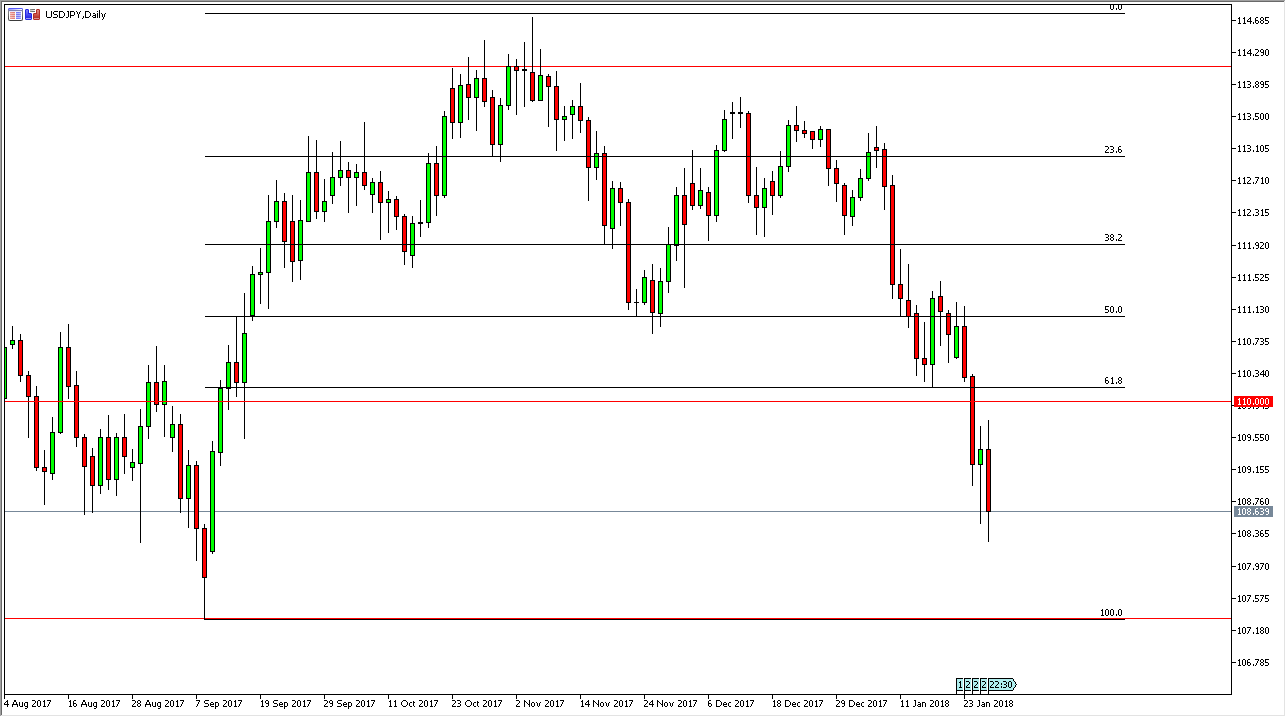

USD/JPY

The US dollar has fallen again against the Japanese yen, piercing the bottom of the hammer from the previous session. The market looks susceptible to selling pressure again, and I think that short-term traders will continue to look at rallies as opportunities to start selling. I believe that the 110 level above is massive resistance and essentially a “ceiling” in the market, so therefore it’s not until we break above there that I am comfortable thinking about buying. However, I recognize that the 107.50 level should be supportive based upon the 100% Fibonacci retracement level, wiping out the entire move to the upside. There should be significant support there, so I believe that short-term selling should probably extend to that level only. If we were to break down below there, the market should go looking towards the next psychologically important level, the 105 handle.

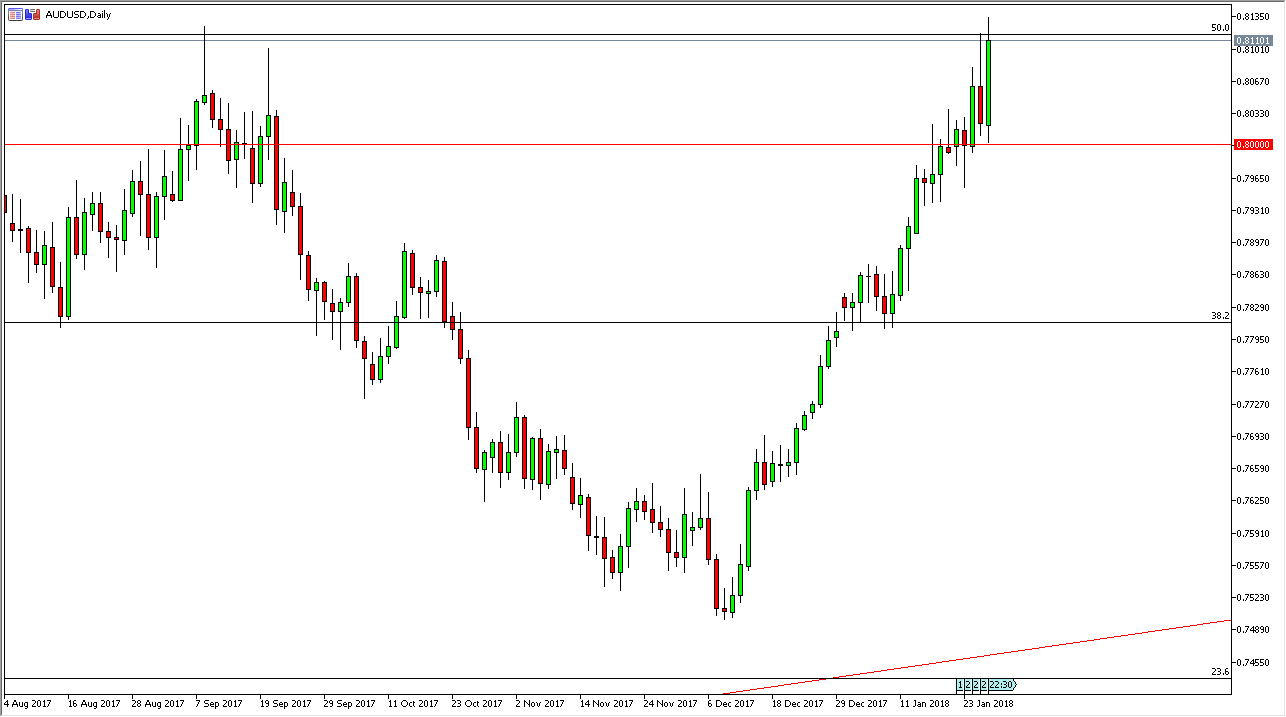

AUD/USD

The Australian dollar has rally during the trading session on Friday, breaking above the top of the shooting star the form for Thursday. That’s a very bullish sign, and the fact that we pierced the 0.81 handle suggests that we should continue to go higher. We might get a short-term pullback, but clearly, it’s a market that has plenty of bullish pressure, I believe that eventually we will go looking towards the 0.90 level, possibly even parity, but obviously that’s a very long-term outlook. I believe that the 0.80 level now offers a bit of a floor, and this could be a theme for 2018 going forward. I like the idea of buying short-term dips, as it offers value. Ultimately, this is a market that might be a bit overbought, but in the end, I think the US dollars on its back foot and this should continue to be an issue.