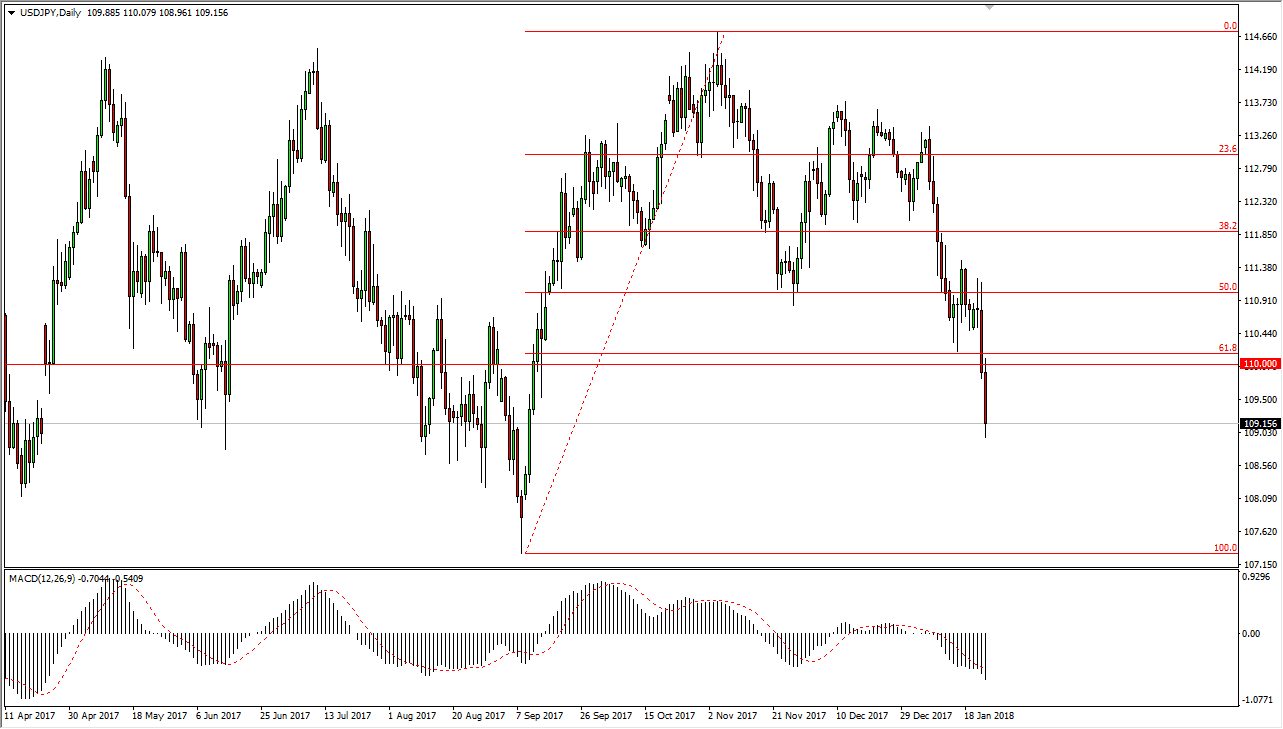

USD/JPY

The US dollar got absolutely pummeled during the trading session on was a, breaking below the 110 level against the Japanese yen. We continue to see a lot of noise in the marketplace, and certainly a lot of anti-US dollar sentiment. The markets continue to be very noisy, and certainly continue to favor selling the US dollar in general, and that would remain to be the case going forward. I think that we have now to look towards the 107.50 level, as we have broken below the 61.8% Fibonacci retracement level. Typically, that means we wipe out the entire move. If we break above the 110 level, then I think the market continues to go higher, but I believe we are more likely to see negativity over the next several days than anything else. Rallies could be selling opportunities towards the 110 level as it should now offer resistance.

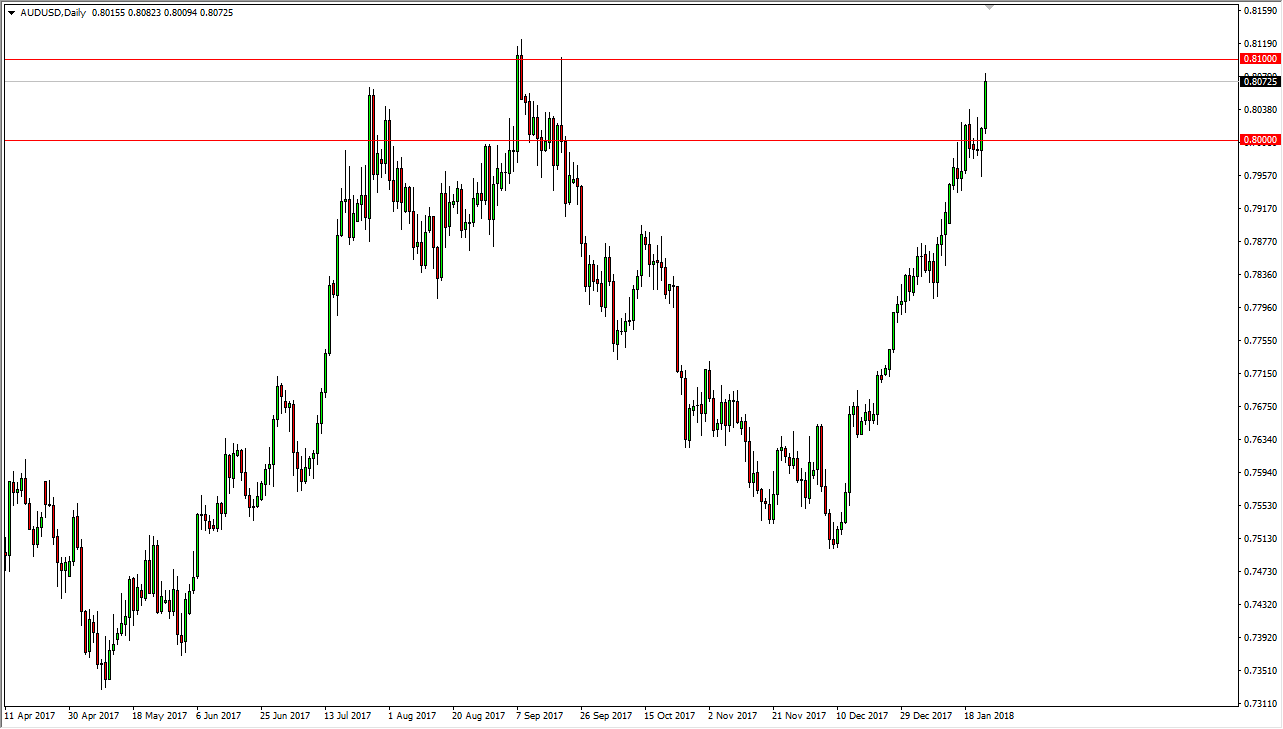

AUD/USD

The Australian dollar has rallied significantly during the trading session on Wednesday as gold broke out. The US dollar continues to be soft against almost all currencies, and the Aussie of course isn’t going to be any different. However, it’s not until we clear the 0.1 level that I think we will be free to go much higher. The market will be noisy of course, as the Aussie typically is but I also recognize that this is a major fulcrum for price and could lead to levels as high as parity over the longer term. This is an ultra-long-term call, and therefore has to be treated as such. A pullback from here makes sense, but I anticipate that the buyers will return, extending down to at least the 0.79 level. Certainly, selling is all but impossible at this point going forward.