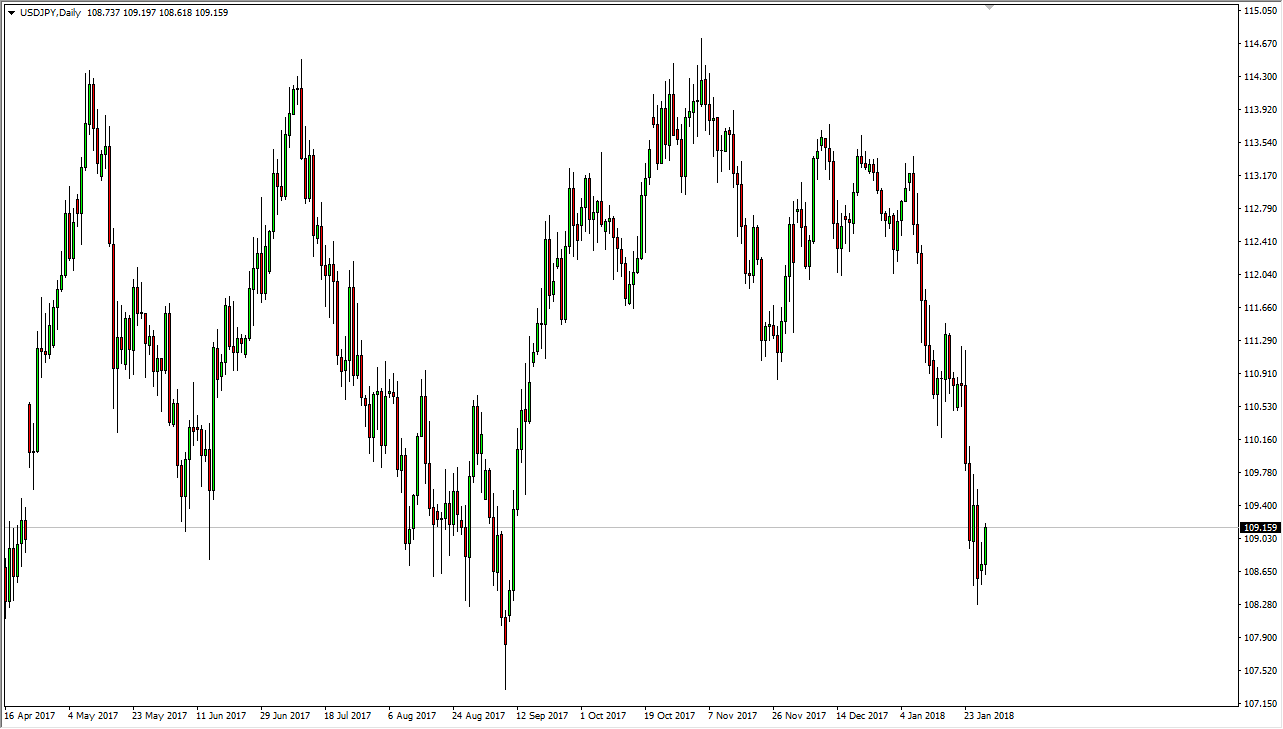

USD/JPY

The US dollar rallied a bit during the trading session on Monday, looking likely to bounce again, reaching towards the 111 level, and then possibly and the 113.50 level. However, if we break down below the 108 level, the market should then break down again towards the 107.50 level. This is a very volatile market, and of course is highly leveraged to what happens with stock markets, especially the S&P 500. Overall, I think the volatility continues, so trade lightly in this market, and keep in mind that the US dollar has struggled a bit. The fall of this pair of the last couple of days has been a bit exaggerated, so I think a bounce makes sense. If we break down to the 107.50 level, there should be plenty of massive support, but if we were to clear that level, look out below!

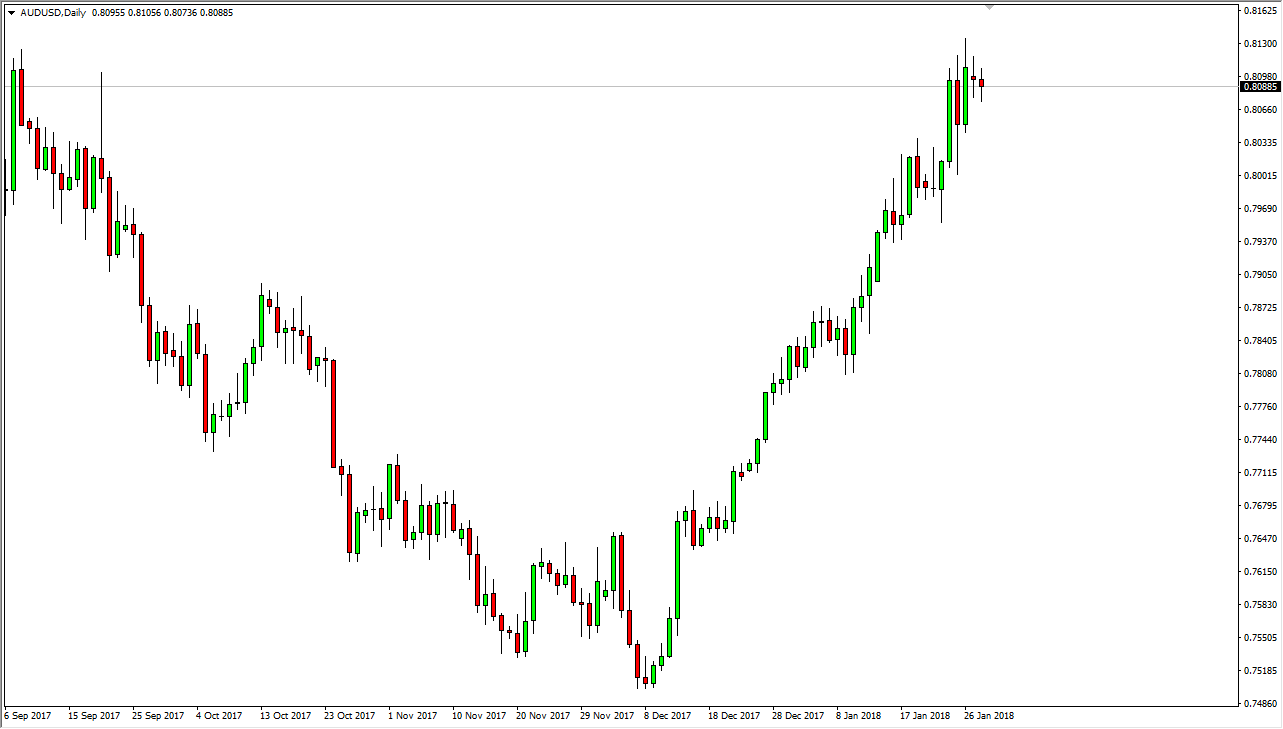

AUD/USD

The Australian dollar has pulled back a little bit during the day on Monday, but it looks likely to continue to try to pound higher, and a fresh, new high should send traders into this market looking for a buy-and-hold type of situation. The gold markets rallying of course will help as well, as it would not only lift the Aussie dollar due to demand but would also signify that the US dollar was losing strength again. Ultimately, I think that happens eventually, but we are bit overextended, so it wouldn’t surprise me to see a pull back to build up the necessary momentum. I suspect that there is a massive amount of support at the 0.80 level, and then of course the 0.7950 level which has shown structural proclivity to bring in buying as well. I have no interest in shorting this market, least not anytime soon.