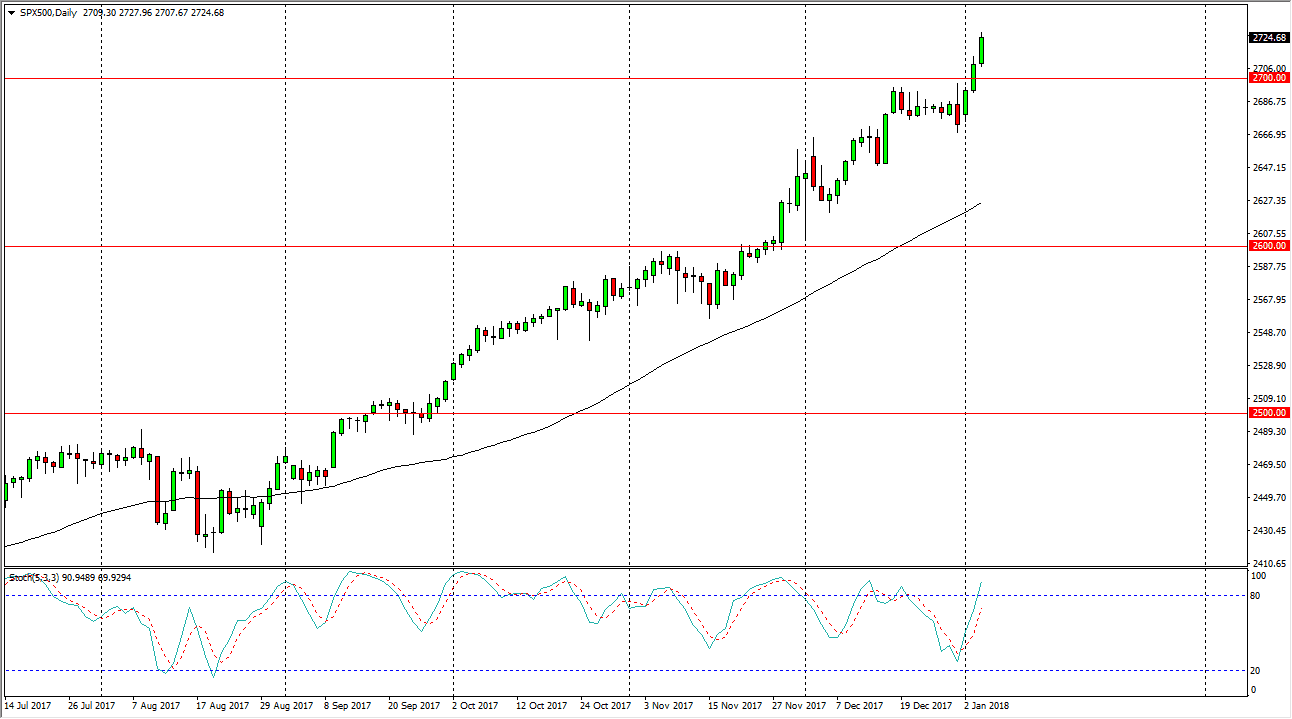

S&P 500

The S&P 500 rallied significantly during the trading session on Thursday, as we continue to see more volume jump into the US stock markets. As we approach the jobs number today, it could be very volatile, but I would love to see some type of pull back towards the 2700 level, where I would expect to see a lot of buying pressure. A bounce in this area should continue to send this market to the upside, but you will probably have to be quick, because this reaction will be almost immediate after the jobs number at 8:30 AM in New York City, which is before the underlying index trades. I think longer-term, we are going to go to the 2750 handle, and then the 2800 handle after that. It’s not until we break down below the 2680 handle that I would be concerned.

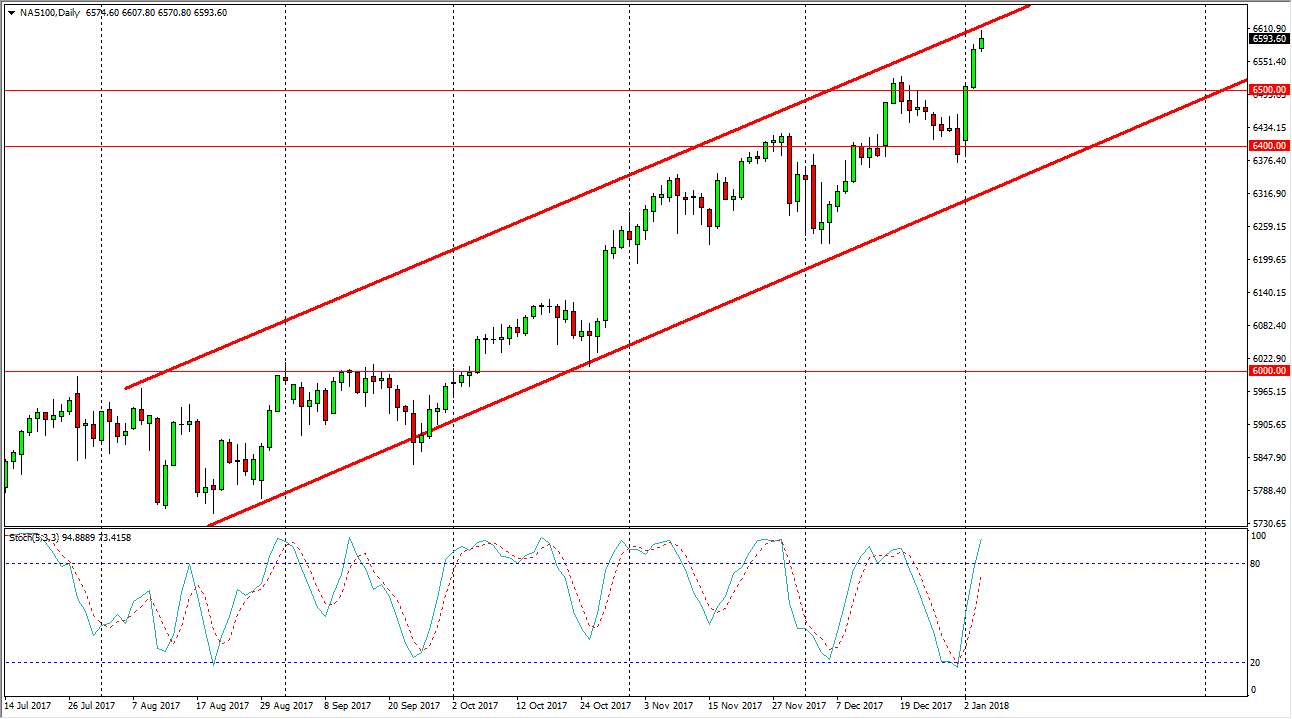

NASDAQ 100

The NASDAQ 100 tried to rally during the trading session on Thursday, but turned around to form a less than impressive candle. Ultimately, it doesn’t matter though, because we are at the top of an up-trending channel, so it makes sense that we may have to pull back a little bit to pick up gains. I think that the 6500-level underneath will offer massive support, and although this is a market that is bullish, it has been a bit of a laggard when it comes to the US markets. Ultimately though, if we can break above the top of the channel, that should put an impulsive bend to this market. I have no interest in shorting, least not until we break down below the 6400 level, something that seems very unlikely to happen anytime soon. Nonetheless, I do prefer the S&P 500 over the NASDAQ 100.