USD/CAD

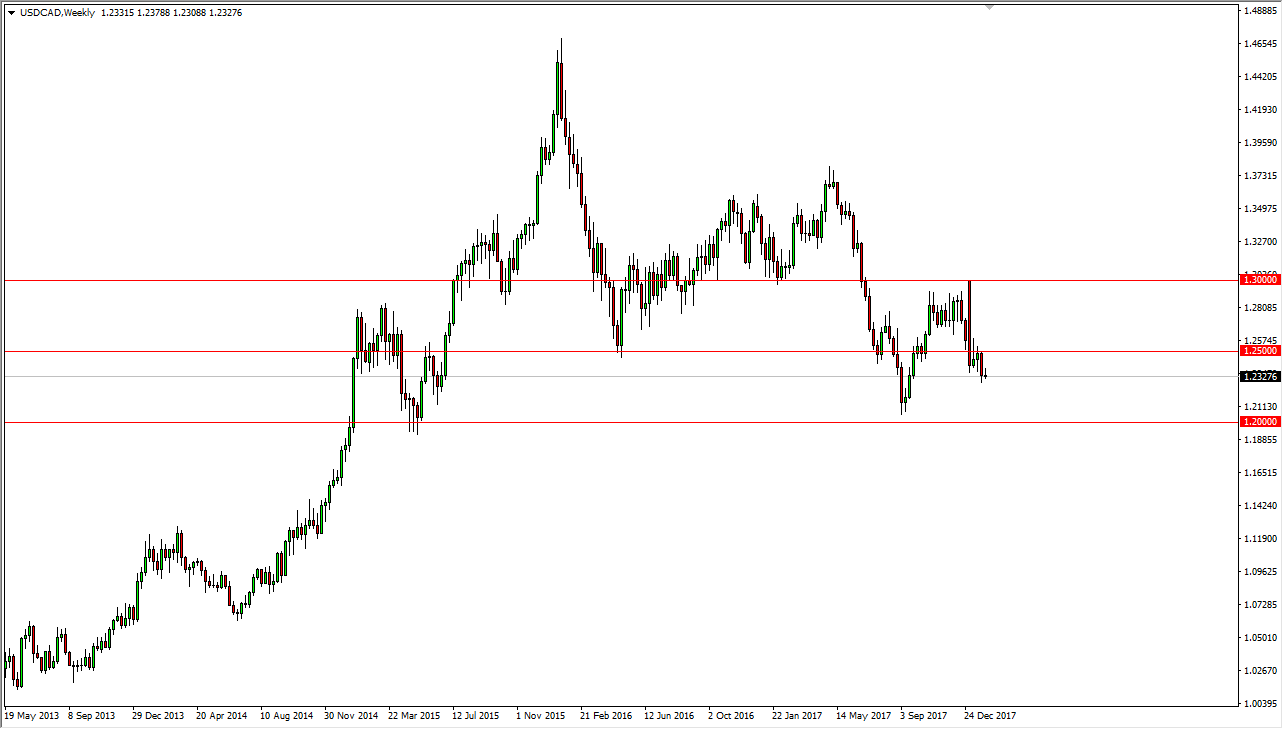

The US dollar has been very negative against the Canadian dollar during most of the month of January, as oil markets have shown a significant amount of strength. This of course is a negative influence on this pair, and further compounding this move is the relative weakness of the greenback against most other currencies. Ultimately, breaking below the 1.25 level was a significant signal that we are going to go lower, and when I look at the charts I recognize that we are probably going to be looking towards the 1.20 level underneath, which has been massively supportive in the past. I think that the downward momentum should continue, and I believe that the 1.25 level should offer a significant amount of resistance.

Oil markets are pulling back towards the last couple of sessions of January, but I believe it is simply an opportunity to go higher yet again, as the market has been a bit overdone. This market is testing significant support, at least in the form of an uptrend line. I believe that this is going to be a very volatile month, but I do believe that in the longer-term, the USD/CAD pair is probably going to go hunting lower levels. I suspect that short-term rallies will be selling opportunities, but if we did break above the 1.25 handle, the market should go towards the 1.28 level initially, followed by the 1.30 level after that which of course will be massive resistance. If we can clear that level, then we continue the massive uptrend that had recently been part of the market. When I look at this chart, it’s not quite a head and shoulders, but it certainly looks as if it is something similar. In general, I think that the negativity in this market should continue.