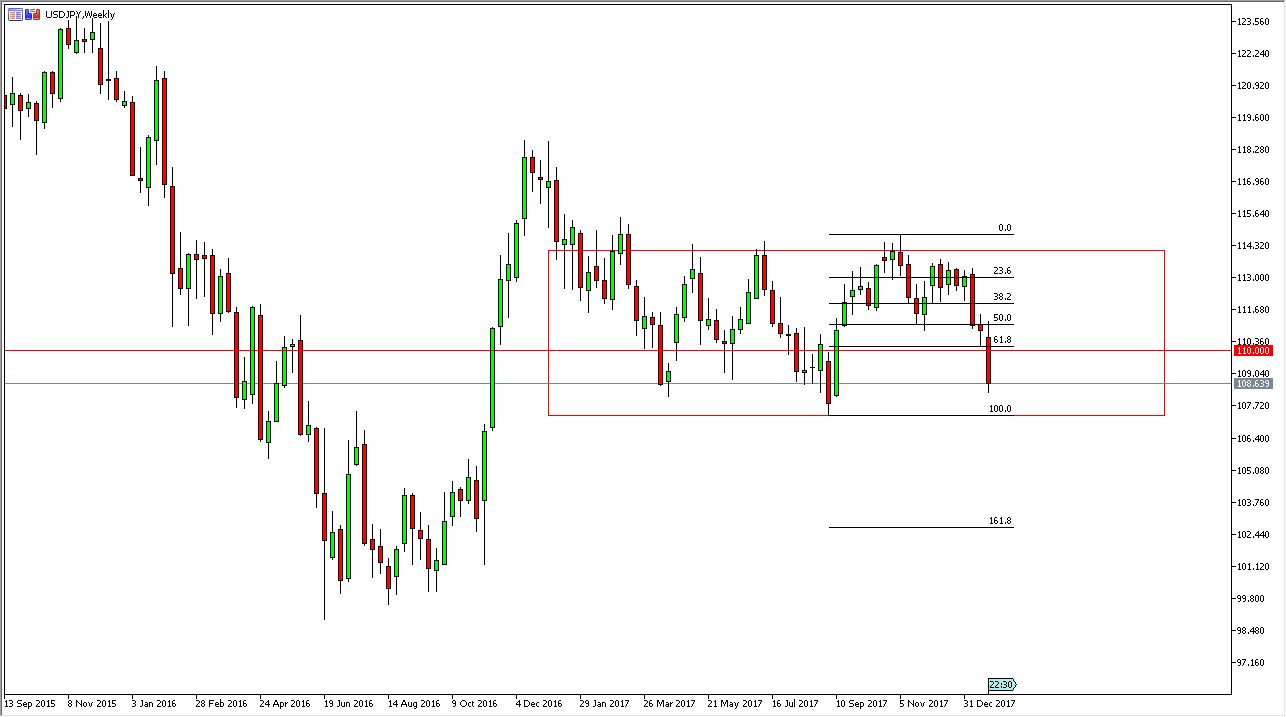

USD/JPY

The US dollar initially tried to rally during the week but found enough resistance near the 111 level to roll over and break down below the 110 handle. By doing so, it looks likely that we are going to continue to reach towards the 100% Fibonacci retracement level, the 107.50 handle. Short-term rallies should be selling opportunities unless of course we can break above the 110 handle, which has a certain amount of psychological importance.

