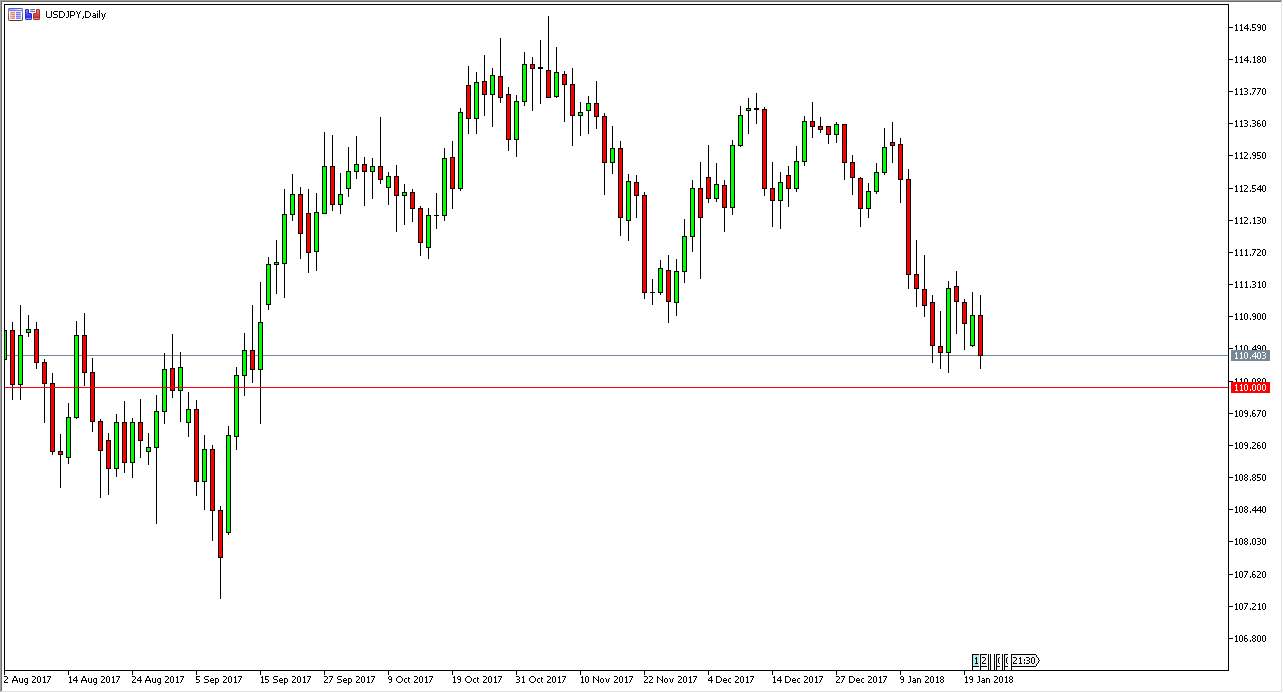

USD/JPY

The US dollar continues to bounce around just above the 110 level, an area that of course has a certain amount of psychological importance to it. It is also the 61.8% Fibonacci retracement level from the larger move higher, so it makes sense that we would see a certain amount of support here. I think that the market will probably continue to consolidate, perhaps reaching towards the 111 level. However, if we were to break down below the 109.75 handle, then I think we could breakdown rather significantly, wiping out the gains overall and reaching towards the 107.50 level underneath. If we can break above the 111 level, then the market will go looking towards the 112 handle. It needs help though, perhaps in the scene of a “risk on” attitude to markets in general.

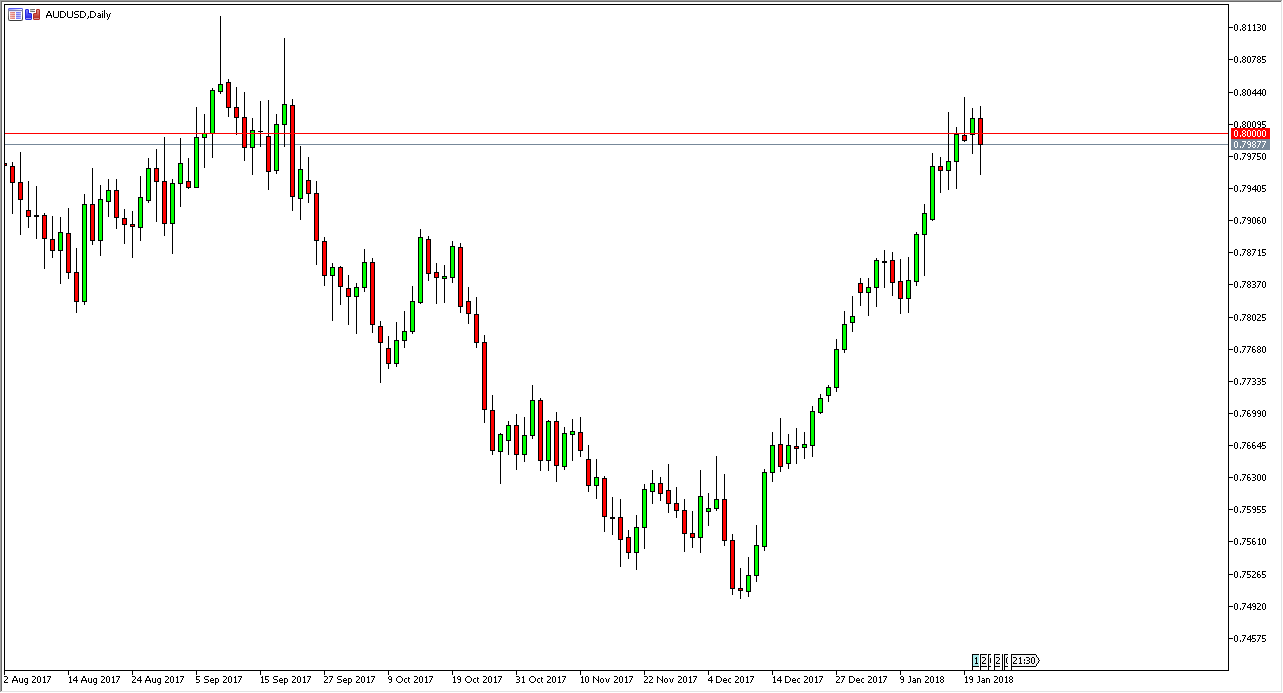

AUD/USD

The Australian dollar pulled back significantly during the trading session on Tuesday, breaking down towards the 0.7950 level. That’s an area that is massively supportive, and we turned around to form a bit of a hammer. The hammer of course is a bullish sign, but we are pressing against a significant amount of resistance, so I’m not overly confident on a move higher in the short term, but I certainly think it happens in the longer term. Pay attention to gold, because gold has a strong positive correlation to this market. If we can break above the 0.81 handle, the market should continue to go much higher and it should be a “buy-and-hold” market. Alternately, if we pull back, and that seems to be likely, there should be plenty of support underneath, at the 0.79 handle and of course the 0.78 level after that. This is a market that has been very bullish, but it is probably a bit overbought.