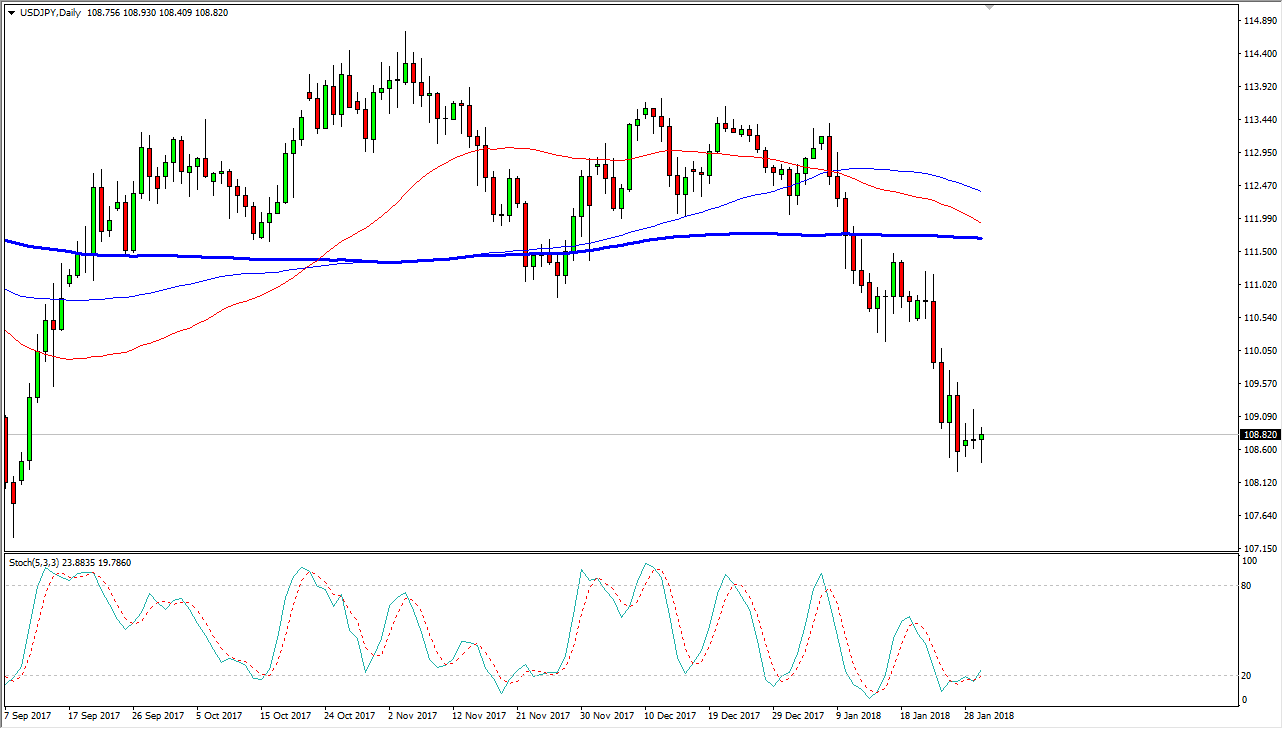

USD/JPY

The US dollar has fallen a bit during the trading session against the Japanese yen, only to turn around and form a bit of a hammer. Look at this market, it appears that the 108.50 level underneath should be somewhat strong, but I believe it’s more or less a “zone” of support underneath, and I believe that the market is trying to find its footing in this area. The stochastic oscillator is crossing, but we might have a bit of squishy trading going forward. If we can break above the 110 level, the market should then go to the 111.50 level, and then eventually the 114 level. The market looks very sideways and consolidating at the time. I believe that the market continues to be very noisy going forward, and of course has the usual correlation to the stock markets, meaning that it goes higher as they do.

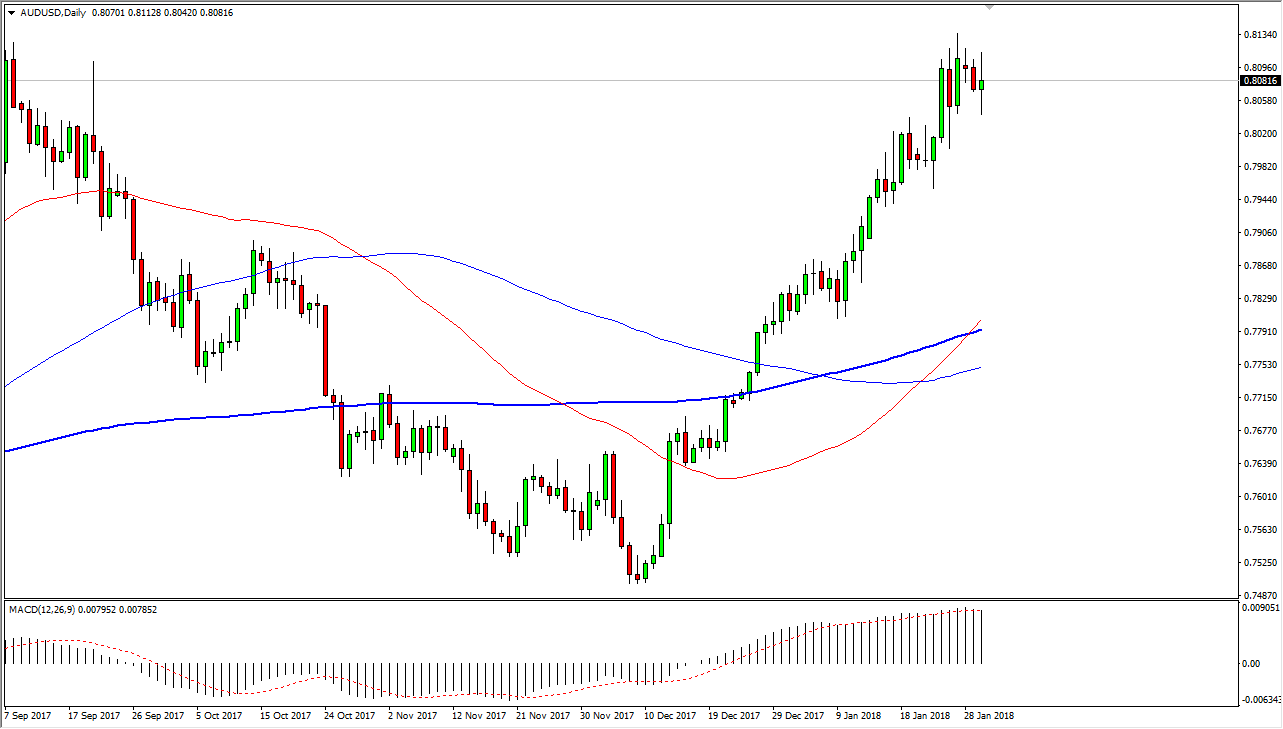

AUD/USD

The Australian dollar has formed a neutral candle during the trading session on Tuesday, as we continue to struggle to break above the 0.81 handle. If we can break above there, the market should continue to go even higher, and perhaps reach towards the 0.85 level. The 0.0 level underneath should be massively supportive, as it is a fulcrum for price, and is essentially the place where the market switches from bearish to bullish, going back to the late 1980s. I think that if we can close above the recent highs, the market is probably going to be more of a “buy-and-hold” scenario than anything else. Other than that, I think a pullback should be buying opportunities, assuming that we stay above the vital 0.79 handle which I see as the bottom of this general region of importance.