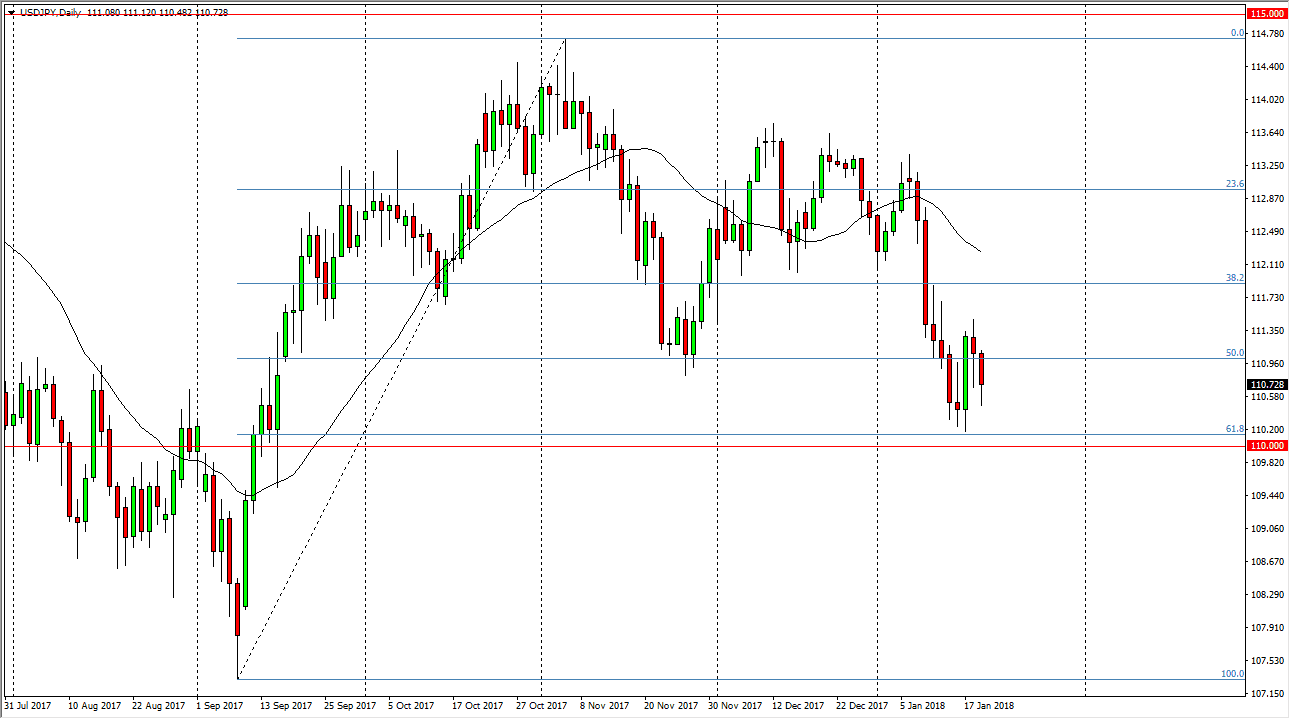

USD/JPY

The US dollar fell against the Japanese yen during most of the session on Friday, but you can see that we did bounce a bit, and it looks as if we are trying to put up a bit of a fight down at these low levels. I recognize the 61.8% Fibonacci retracement level is just below, and of course we have the large, round, psychologically significant number in the form of the 110 handle. If we can break above the 111.50 level, the market will probably reach towards the 112.25 level next. Longer-term, we will more than likely go towards the 113 handle above. The alternate scenario is that we break down below the 110 handle, which should send this market lower, perhaps wiping out the entire move to the upside, which means falling to the 107.50 range.

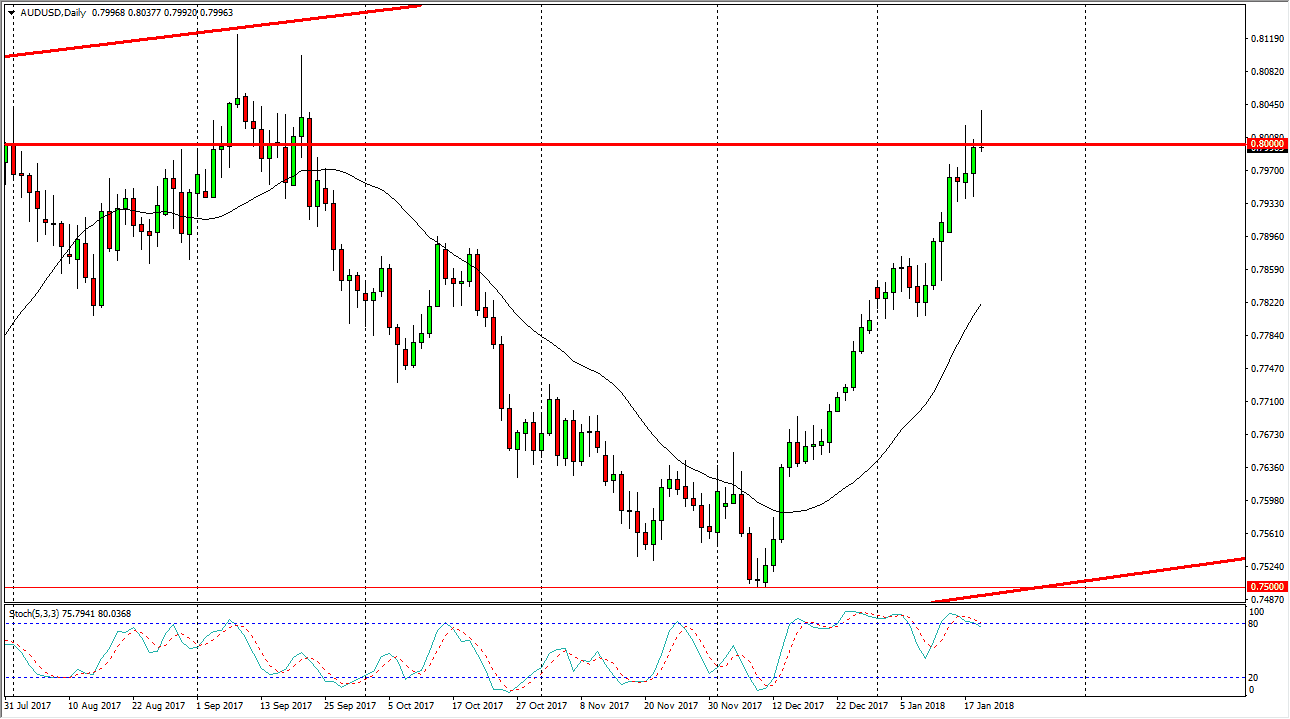

AUD/USD

The Australian dollar has rallied significantly during the trading session on Friday, breaking above the 0.80 level during the day, but then turned around to fall below that level. The massive shooting star that has formed for the Friday session suggests that we are going to pull back, and that makes a significant amount of sense considering that we have been rallying so drastically over the last couple of months, and probably need to pull back. Beyond that, the 0.80 level is massive resistance, so it does not surprise me that it will take several attempts to break out above there for a significant amount of time. In fact, we could drop as low as 0.78 underneath, and still be very much in an uptrend. If we break above the top of the shooting star, that should send this market looking to the 0.81 handle, and a clearance of that becomes a “buy-and-hold” scenario.