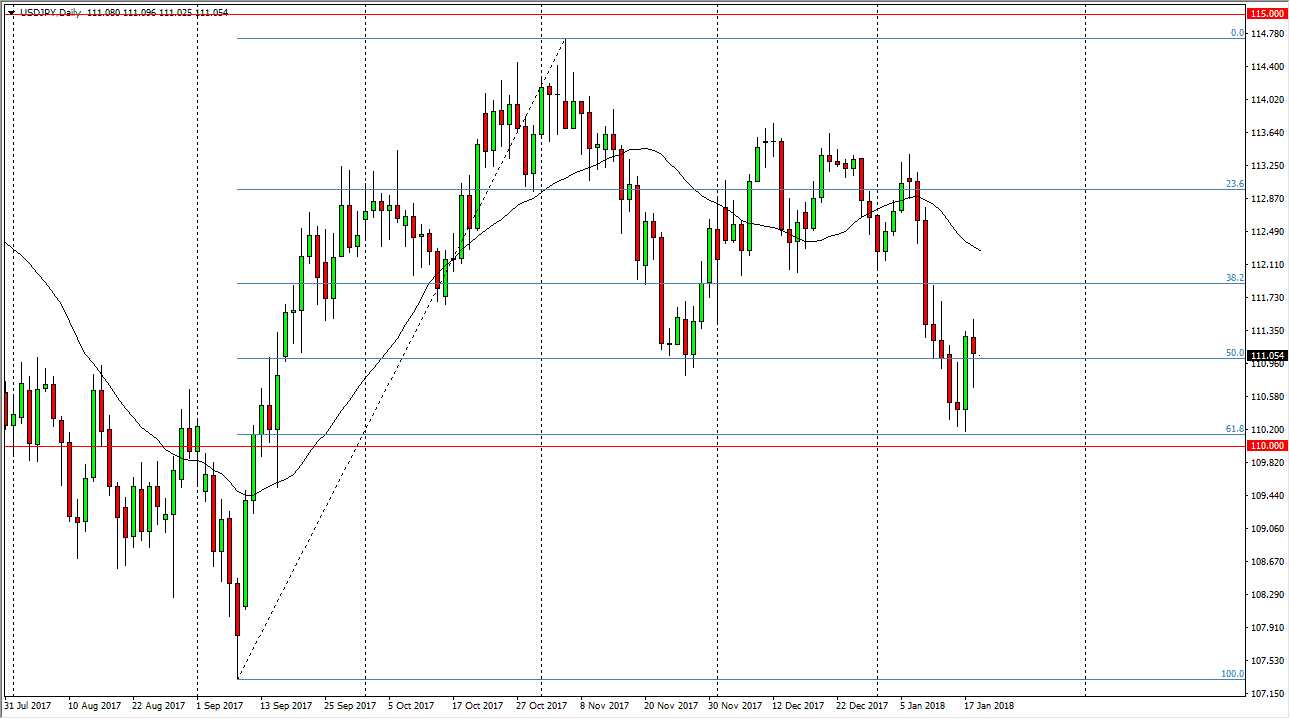

USD/JPY

The US dollar fell significantly during the trading session on Thursday, but turned around to form a bit of a hammer. This is a positive sign as we had a bullish candle appear the day before. I think that it is only a matter of time before the buyers return on these dips, and I think that a break above the highs of the session on Thursday would be a sign that we are going to go higher, and at that point I would be willing to bring a position into the market. The 110-level underneath is massively supportive, and essentially the 61.8% Fibonacci retracement level from the strong move higher. If we were to break down below the 110 level, we should continue to go much lower, perhaps reaching towards the 107.50 level. All things being equal, I think we are likely to see a bit of a bounce, which of course will be coincided with the behavior of stock markets.

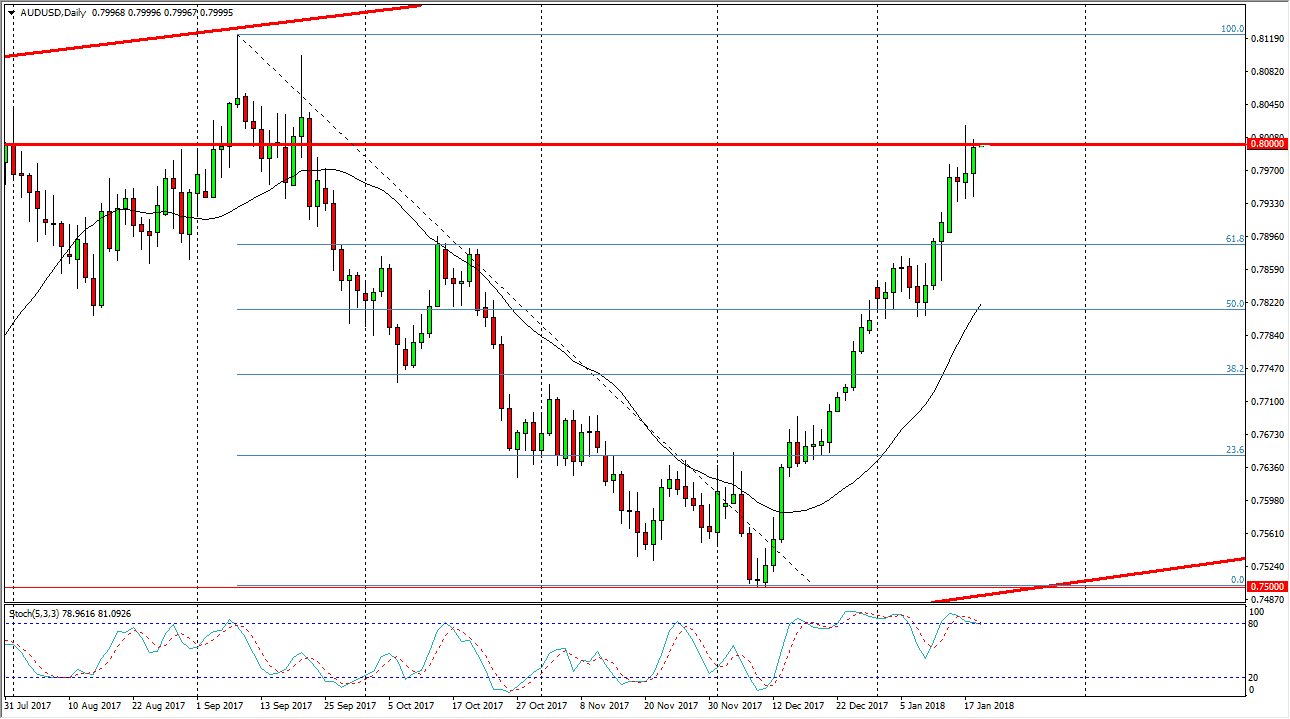

AUD/USD

The Australian dollar initially dipped during the Thursday session, but then turned around to show signs of strength as we reached into the 0.80 level. That’s an area that is a major level that we can pay attention to from longer-term charts, so I think that if we can break above the shooting star from the Tuesday session, if not the 0.81 level, I think the market goes much higher. At that point, it becomes more of a “buy-and-hold” scenario, and I think that it is going to be very difficult to find any other way to trade this market once that happens.

If we do get pullbacks, and we very well could, they should offer value as we try to build up enough momentum to finally break out to the upside. It is not until we break down below the 0.78 level that I would be concerned about the Australian dollar.