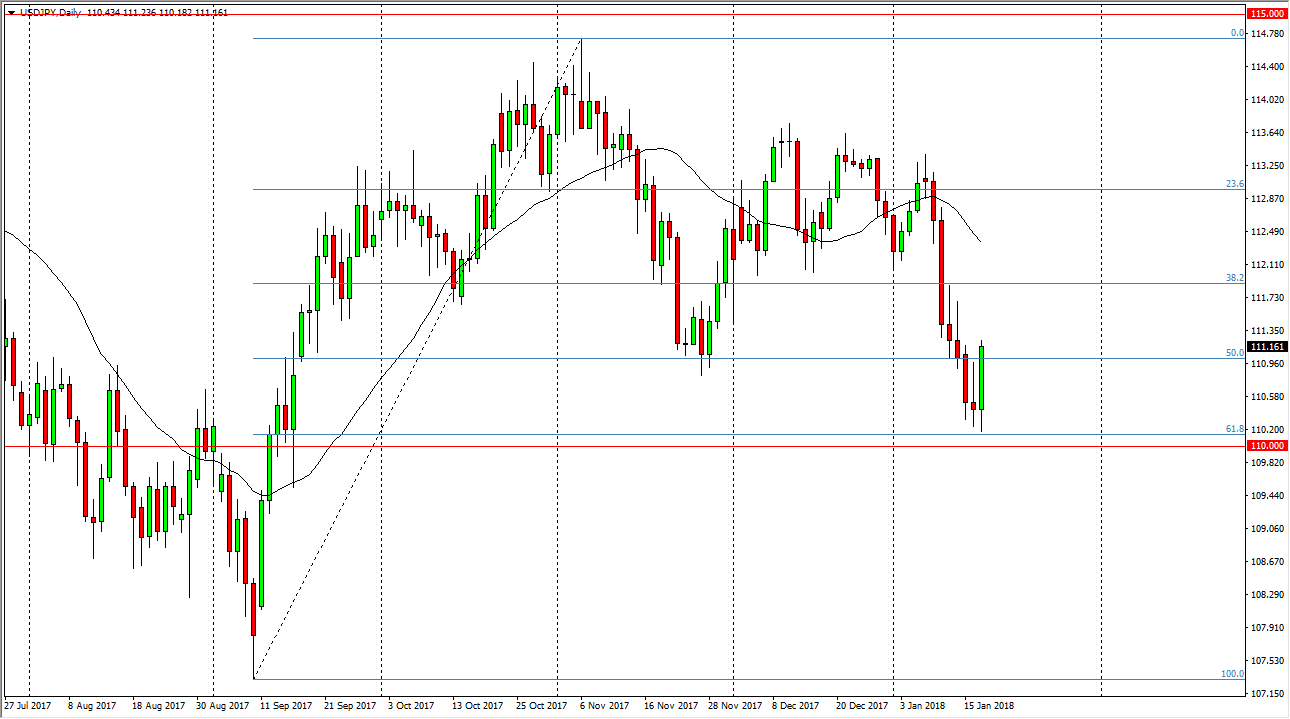

USD/JPY

The US dollar has initially fallen during the day on Wednesday, but found enough support at the 61.8% Fibonacci retracement level to rally, and it broke above the top of the shooting star from the previous session. Because of this, it is a market that looks as if it is trying to go higher, but I also recognize that the previous shooting stars will continue to offer resistance. Because of this, I think that if you do choose to go long of this market, you should probably do so on pullbacks using a short-term chart. However, if we break down below the 110 level, the market should then go lower, perhaps reaching to the 107.50 level, the beginning of the move higher. The market has a significant amount of support, but breaking below that support would be catastrophic.

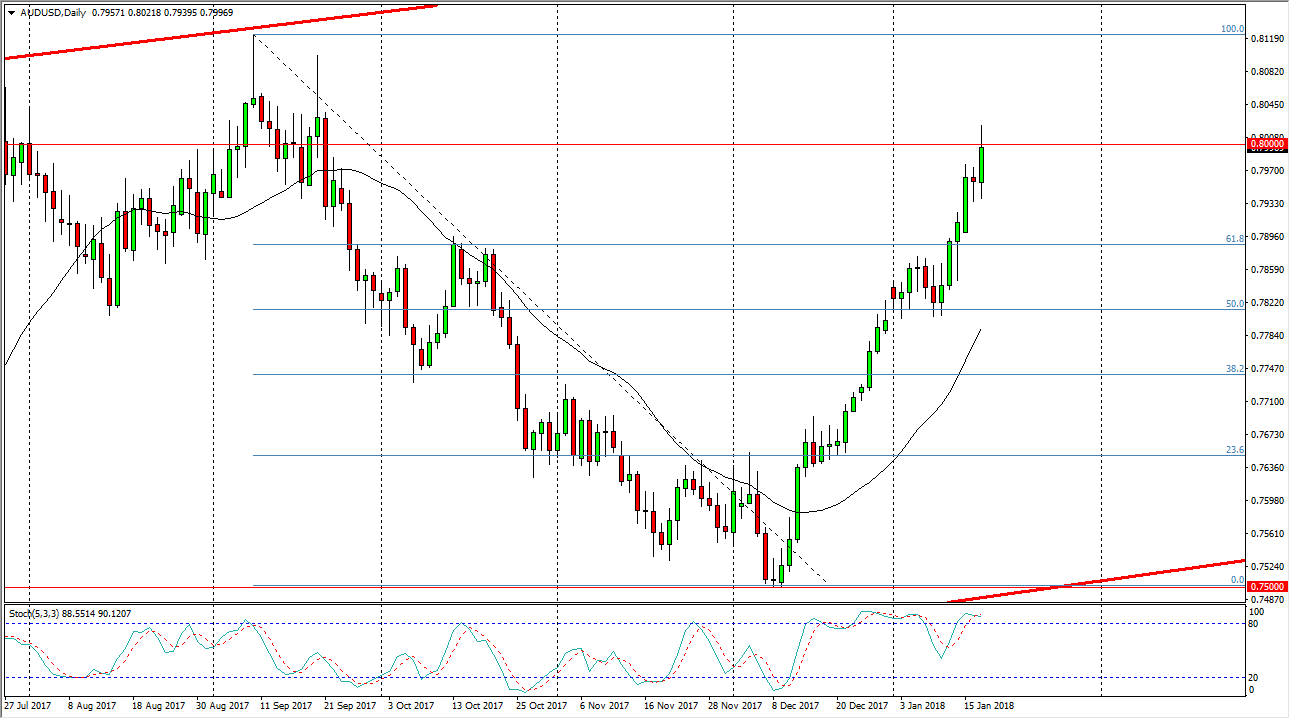

AUD/USD

The Australian dollar rallied during the day on Wednesday, breaking above the 0.80 level. However, the market has turned around to show signs that there are still plenty of sellers above. I believe that the market can finally break above the 0.81 level, then it becomes more of a buy-and-hold scenario. Until then, expect a lot of volatility but with more of an upward slant than anything else. I look at pullbacks as buying opportunities, and I also believe that the 0.79 level will offer plenty of support.

Gold markets of course have their say in this situation, and if they can break out to the upside as likely that the Australian dollar will continue to show signs of strength as well. Market participants continue to look at pullbacks as value, and I don’t think that’s going to change anytime soon, although it may take several attempts to finally clear the barrier above.