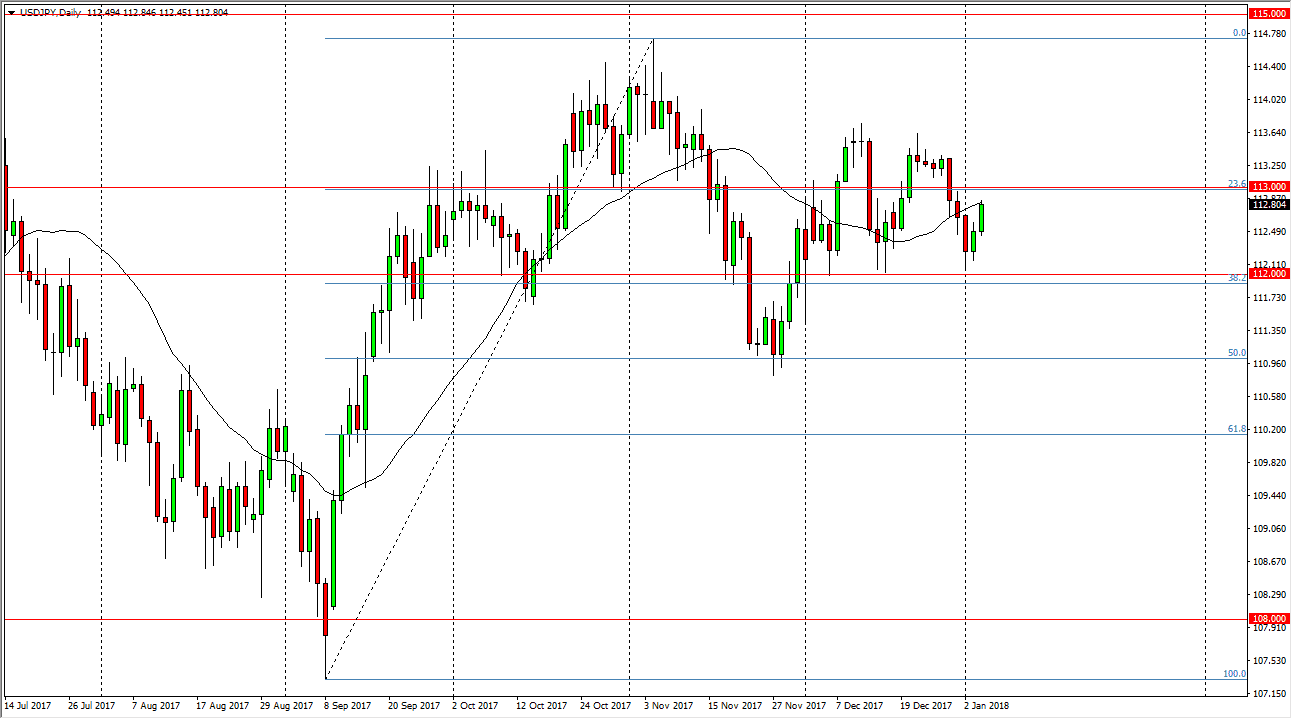

USD/JPY

The US dollar rallied significantly against the Japanese yen during the trading session on Friday, as we continue to bounce around ahead of the jobs number today. That is going to be a major move or of this market place, as it tends to go higher with a better jobs number, and lower with a softer one. I think that the 112-level underneath continues to be supportive, and that we will probably go looking towards the 113.50 level if we get a decent number. A break above there should send this market looking towards the 114.50 level above, which begins massive resistance. Once we finally break above the 115 handle, and I think we will someday, it’s more of a longer-term “buy-and-hold” scenario. Otherwise, if we break down below the 112 handle, the market probably goes out to the 111 level after that.

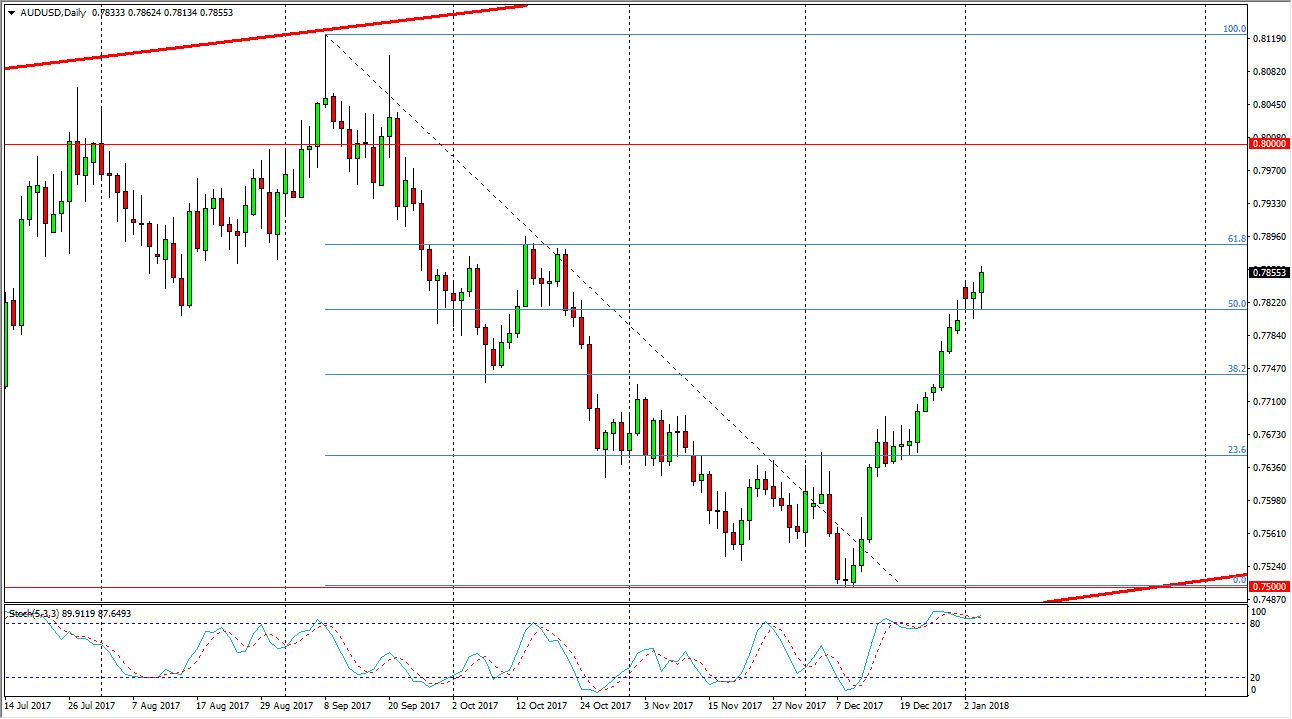

AUD/USD

The Australian dollar initially fell during the trading session on Thursday, but as we had seen during the Wednesday session, there seems to be plenty of support near the 0.78 handle. The fact that we had formed the supportive looking candle suggests to me that we are going to continue to go higher, and that short-term pullback should be buying opportunities. This will be especially true if the gold markets continue to find buyers, which certainly look as if they are ready to do. The 0.80 level above is massive in its importance, and a break above there becomes more of a “buy-and-hold” scenario. Both of these markets are very similar right now, and I think they will move in synchronicity once we get to break out. If we do pull back from here, I expect to see a lot of support near the 0.7750 region.