anticipate a rally from here will more than likely be an opportunity to build up momentum to finally break out above the vital $65 handle. Move above there sends the market much higher, with the initial target being the $67.50 level. A breakdown below the $63.50 level should be an opportunity to pick up value, which of course hedge funds have been doing for some time now. If we were to break down below the $63.50 level, the market will more than likely go looking towards the $60 level after that, which will be even more supportive in general.

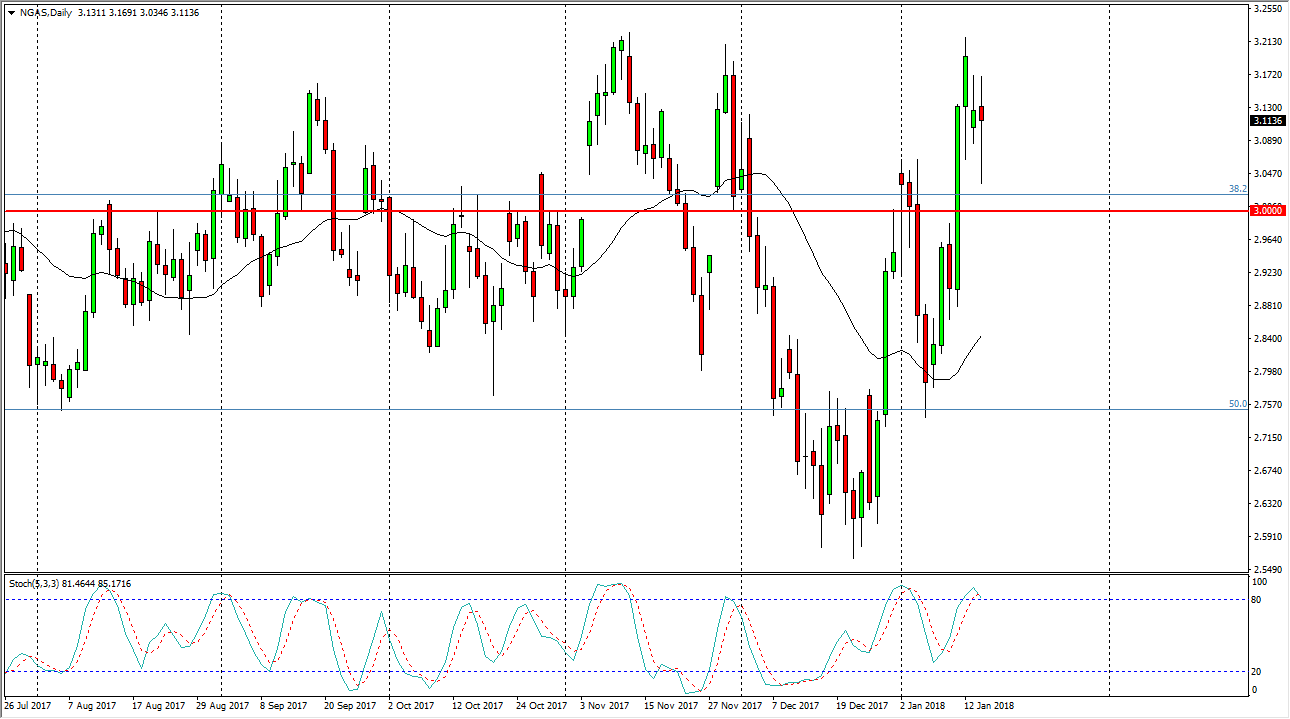

Natural Gas

The natural gas markets have been extraordinarily noisy during the trading session on Tuesday, as the volume picked up after the Martin Luther King Jr. holiday. Because of the volatility that we have seen, I think that the market will continue to be very difficult to hang onto, but I think ultimately you need to look at the history of this market, which has been every time we show signs of strength, there is nothing but disappointment for the buyers. A breakdown below the $3.00 level should send this market down to the $2.75 level next. I think there is more than enough resistance at the $3.20 level to keep this market down, and I think that any signs of exhaustion should be an opportunity to go short yet again. This is the most bullish season of the year, and yet we don’t hang on the gains.