S&P 500

The S&P 500 has broken down during the trading session on Tuesday and formed a very negative candle on strong volume. However, a little bit of realism is necessary when looking at this chart, because we have simply seen a 1% decline. Quite frankly, at this point I would love to see a pull back to even lower levels, and the 20 SMA is just below the 2800 level, so that would be a nice target. The stock markets are overbought by any measure you can use, so I think this is going to be a nice buying opportunity at the end of the move. Longer-term, I suspect that we are going to go looking towards the 3000 level. I have no interest in shorting this market, as we are in a very strong uptrend, and the fundamental still favor higher stock market pricing.

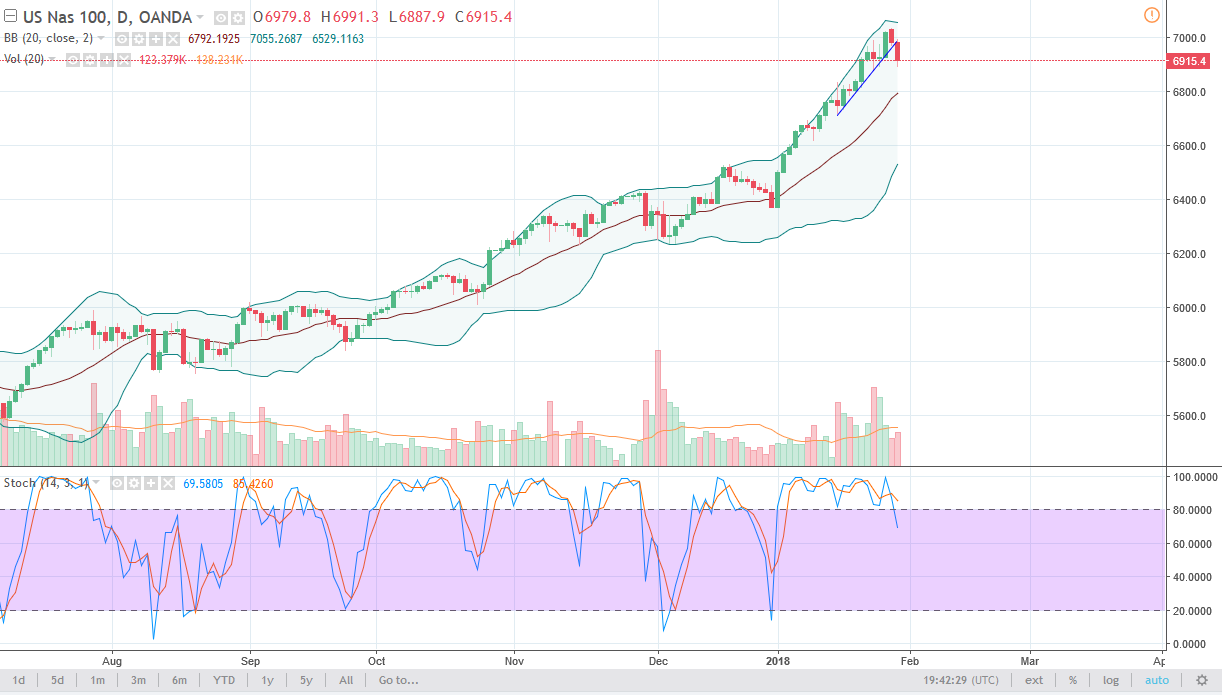

NASDAQ 100

The NASDAQ 100 broke down during the session on Tuesday, slicing through a significant uptrend line. The 6900 level is an area that has offered a little bit of support, but the 20 SMA is closer to the 6800 level, and I believe that the market should offer a nice buying opportunity on that very range. I believe that a supportive candle is an opportunity to go long, and while the S&P 500 has sold off on strong volume, the NASDAQ 100 has shown very little in the way of volume, suggesting that we don’t have any type of panic. I think that the pullback at this point offers a value proposition as well, and I think that we will see no more than a couple of days’ worth of selling. It makes sense we pulled back, as the 7000 level is a massive round number to pay attention to.