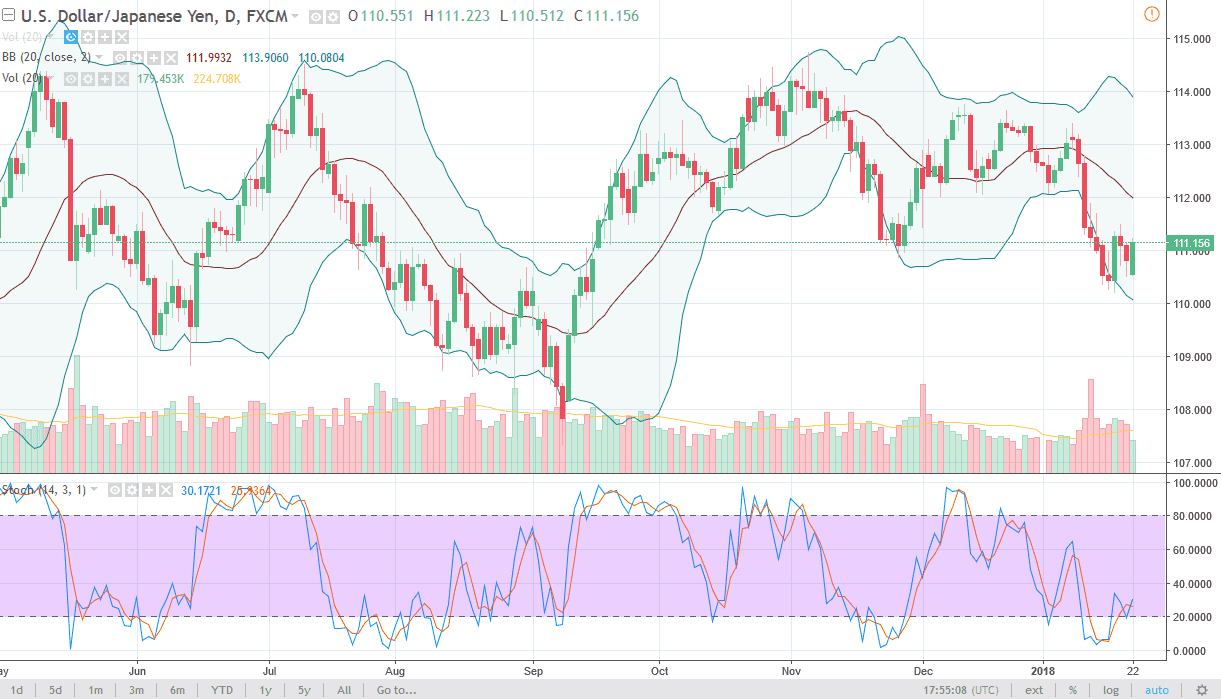

USD/JPY

The US dollar rallied a bit against the Japanese yen after initially falling on Monday, as we have broken above the 111 level. Part of this is due to the Senate looking likely to vote to open the government again, and that of course helps the US economy, albeit minimally. We are just above a major support level in the form of a large, round, psychologically significant handle at 110, so a bounce was always going to be a possibility. I think that the market will eventually reach towards the 112 handle, but we may have to go back and forth in the meantime, as volatility is the norm for this pair. A breakdown below the 110 level should send this market down towards the lows again, closer to the 107.50 level.

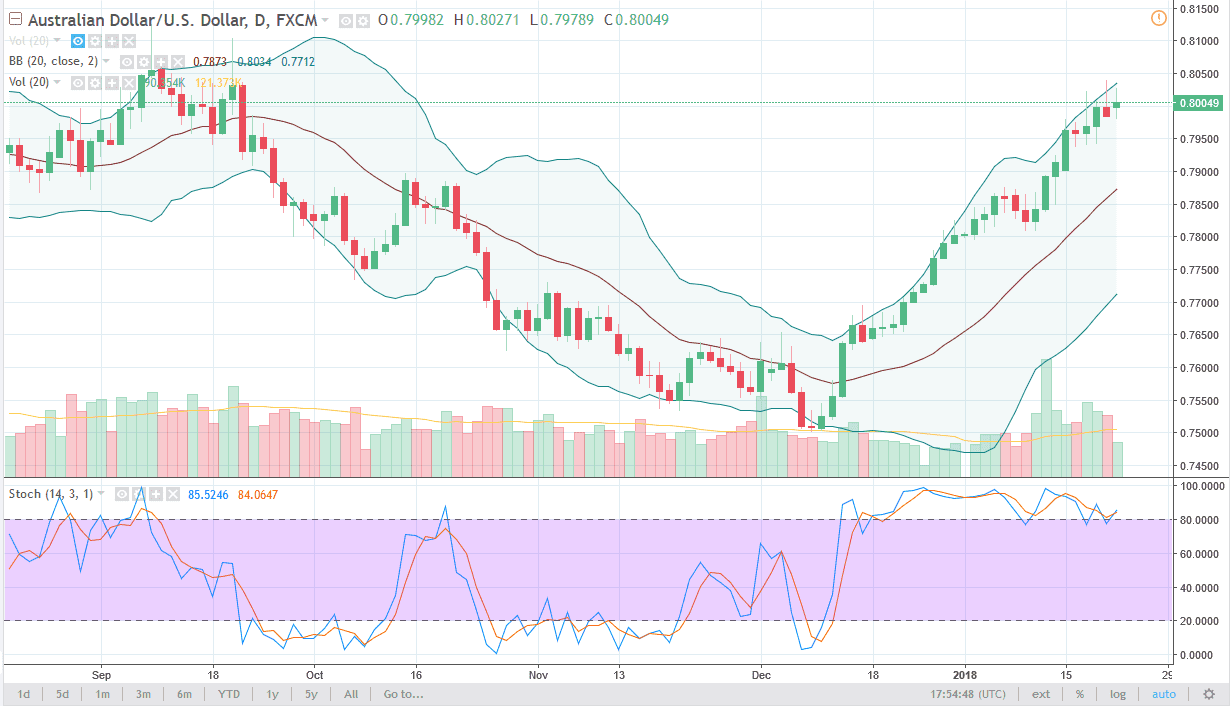

AUD/USD

The Australian dollar tried to rally during the day but gave back most of the gains in order to form a bit of a shooting star. Again, it looks as if the 0.80 level is going to offer a major amount of resistance, and that is the major fulcrum for price that we have in this market going back decades. I think it’s going to take something special to break out to the upside, but once we clear the 0.81 handle, I’m willing to “buy-and-hold.”

In the meantime, I suspect that a pullback is very likely, perhaps reaching down to the 0.7950 level first, and then eventually the 0.79 handle. The market has been very bullish lately, so a pullback is probably going to be healthy as it gives the market a bit of time to digest the gains, and eventually build the momentum that will be needed to smash through this major area.