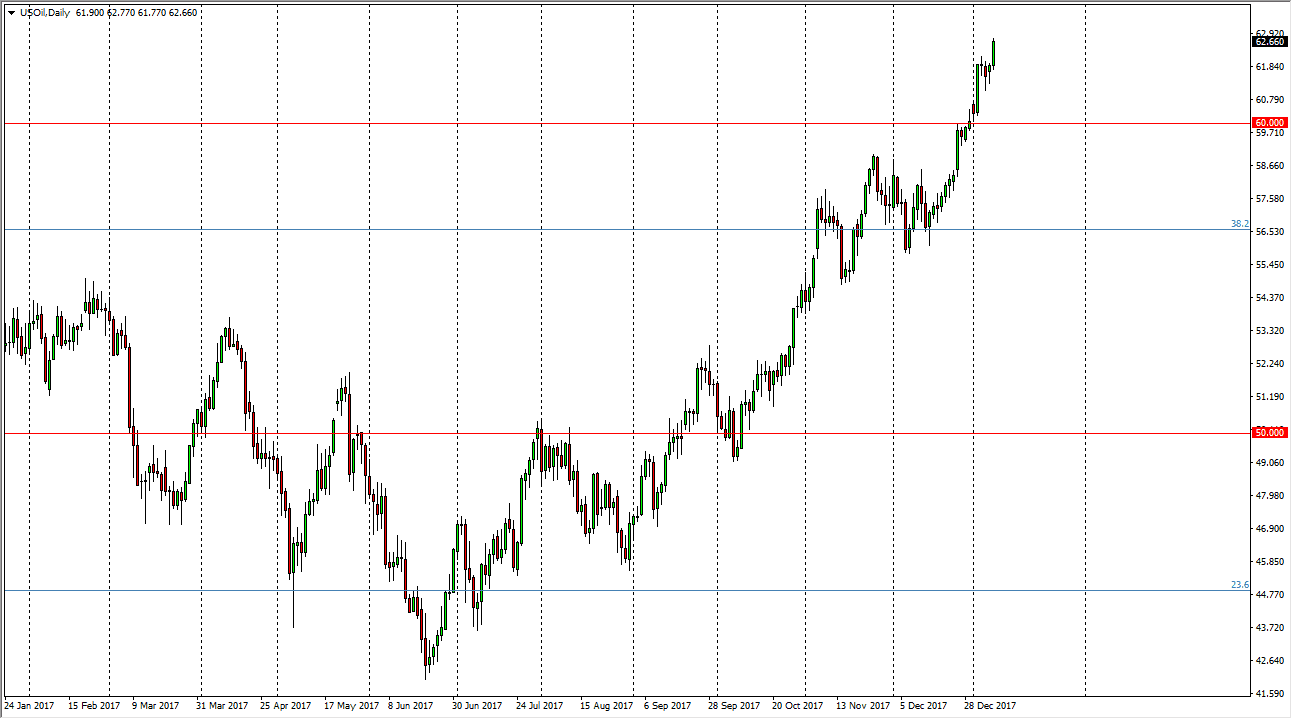

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Tuesday, breaking above the top of a couple of the hammers. The market clearing the $62.70 level is a good sign, and I think at this point will probably go looking towards the $63 level rather quickly. I think pullbacks are buying opportunities and the $60 level should be thought of as a “floor” in a market that is obviously very bullish. With tension in the Middle East, Russians and OPEC nations willing to cut back on production, and the US dollar following a downward trajectory, it makes sense of this market may continue to go to the upside. I don’t know if we can break above the $65 handle and the short-term, but it certainly looks as if traders are going to try to find out.

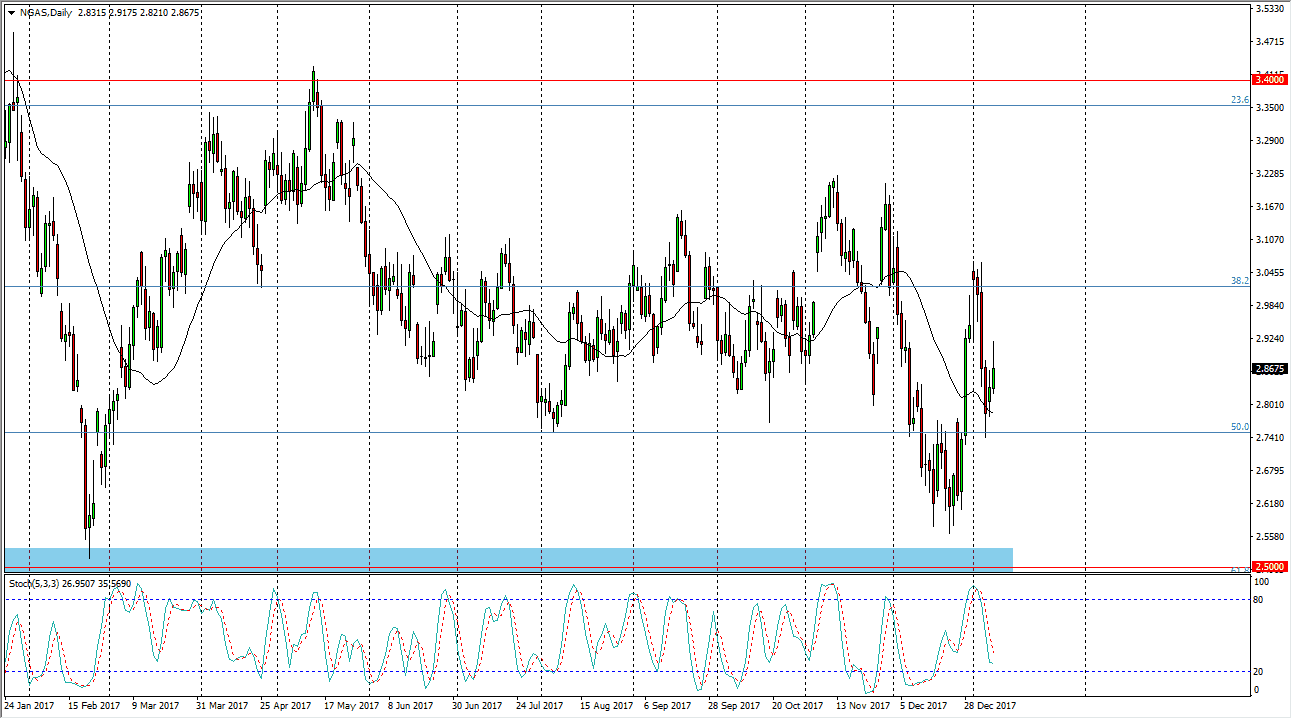

Natural Gas

Natural gas markets initially rally during the day on Tuesday, but gave back quite a bit of the gains to form a shooting star like candle. By doing so, it looks as if we are ready to test the $2.75 level again, an area that has been supportive and resistive in the past. There is a massive amount of support underneath their though, so I am a bit cautious about selling under that level. I think short-term traders will continue to flood into the market to the downside, and at this point even if we rally from here, I would be more than willing to sell signs of exhaustion as natural gas markets have not been able to keep gains, even in the most bullish season of the year. I think this continues to be a “of the rallies” scenario.