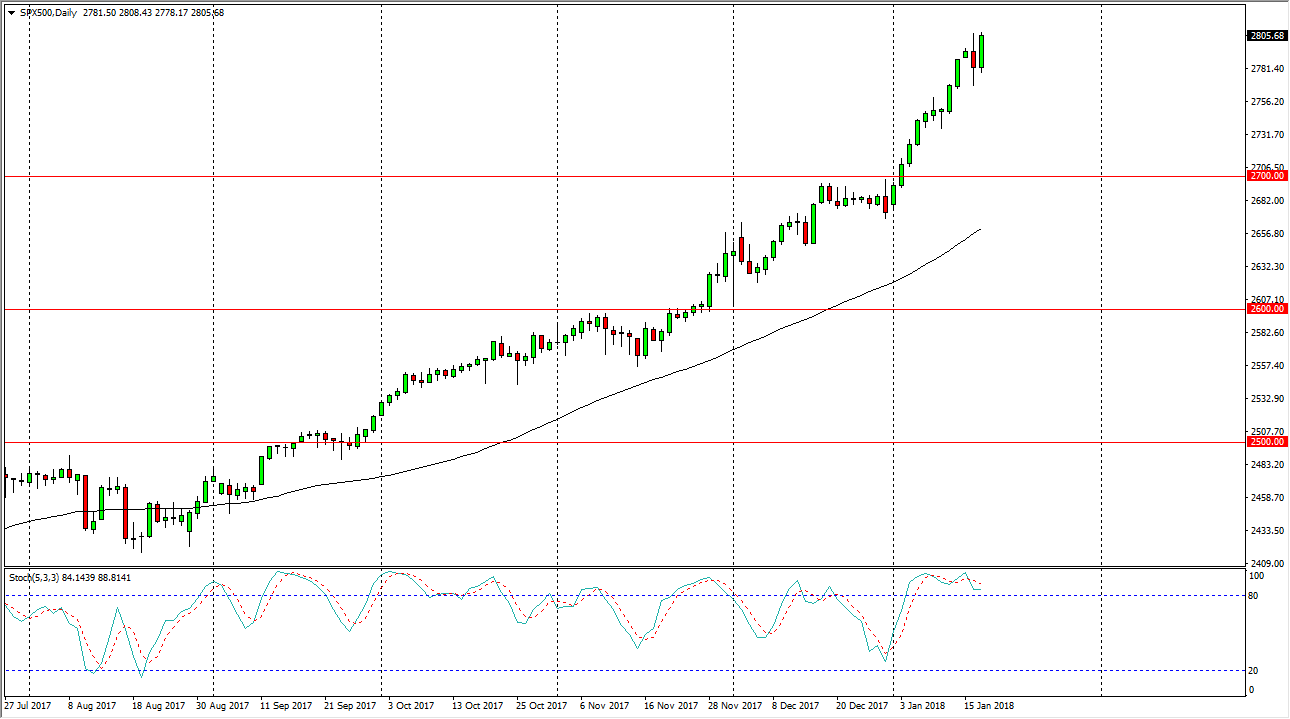

S&P 500

The S&P 500 rallied during the day, reaching towards the 2800 level. That’s an area that should be important, and I think that it should have this market looking towards the 2900 level after that. Longer-term, I anticipate that the market goes to the 3000 handle above, the longer-term target in general. In the meantime, I’m looking for short-term pullbacks as buying opportunities, and it makes sense that we will get them from time to time, especially considering that we are bit overextended. I anticipate that the 2700 level underneath is the floor in this market, and I will continue to be bullish until we break down below that level. Volatility continues to be an issue, but longer-term I think that the buyers will continue to be in control of the situation longer term.

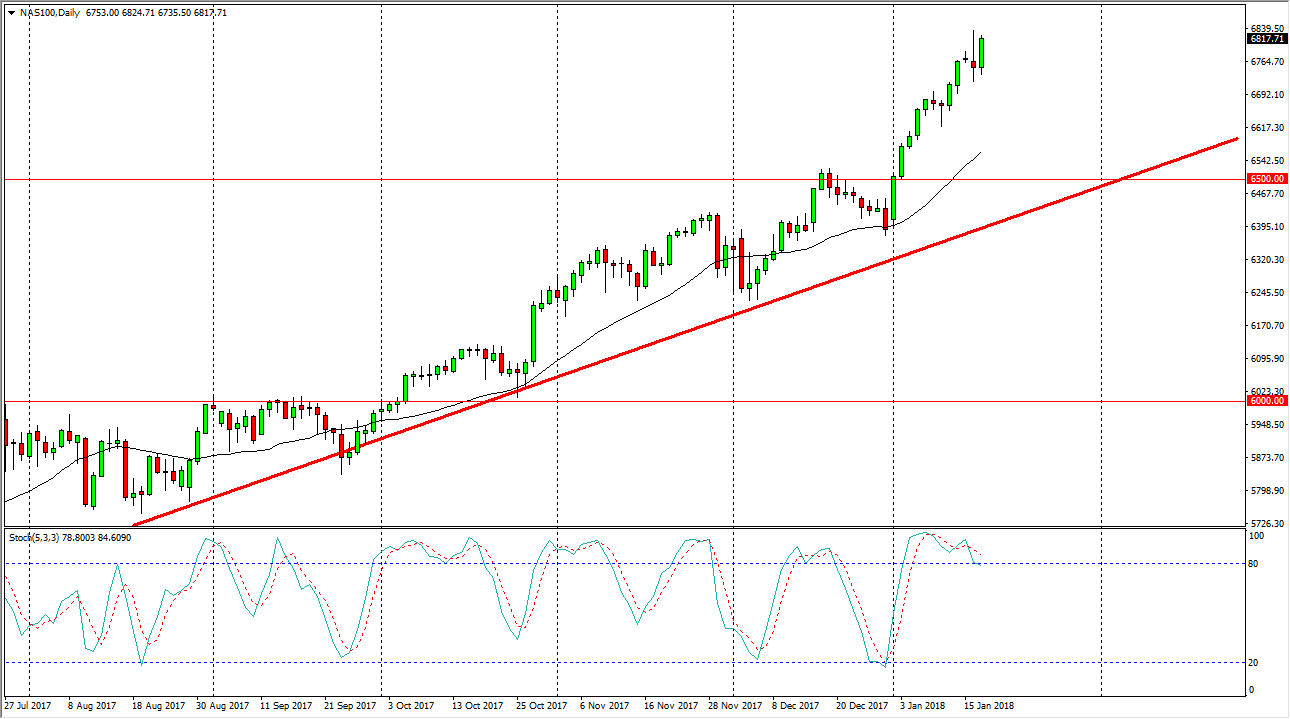

NASDAQ 100

The NASDAQ 100 rally during the session on Wednesday as well, reaching towards the top of the shooting star from the previous session. If we can break above that, the market should continue to explode to the upside, perhaps catching up to some of the volatility that we have seen in the S&P 500 and the Dow Jones 30. I think pullbacks continue to be buying opportunities, but we are bit overextended, so we may get a couple of bad days. That would be perfect though, because it gives us an opportunity to pick up value in a market that seems to not be offering much these days. The 6500 level is the “floor” from what I can tell, and I think that continues to be an area where massive amounts of buying orders should be what to expect. A breakdown below the 6500 level, it’s likely that we will see a significant selloff, but that’s the least likely of scenarios.