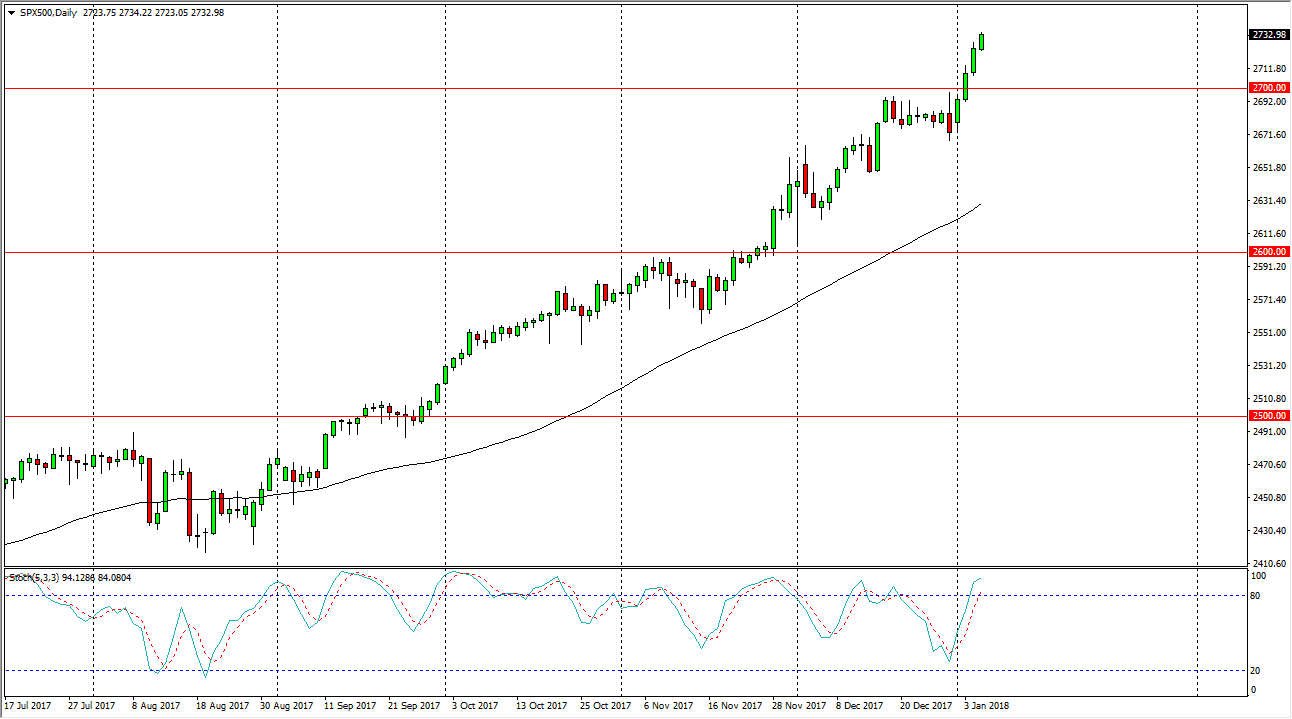

S&P 500

The S&P 500 rallied slightly during the session on Friday, which is a bit impressive considering that the jobs number missed significantly. Having said that, it looks as if the buyers are willing to jump in, and I think now that the 2700 level should be a short-term floor in the market and that we will continue to see people be attracted to the S&P 500 overall. Money managers are coming back from the holidays, so there’s plenty of fresh money on Wall Street to push things to the upside. I like buying dips, and I believe we are going to go looking towards the 2750 level next. Expect a lot of volatility, but quite frankly I don’t see the reason to short this market, as we have been so reliably bullish for weeks.

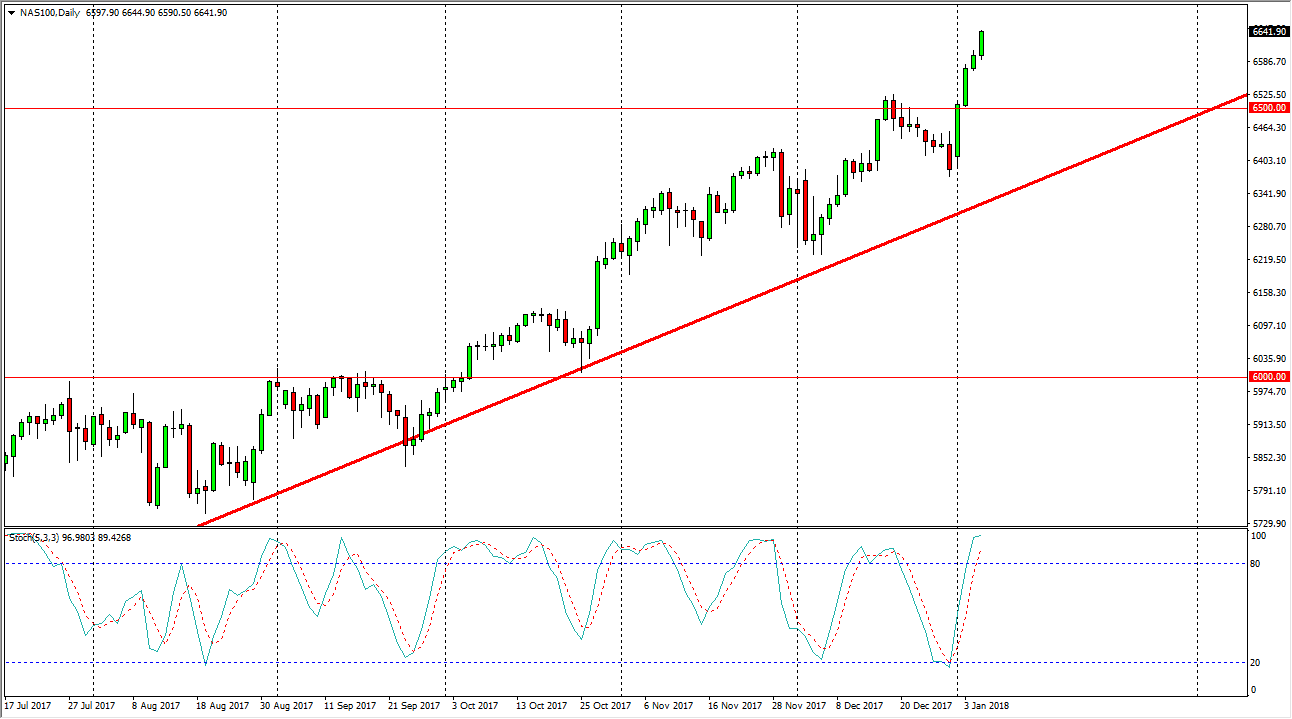

NASDAQ 100

Not to be outdone, the NASDAQ 100 also rally during what should have been a negative day. We have recently cleared the significant 6500 level, and that of course suggests that we are going to continue to go to the upside. The uptrend line underneath should continue to keep the market bullish as well, and I think the given enough time we will get pullbacks we can take advantage of. The NASDAQ 100 has been a bit of a laggard compared to the other US indices, but it has been bullish as well. Perhaps we should play catch-up now, but either way I don’t think there is a significant argument to short this market. I think in general, it’s probably best to look for dips as value instantly add to a position there. I believe that we are going to go looking towards the 6750 level.