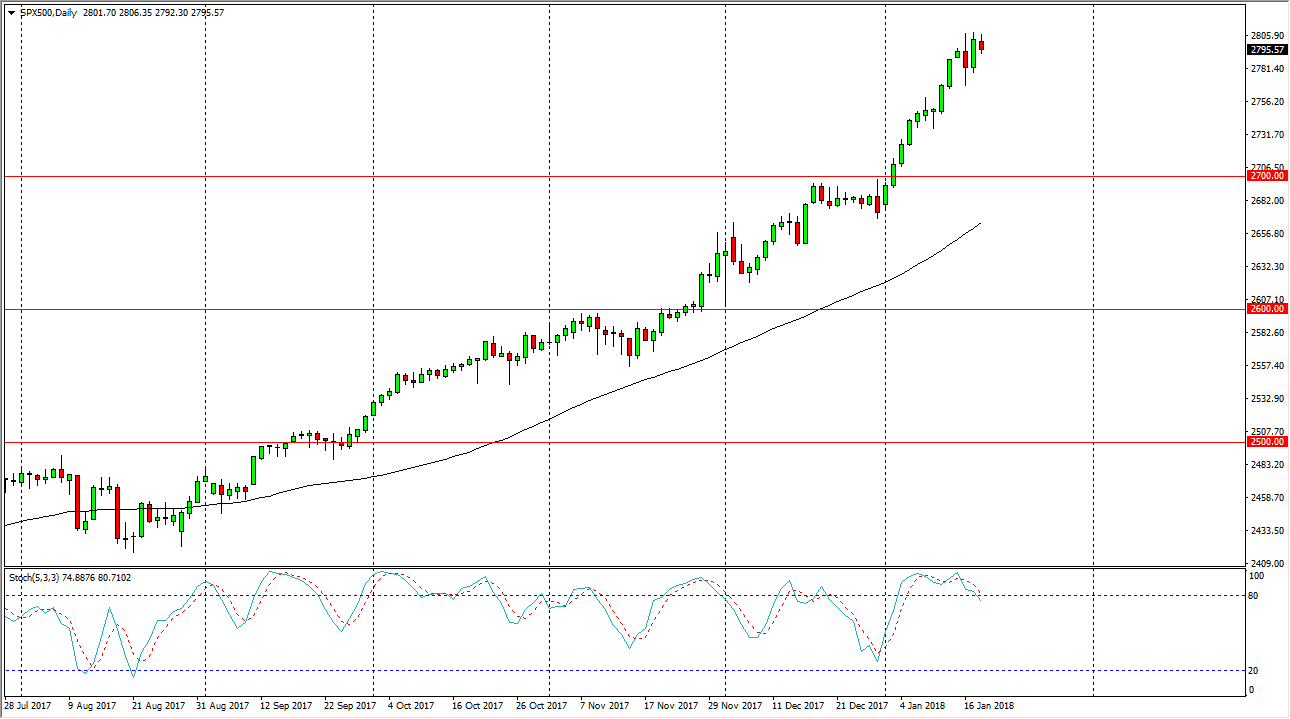

S&P 500

The S&P 500 fell a bit during the session on Thursday, but at this point I think that the market should continue to find plenty of support below, and the pullback makes sense as the 2800 level offers resistance. Ultimately, this is a market that should continue to see buyers on dips, as the algorithmic traders around the world continue to pick up the S&P 500 based upon short-term pullbacks, as the market simply cannot even lose a single percent. Ultimately, I believe that we break above the 2800 level and continue to go towards the 3000 longer-term. I look at the 2700 level underneath as a hard floor in the market, and if we stay above there, it becomes a “buy on the dips” scenario, but it will of course be very choppy as we are bit overextended.

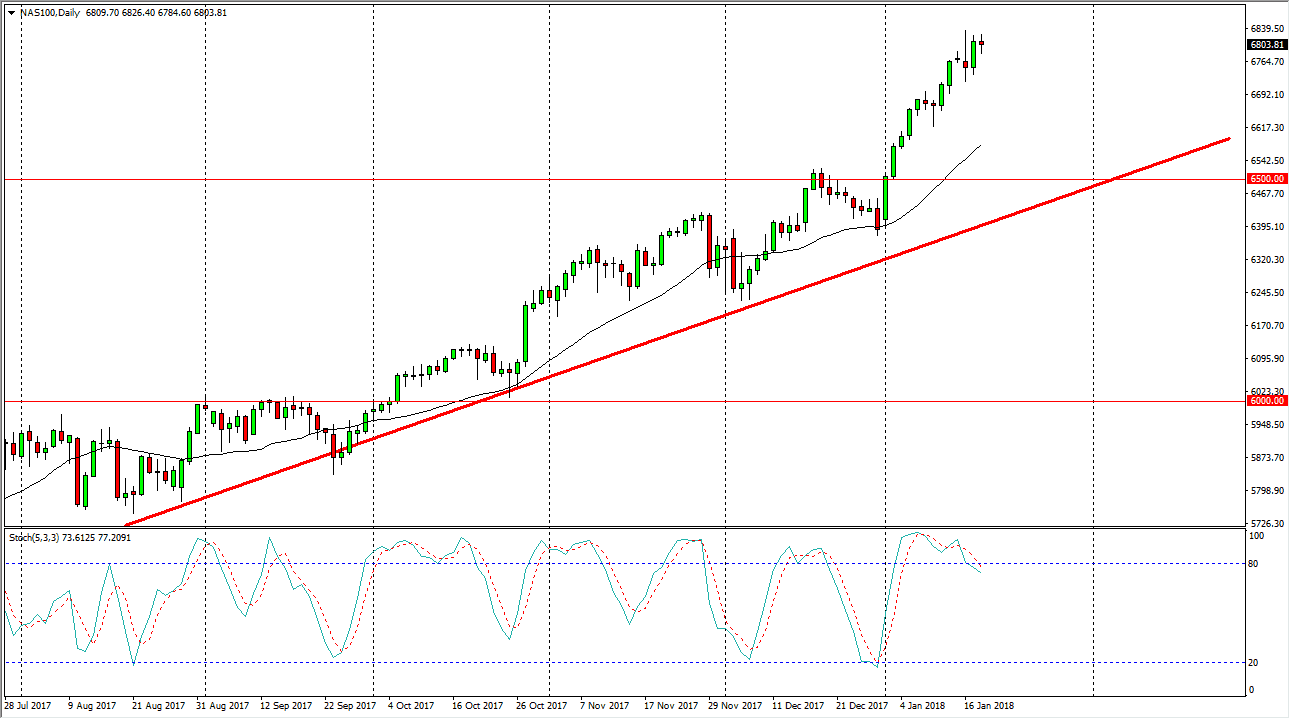

NASDAQ 100

The NASDAQ 100 has been rather noisy during the day, but in the end settled on a reasonably neutral candle. I think that the market pulling back from the 6800 level makes a lot of sense though, and it will be looked at by most people around the world as value. The value continues to be a situation where people are looking to take advantage of a very strong uptrend, even though the NASDAQ 100 has been a little bit of a laggard compared to other US indices. However, they all tend to move in the same direction over the longer term, so it makes sense that this is a “buy only” market. I look at the 6500 level as the floor in the market, and I think that we will continue to find plenty of buyers. The 7000 level above is the longer-term target, and of course an area that will attract a lot of attention.