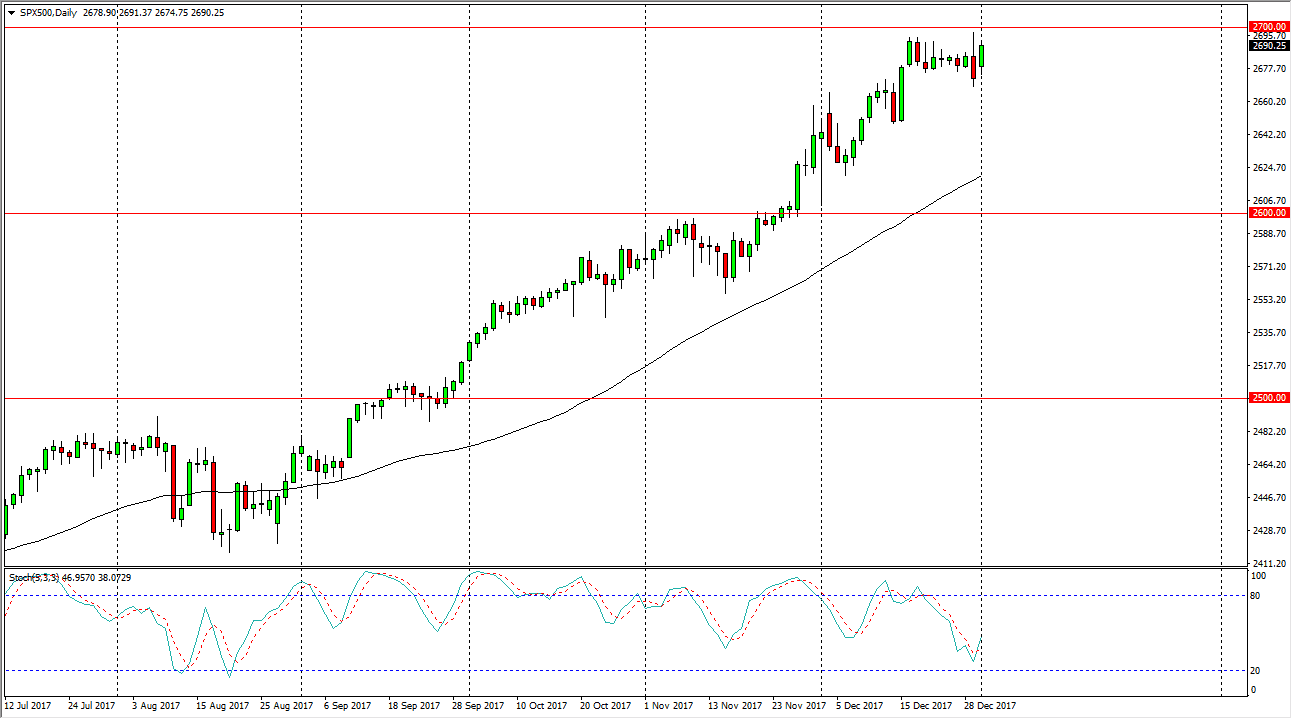

S&P 500

The S&P 500 had a positive start to the year, as we reached towards the 2690 handle. There is an obvious resistance at the 2700 level, and if we can break above there think that the market is free to go much higher. Eventually, I do expect this to happen, but eventually we should go to the 2750 handle. I think that pullbacks of this point should be buying opportunities, especially near the 2650 handle, which is a minor support level, followed by an even more significant support level at the 2600 level. I believe that the buyers will continue to look at pullbacks as opportunities to take advantage of value in a market that is obviously very bullish. With the tax plan passed in the United States, it’s very likely that we will continue to see US stock markets rally.

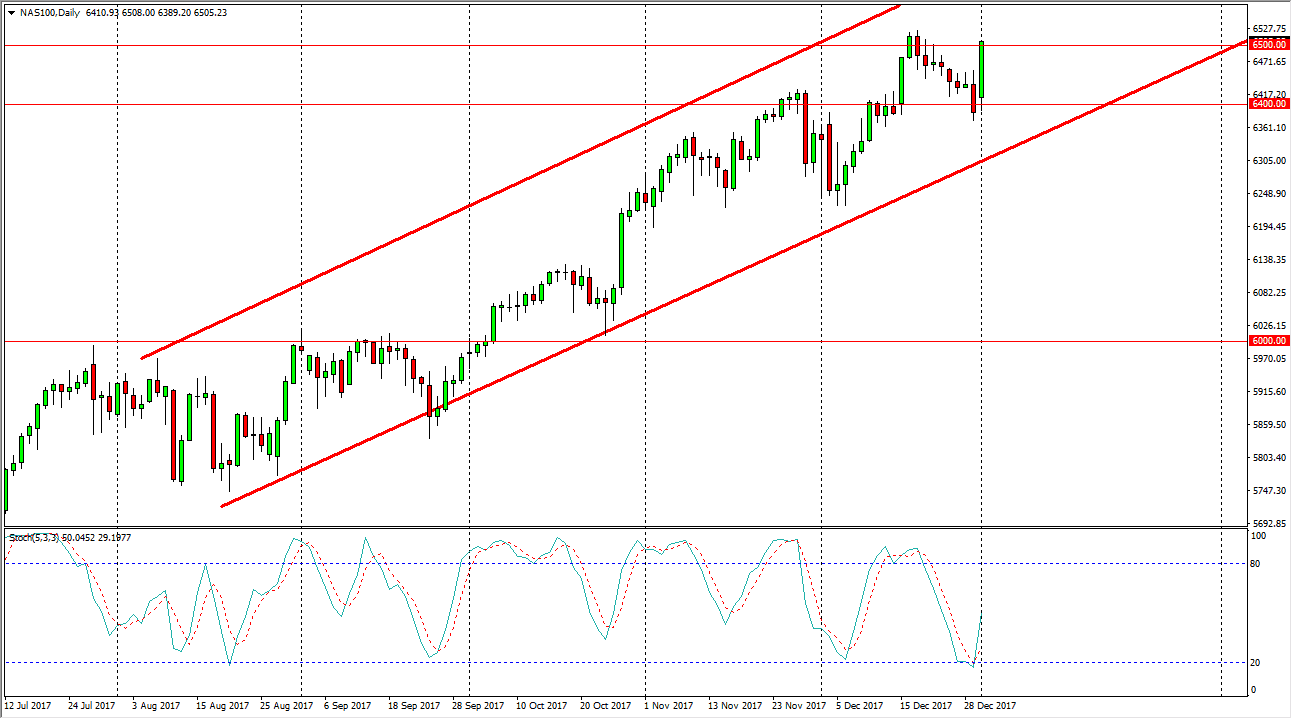

NASDAQ 100

The NASDAQ 100 shot straight up in the air at the open on Tuesday, but then pulled back to fill that gap. By the end of the day though, we broke even higher and sliced through the 6500 level. That’s an area that begins significant resistance, but if we can break above the 6525 handle, the market continues to go much higher. I think that short-term pullbacks are buying opportunities, as we are in a nice up trending channel, as the 6400-level underneath will be the “floor.” In general, I think that buying the dips continues to be the best way to play the markets in the United States, as we should continue to see plenty of support. It’s not until we break down below the bottom of the up-trending channel, somewhere closer to the 6300 level, that I would be interested in selling this market, something that doesn’t seem very likely.