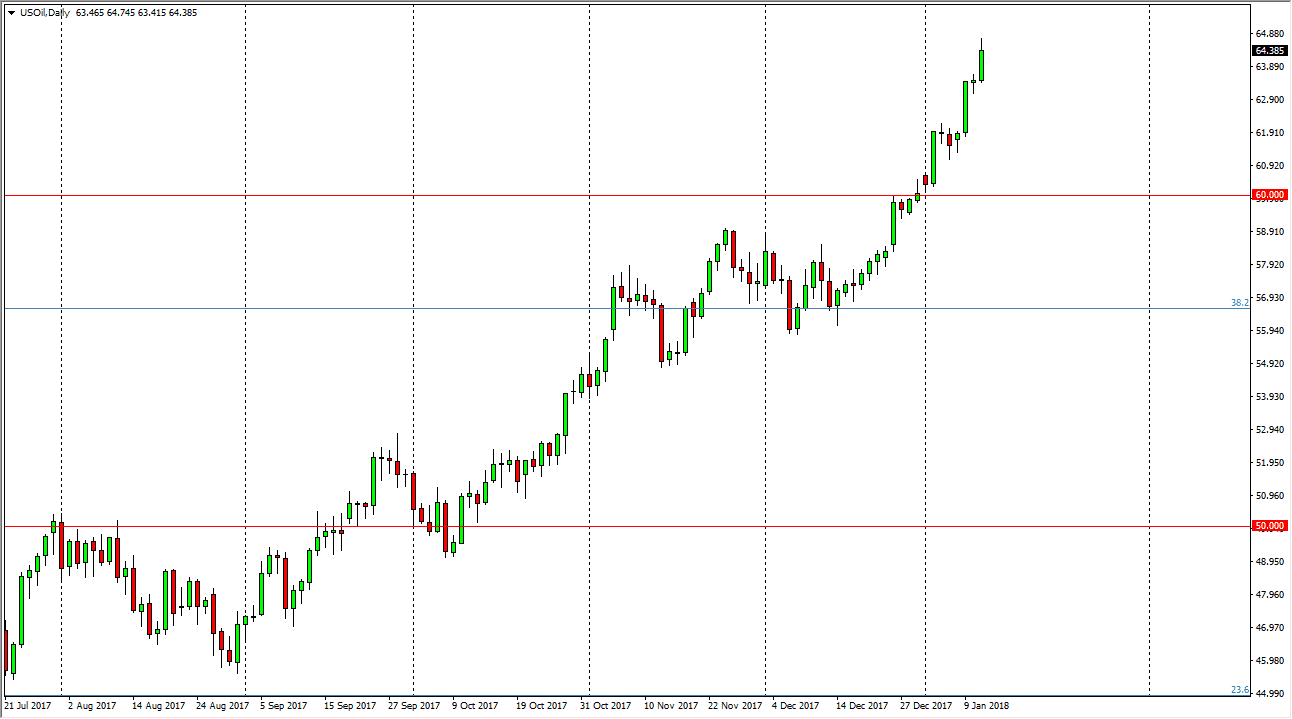

WTI Crude Oil

The WTI Crude Oil market rallied again during the trading session on Thursday, as we reached towards the $64.50 level. The market continues to be very bullish, and even though we are bit overextended, I think we’re probably going to make a serious challenge to the $65 handle. I think pullbacks at this point are buying opportunities, especially if the US dollar continues to soften. I look at the $60 level as the “floor” in the market right now, and I think that selling is all but impossible under the current environment. I think that a break above the $65 level is possible, but we may need to pull back a couple of times to build up the necessary momentum. OPEC cutting back on production of course has an effect, but more importantly, the US dollar has been falling which means that it will take more of those US dollars to buy a barrel of oil.

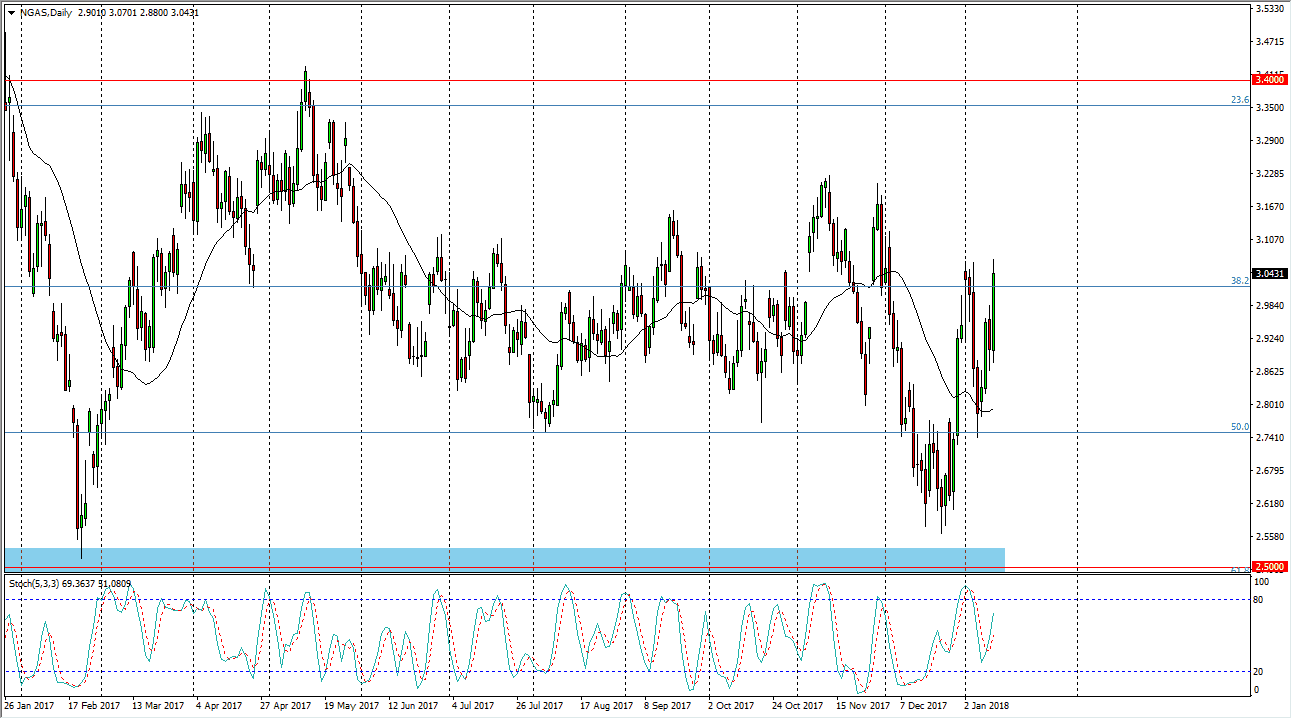

Natural Gas

Natural gas markets had a very bullish session on Thursday, reaching towards the $3.05 level after the announcement came out that more storage had been used than anticipated in the Americas. That of course is bullish for the natural gas markets, but when you look at the longer-term charts, which of course I have zoomed out in this video, you can see that there is a clear barrier of resistance above. We are seen quite a bit of volatility, but that’s expected as it is winter time in the northeastern part of the United States, atypically bullish time here. However, the same time we still have a massive oversupply of natural gas, and plenty of suppliers out there to flood the market with supply once we get above the $3 handle, so I think it’s only a matter of time before we roll over. I wouldn’t do anything today, but on and exhaustive daily candle, I’d be more than willing to short again.