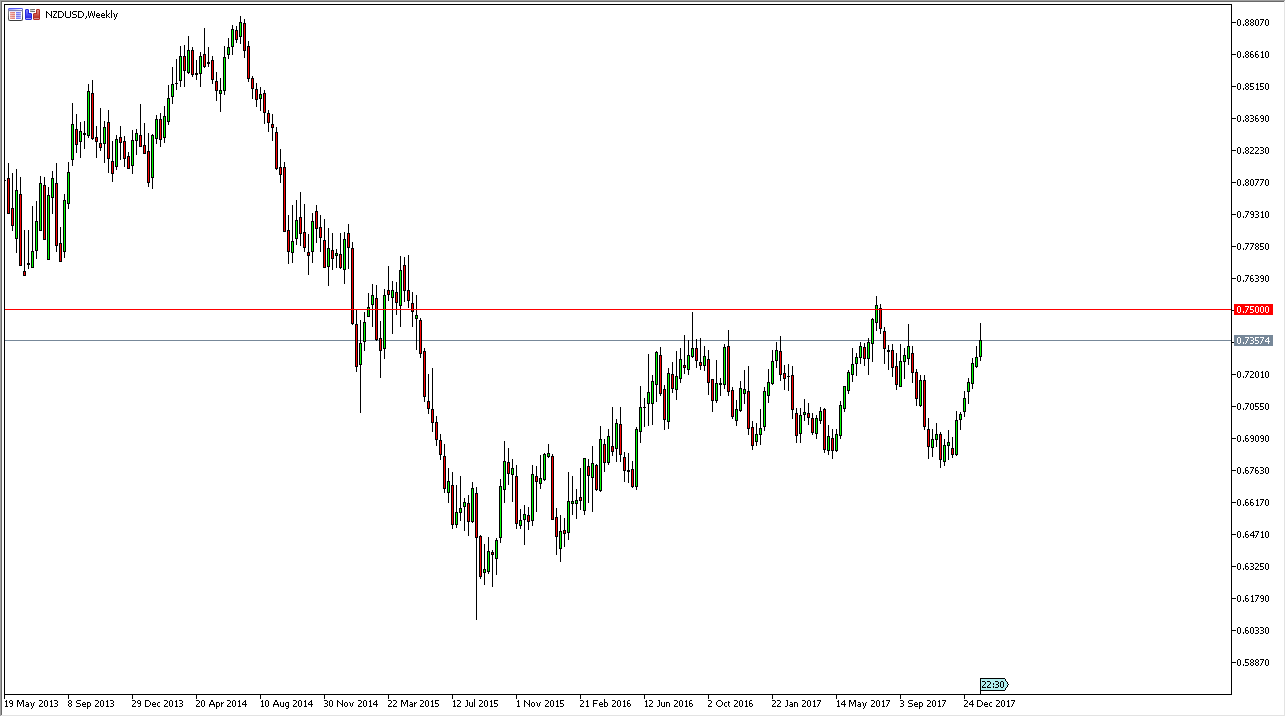

NZD/USD

The New Zealand dollar rallied during the week but gave back a significant amount of the gains once we broke above the 0.74 level. The fact that the market has extended so much over the last 6 weeks or so tells me that we are overbought. I think that a pullback is likely, so I would expect some short-term weakness. I anticipate that there is more than enough support below, but I believe this week will probably form a negative candle. If we break above the 0.75 level, then the market will finally be ready to break out to the upside.

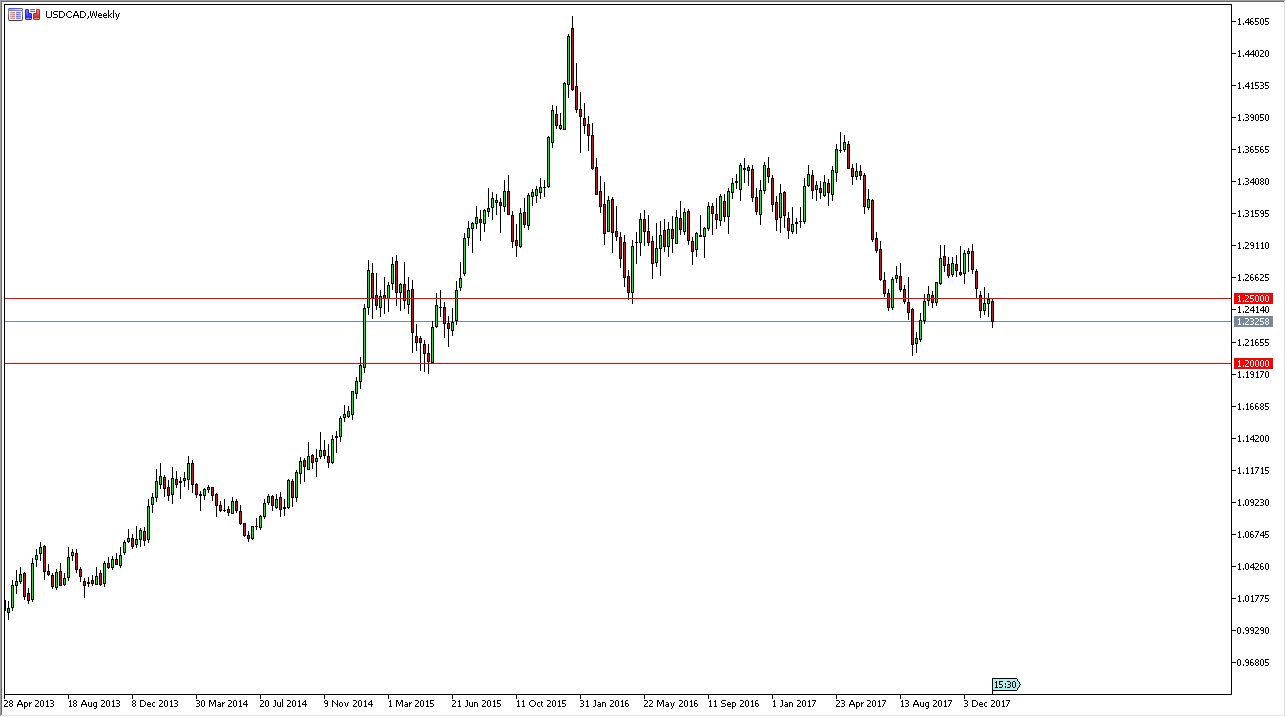

USD/CAD

The US dollar fell against the Canadian dollar during the past week, as 1.25 level has offered a significant amount of resistance. By breaking below the bottom of the hammer from the previous week, the market looks ready to go lower, perhaps reaching down to the 1.20 level underneath. I believe that short-term rallies are to be sold, especially if the oil markets continue to gain, which of course they look likely to do.

EUR/USD

The EUR/USD pair broke out to the upside during the week, slicing through the 1.25 handle at one point. However, we get back some of the gains in the thick we may get a short-term pullback to build up the necessary momentum to break out to the upside. If we can clear the 61.8% Fibonacci retracement level, the market is free to go much higher. Even though this could be a negative way, I believe longer-term traders will continue to push higher.