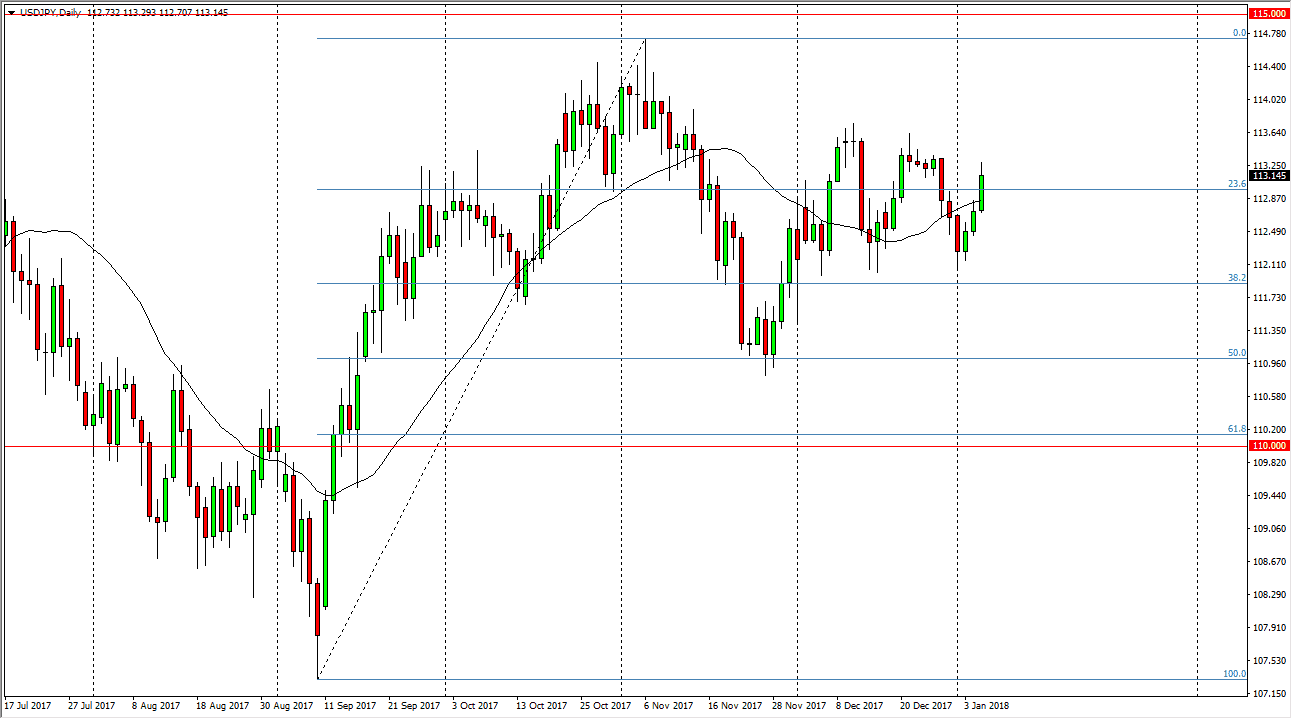

USD/JPY

The US dollar has rallied against the Japanese yen on Friday, which of course is significant considering that the jobs market number missed completely. I think that it shows that there is plenty of buying proclivity in this market, and that we will eventually go looking towards the 114 handle. Ultimately, if we break above the 115 handle, then the market can find more of a “buy-and-hold” move. I think that the market has plenty of support at the 112 level, so I like buying pullbacks on short-term charts to take advantage of what I think is mounting pressure to the upside. The fact that we did not fall apart after a missed jobs number tells me just how strong the underlying support is in this market.

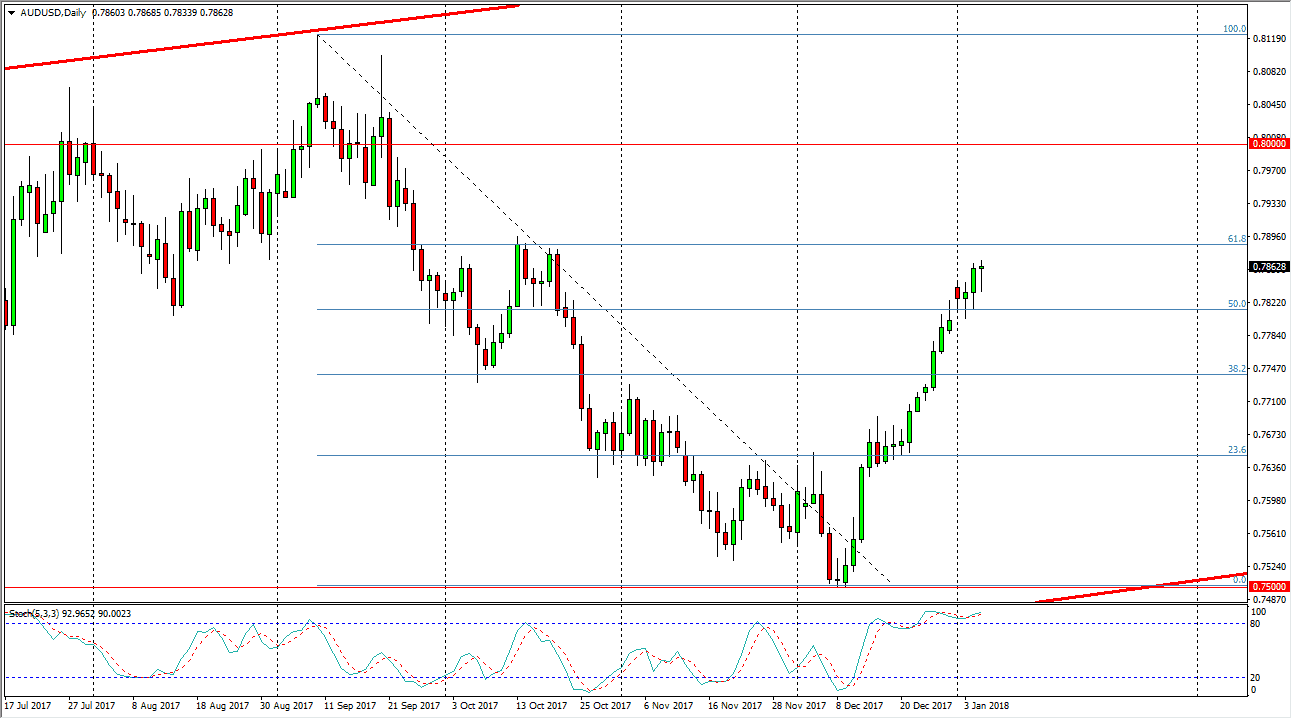

AUD/USD

The Australian dollar initially fell during the trading session on Friday, but then found enough support underneath to turn things around and form a hammer. The hammer is a very bullish sign, although it is at the top of an extended moved to the upside. I think that the 0.79 level is an area that will be difficult to break above, but eventually we will. Once we break above that level, the market probably goes to the 0.80 level after that, which is a larger round number that people will be paying quite a bit of attention to, as it has been a bit of a fulcrum for price. If we can break above that level, the market should continue to go much higher, perhaps to the 0.81 handle, and a break above there makes the market even more bullish. Pay attention to gold, and it has a significant amount of influence on the market. Pullbacks continue to offer value.