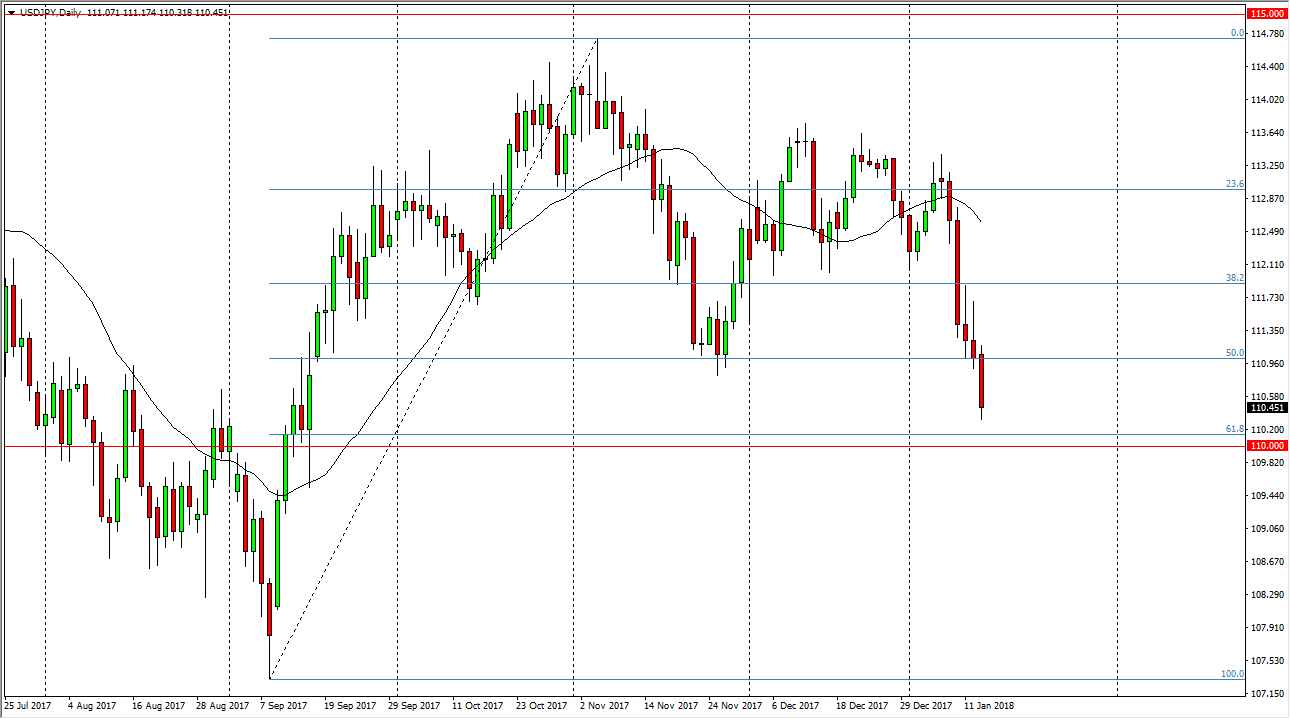

USD/JPY

The US dollar fell during the trading session on Monday, breaking below the bottom of the Thursday and Friday shooting star, suggesting that we are going to go looking towards the 61.8% Fibonacci retracement level, just above the 110 handle. I recognize that both the 61.8% Fibonacci retracement level, and of course the 110 level will start fighting plenty of support. If we broke down below the 110 handle, the market is free to go much lower, closer to the 107.25 level. Otherwise, we could bounce from these areas just below, and I think offer an opportunity to go long. I think that the market will continue to be very noisy, and I only read so much into this move during the day, because Americans were away for the Martin Luther King Jr. holiday.

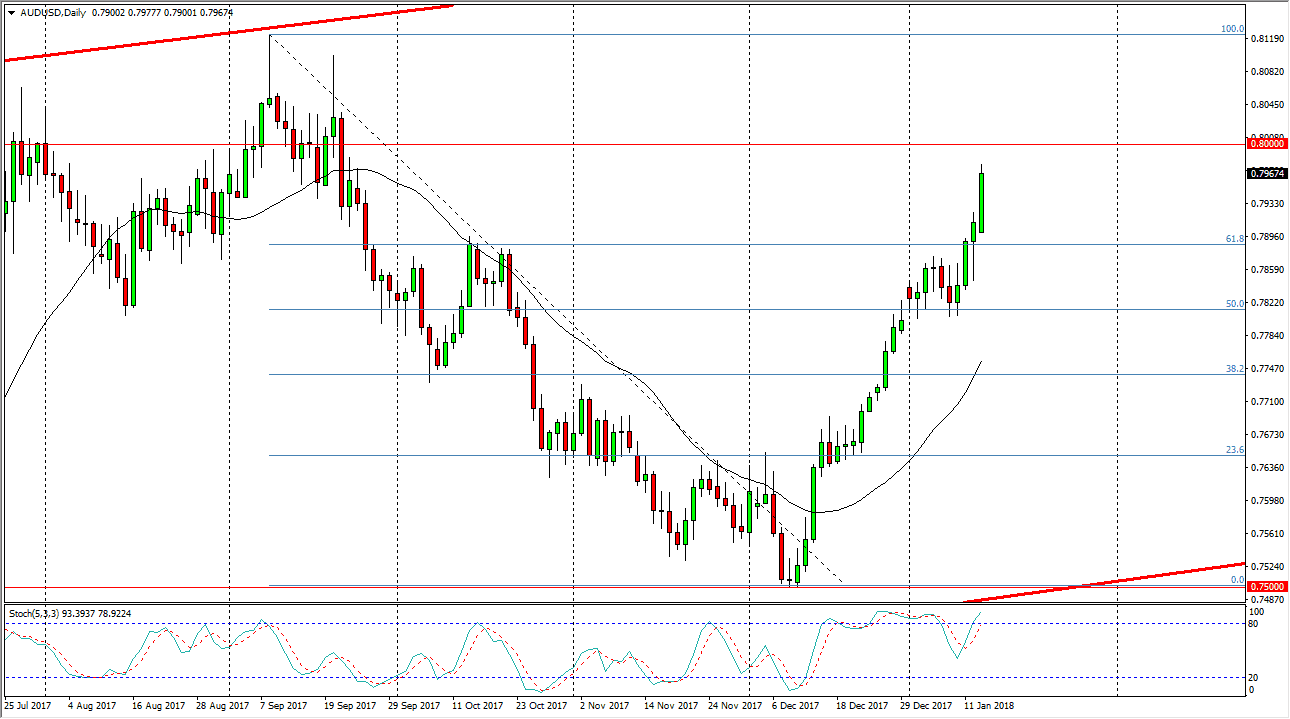

AUD/USD

The Australian dollar rallied significantly during the trading session on Monday, reaching towards the 0.80 level above. That’s an area that has been important on longer-term charts, and because of this I think there is going to be a lot of noise in this general vicinity. If we break above the 0.80 level, we are free to go to the 0.8120 level, where we would have a 100% Fibonacci retracement pull back. If that happens, it’s only a matter of time before we go even higher. I believe that pullbacks offer buying opportunities, because we are starting to see a major negative bias when it comes to the US dollar, and if gold rallies that will only push this market even higher. I think that there is a significant amount of support at the 0.78 level underneath, meaning that we may see a bit of noise trying to build up to a breakout to the upside.