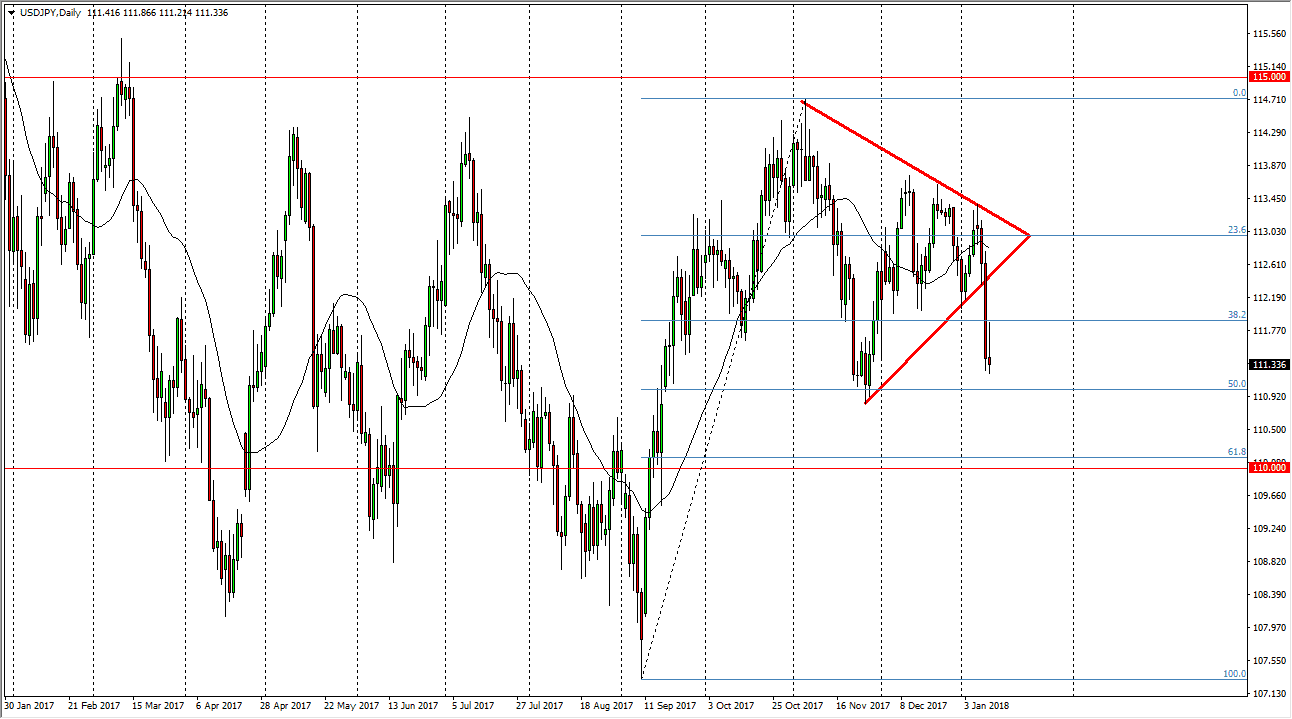

USD/JPY

The US dollar initially tried to rally against the Japanese yen, but struggled at the 112 level, and then rolled over as we received less than stellar economic numbers coming out of the United States during the day. Because of this, it’s likely that the market will continue to drift a little bit lower, perhaps reaching towards the 111 level. A breakdown below there frees the market to go down to the 110 handle. That is the 61.8% Fibonacci retracement level, so I would expect to see support in that general vicinity. In other words, this might offer short-term selling opportunity, but it should be just that: short term. Alternately, if we break above the 113 handle, that frees the market to go much higher, but right now that looks less likely with the shooting star like candle.

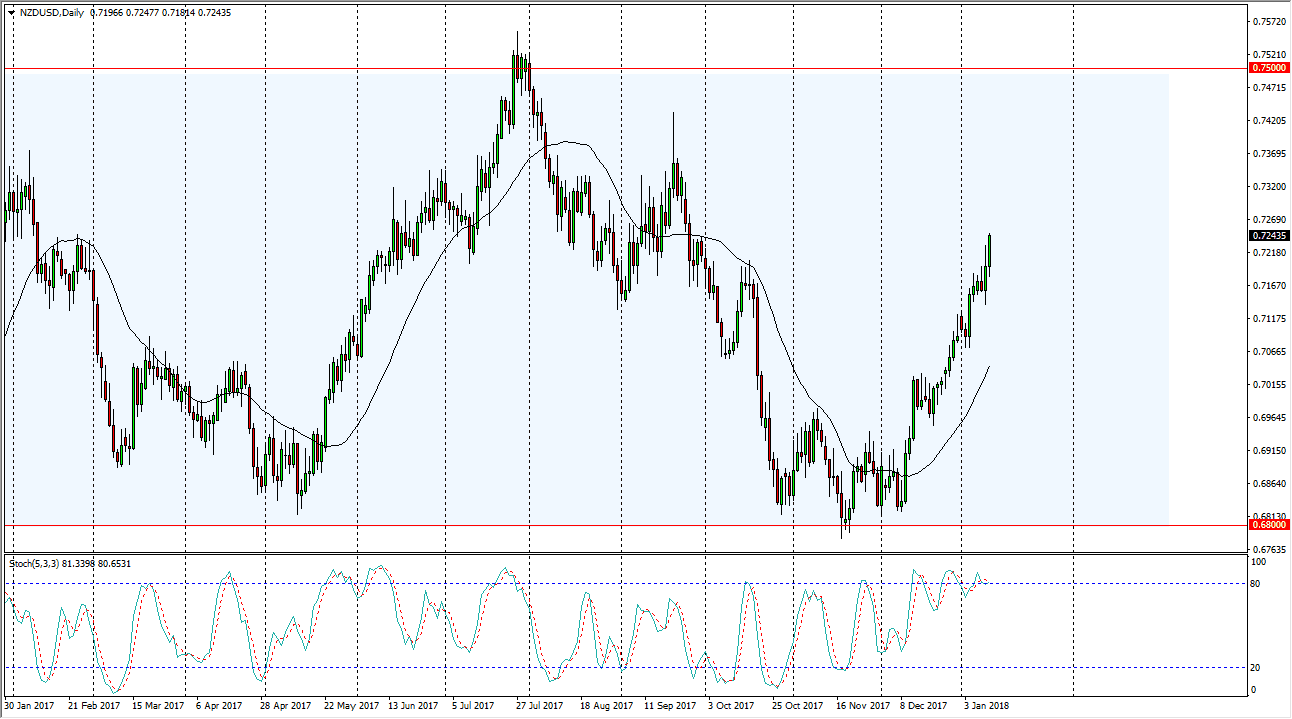

NZD/USD

The New Zealand dollar initially dipped during the trading session on Thursday, but then broke above towards the 0.7250 level. By doing so, the market looks as if it is ready to go higher, perhaps reaching towards the 0.7350 level next. Short-term pullback should be buying opportunities, and we are a bit over stretched at this point so it’s likely that the market will continue to be volatile, but I think this should continue to offer plenty of opportunities as the US dollar has struggled. I would anticipate seen support at the 0.71 level underneath, and of course the 0.70 level after that. The marketplace of course is highly correlated to commodities, so keep that in mind as well. I think that the 0.75 level above is the longer-term target but it is going to take a certain amount of momentum to reach that level. Because of this, adding on dips is my strategy.