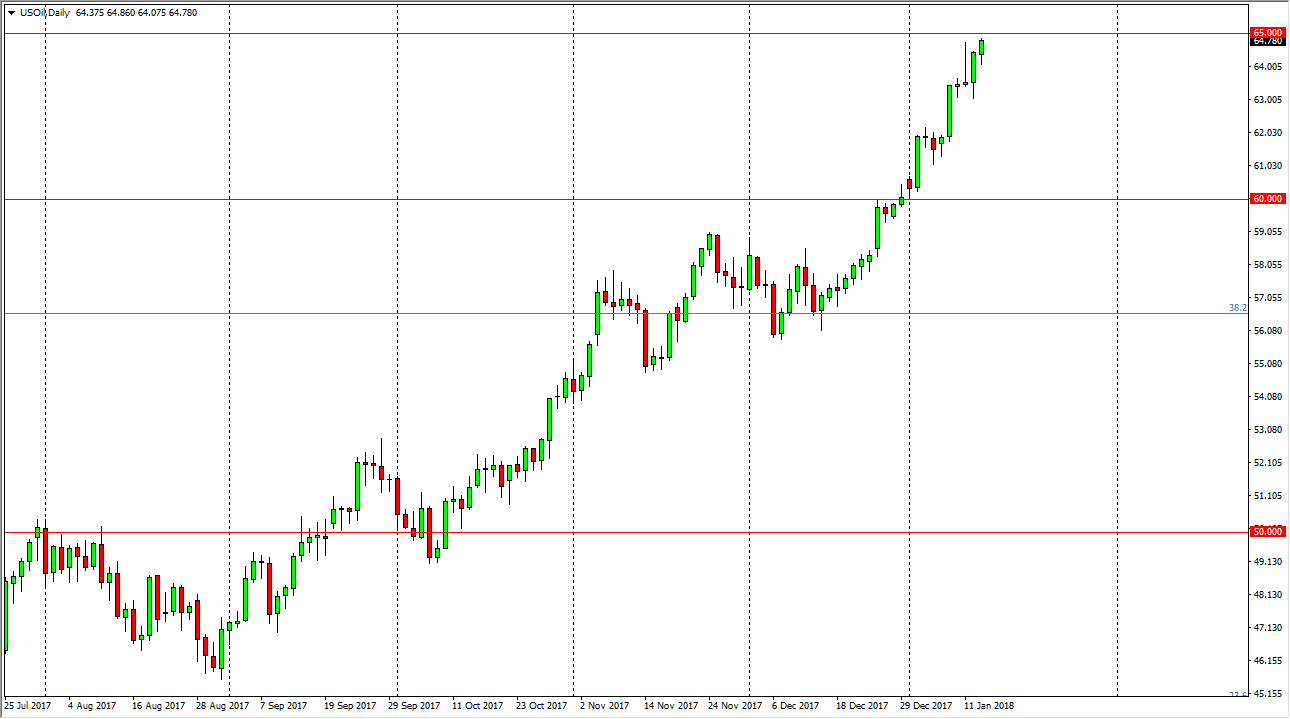

WTI Crude Oil

The WTI Crude Oil market initially dipped during the trading session on Monday, but turned around to rally towards the $65 level. This is a market that continues to show a significant amount of buying pressure, but Monday was of course very thin as far as the volume is concerned, as Americans were celebrating the Martin Luther King Jr. holiday. I believe that pullbacks to offer buying opportunities though, especially near the $64 level, which of course is a large, round, psychologically significant number, and an area where we have seen a bit of resistance in the past. I think we may have to pull back several times to build up enough momentum to finally break out to the upside. We are overbought, so these pullbacks of course make sense.

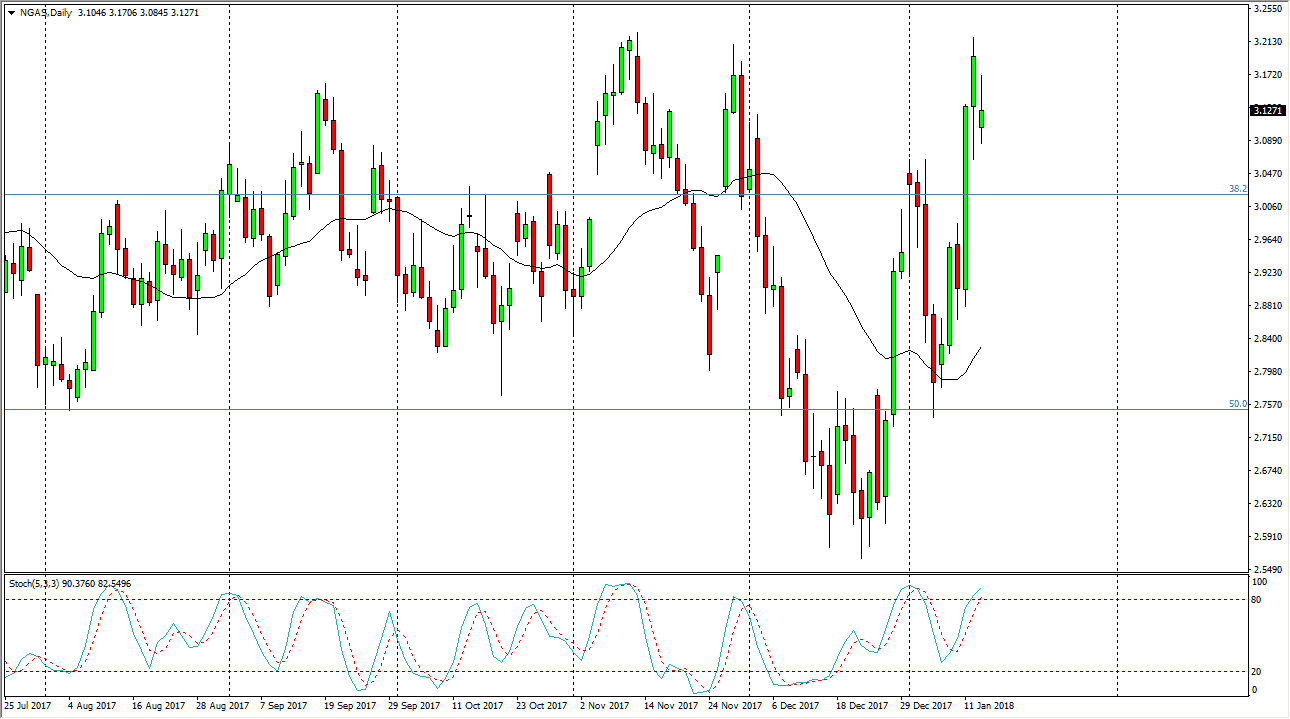

Natural Gas

The natural gas markets have gapped lower at the open on Monday, and then rallied a bit to find sellers again. The candle that form for the trading session is a shooting star, and I think that it is only a matter of time before we go lower, as the $3.20 level above is massively resistive, and the scene of a major resistance as the market deals with an oversupply of natural gas in the United States, and of course people are willing to put that supply of natural gas into the marketplace as soon as it gets to be somewhat profitable to do so. With this in mind, I think that there is a bit of a permanent ceiling in the market, and I believe that a breakdown below the lower range of the trading session on Monday is an opportunity to start selling yet again. This market’s going to be noisy, but quite frankly have no interest in trying to play both sides of the trade, I am more comfortable shorting.