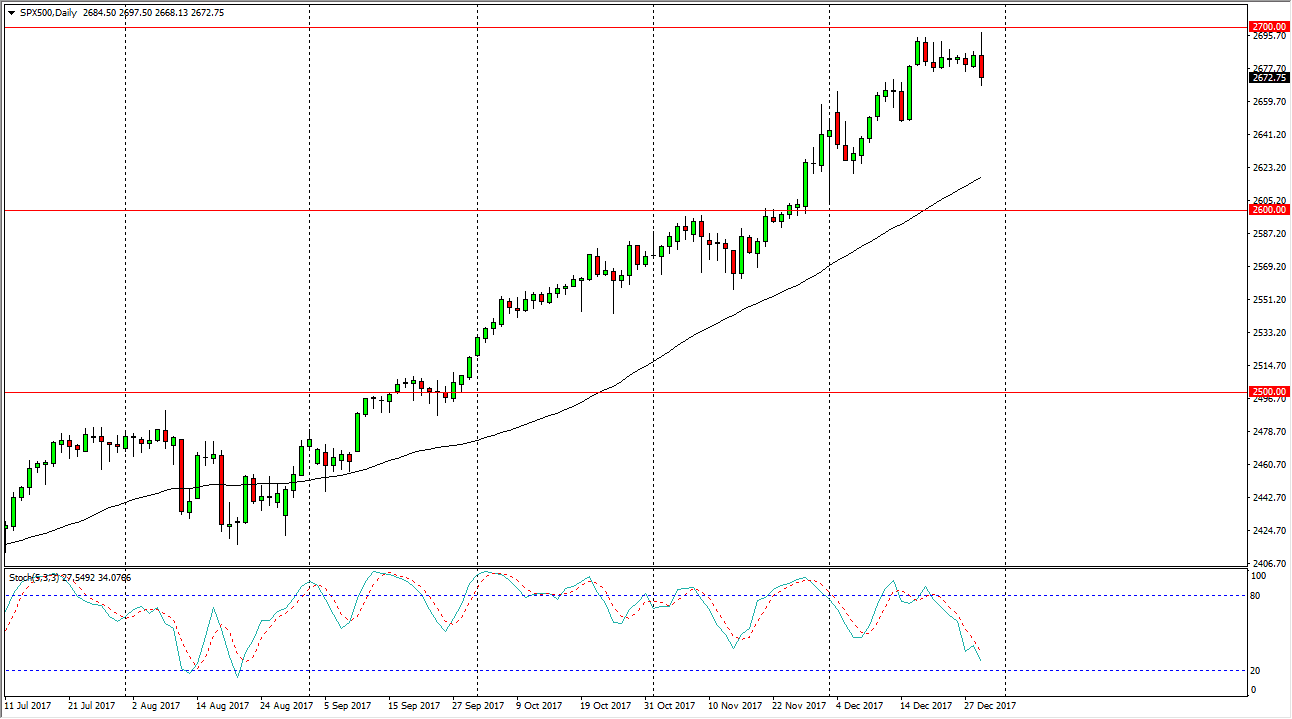

S&P 500

The S&P 500 initially tried to rally during the session on Friday, but found enough resistance at the 2700 level to turn things around and form a negative looking candle. The market sold off rather drastically towards the end of the session, but quite frankly I think a lot of this was positioned squaring for the end of the year, and I don’t read too much into it. The 2700 level has offered a significant amount of resistance, so it’s clear to me that if we break above there, the market probably is free to go much higher. I believe that there is a massive amount of support underneath that the 2650 handle, and then the 2600 level after that. On supportive candles or bounces I’m willing to get involved, but with the jobs number coming up in a few sessions, it’s likely that the markets might be quiet until we get those results.

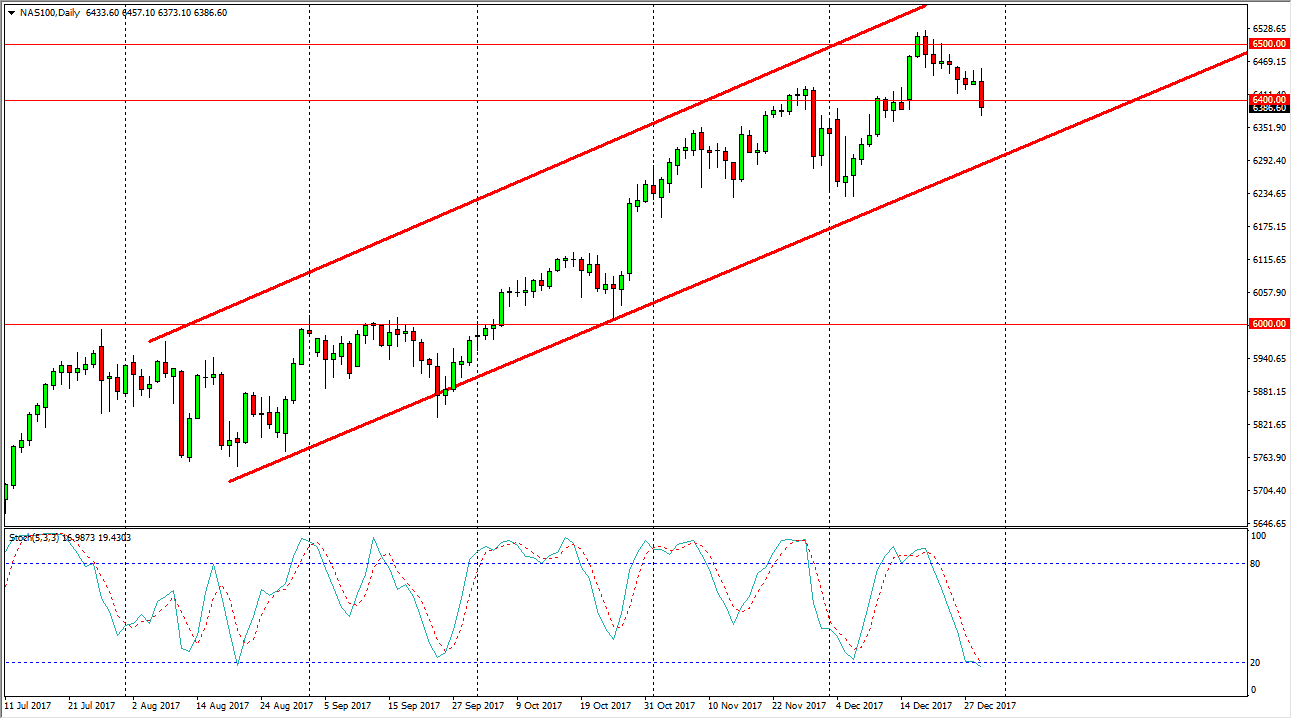

NASDAQ 100

The NASDAQ 100 initially rallied as well, but just as the S&P 500 did, we ended up falling during the day. We broke below the 6400 level, but that isn’t much of a concern for me, because we have been in an uptrend for some time, and a nice looking up trending channel continues to be supportive as well. I believe that the market should eventually find buyers, so the closer we get to the uptrend line at the bottom of the channel, the more interesting this market becomes for me. I think eventually we will build up enough momentum to go towards the 6500 level above, but once we break above there the market should continue to go even further. In general, this is a market that I think will eventually rally, but patience may be needed.