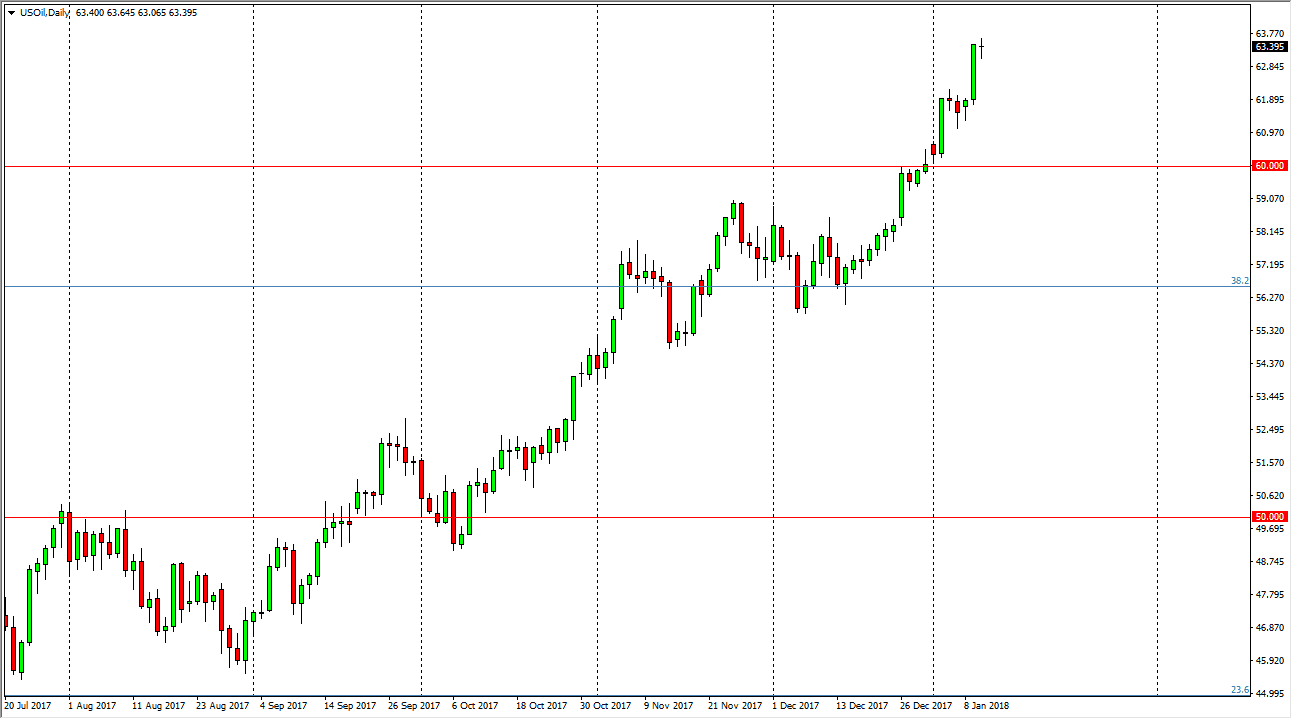

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Wednesday, forming a neutral candle. We have gotten a bit overextended, so it makes sense that we would pull back a little bit. I think at this point, we could go looking for the $62 level underneath, possibly even the $60 after that. Either way, there should be plenty of support underneath, and at that point I would be willing to buy on signs of a bounce. I think that over the longer term, the market probably goes to the $65 level, which is another psychologically important area. Alternately, if we were to roll over and break below the $60 level, we should continue to go much lower. I think that the crude oil market is going to continue to be very volatile, based upon headlines coming out of OPEC and of course the US dollar going back and forth.

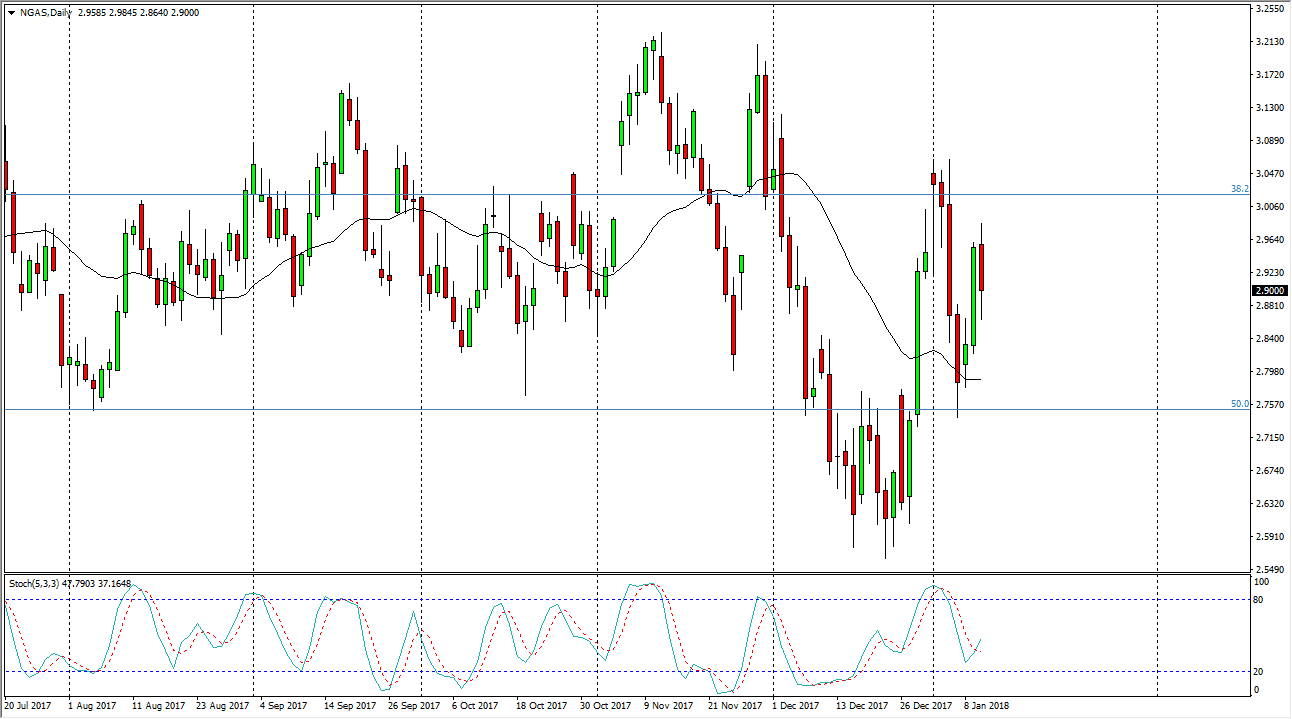

Natural Gas

Natural gas markets ended up forming a negative candle during the trading session on Wednesday, as the market continues to be very noisy. The $3 level above has offered resistance, and I think that every time we rally, you should be looking at the market for potential exhaustion candles to start selling. If we rally towards the $3 or even the $3.10 level, I would jump on the first signs of exhaustion to start selling yet again. The market will probably go looking towards the $2.75 level underneath, which has proven itself to be rather important and supportive. It’s not until we break above the $3.20 level that I would be comfortable buying this market. There is a gap just above current pricing from a couple of weeks back that could be important as well.