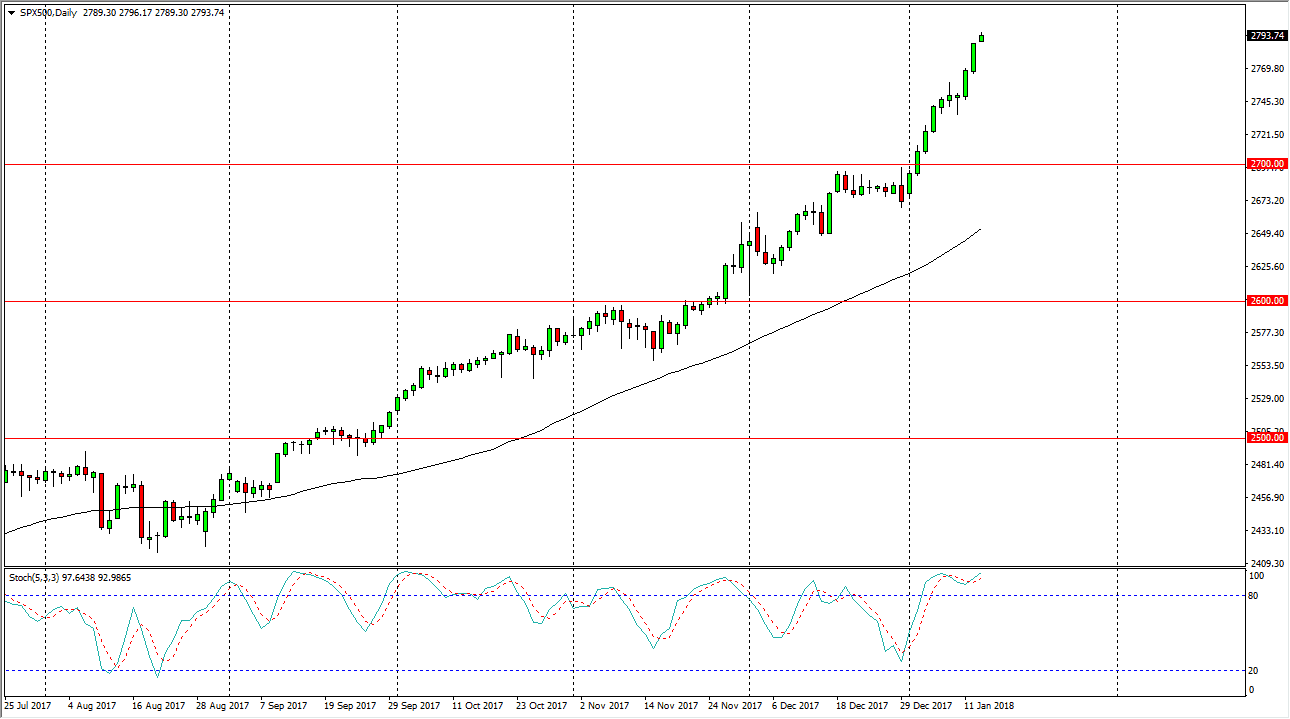

S&P 500

The S&P 500 rallied slightly in the CFD market on Monday, but obviously the underlying trading was nonexistent as Americans were celebrating Martin Luther King Jr. day. Because of this, I think that not much can be read into the marketplace, but as you can see, we have been rallying for some time. I think that the market continues to find buyers on short-term dips, as the algorithmic traders continue to pick up the marketplace. With the tax reform passing, and of course a strong economic backdrop, the S&P 500 should continue to gain over the longer term. We are a bit overextended, so I would love to see some type a pullback that the high-frequency traders will almost certainly turn into this market and start buying yet again. I believe that the 2700 level is the “floor” in the market.

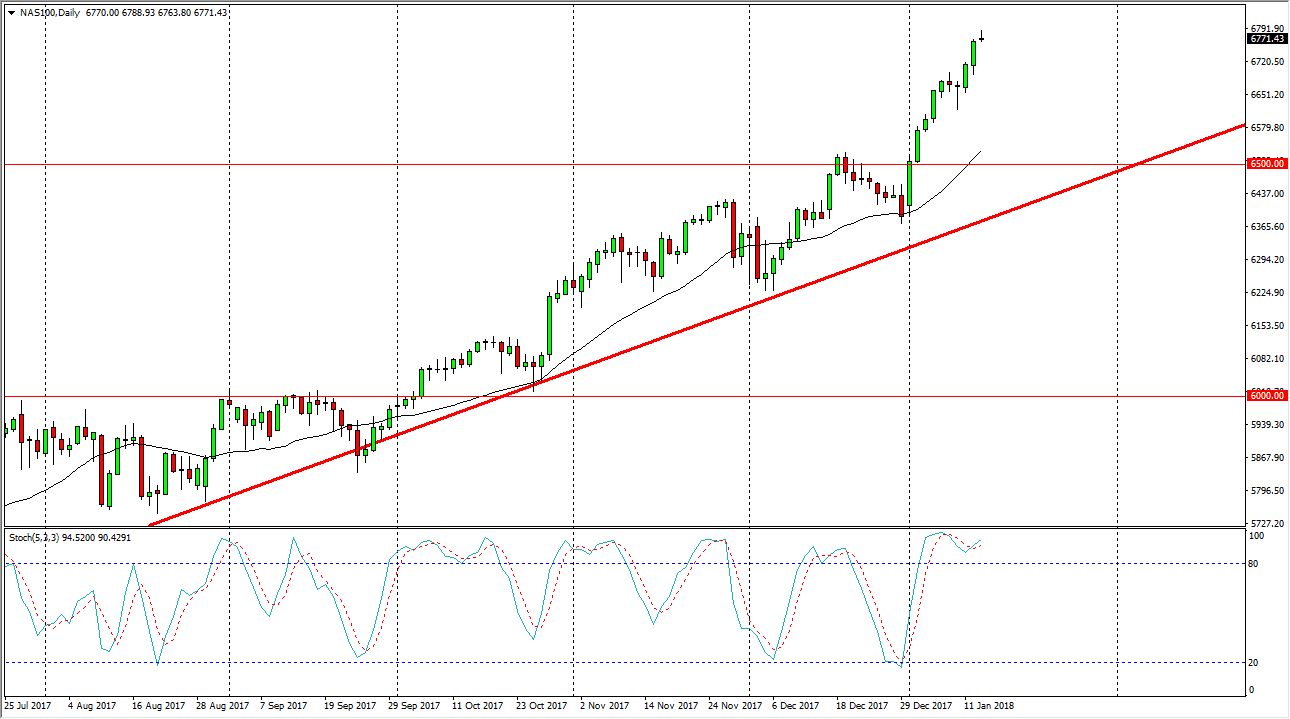

NASDAQ 100

The NASDAQ 100 CFD market also initially tried to rally during the day on Monday, but the underlying NASDAQ 100 of course wasn’t trading. When uniform in a bit of a shooting star, so we are likely to get a short-term pullback from here, but that short-term pullback should end up being a buying opportunity as it represents value. I think that the 6500-level underneath is massively supportive, and essentially the “floor” in the market. The 6650 level is also an area of support, and I think that given enough time, the market will continue to find value on dips and algorithmic traders will start buying again. The longer-term, I think that the market goes looking towards the 7000 handle, but it’s obviously going to take a while to get there as it is a bit of distance between here and there. Buying on the dips continues to be my trading plan.