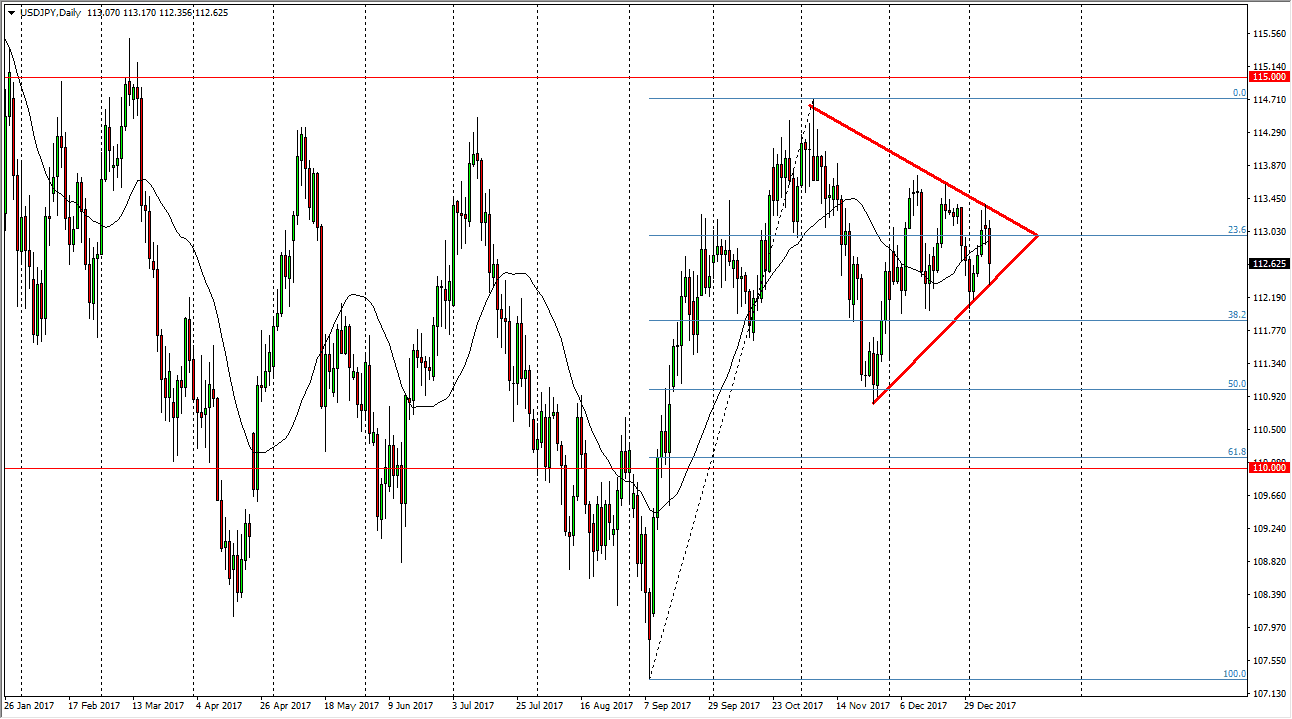

USD/JPY

The US dollar fell significantly during the trading session on Tuesday, testing an uptrend line underneath. As you can see on the daily chart, we are forming a bit of a symmetrical triangle, perhaps with a slightly upward till. I think that we are going to go back and forth, but once we break out of this triangle, perhaps we can put serious money to work. A break above the downtrend line should send this market towards the 114.50 level. If we break down below the uptrend line, the market will more than likely go looking towards the 112 handle, and then eventually the 111 level. Expect volatility, but recognize that the market seems to be favoring the upside in general.

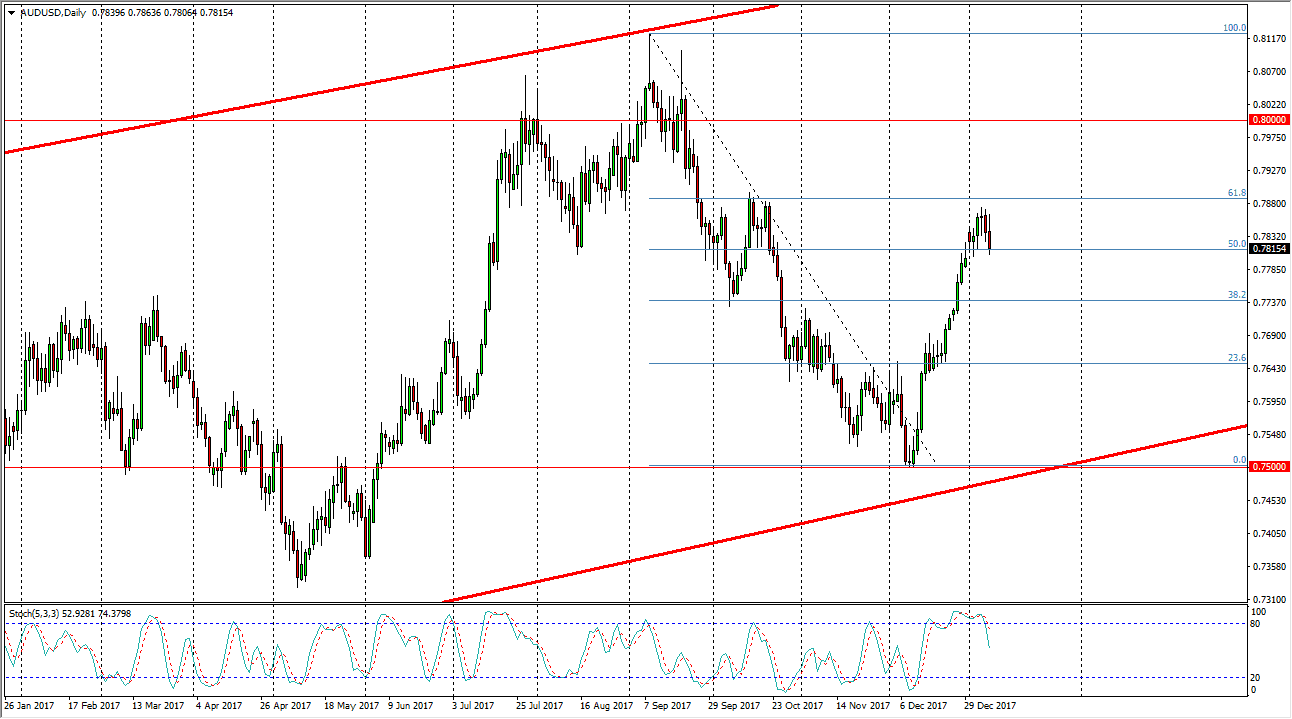

AUD/USD

The Australian dollar initially tried to rally, but then fell towards the 0.78 handle. If we can break down below there, the market will probably go down to the 0.77 handle after that. Alternately, if we can break above the 0.79 level, the market probably goes towards the 0.0 level above, which is crucial on the longer-term charts. I have an uptrend channel marked on the chart, and it seems that the 0.75 level underneath is massive support. I believe that the market should continue to be one that eventually buyers will be interested in, but the short-term it looks as if we are getting a bit exhausted. We have already crossed in the overbought condition on the stochastic oscillator. By doing so, looks likely that we are ready to roll over, but I think you should pay attention to the gold markets as well, because they will obviously have the typical influence.