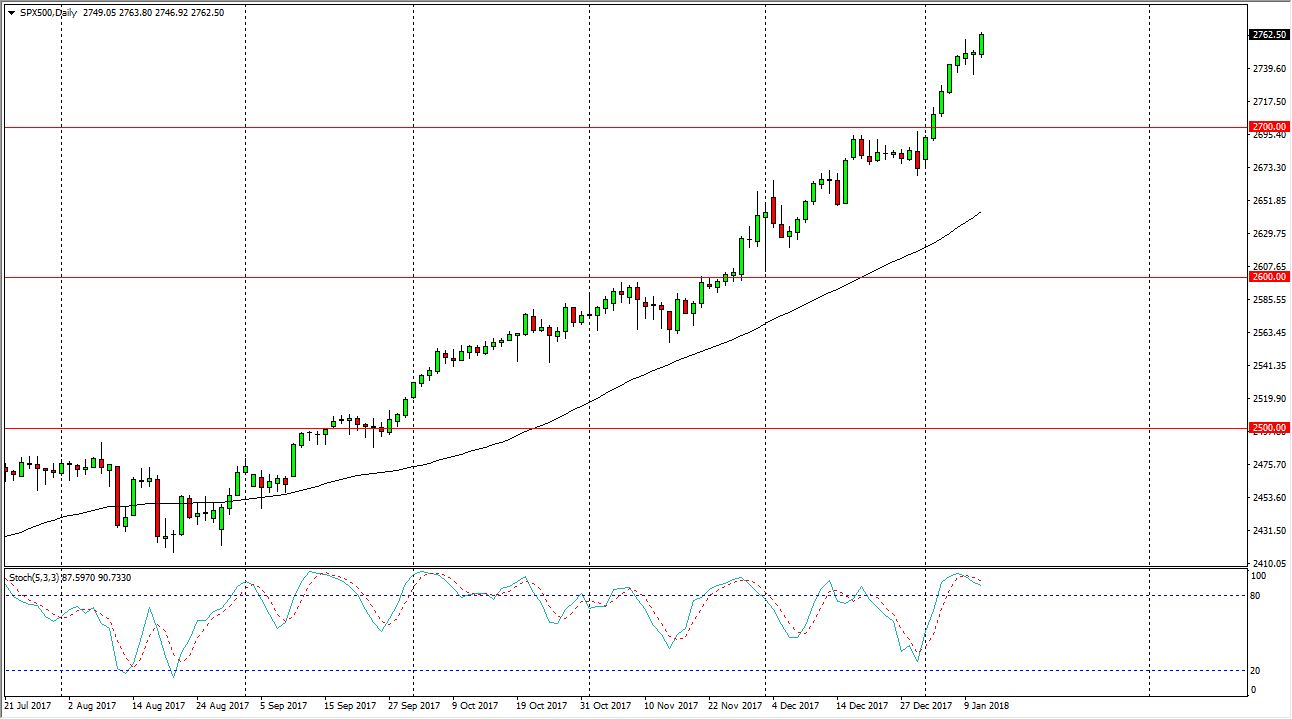

S&P 500

The S&P 500 continues to rally, as the Thursday session was bullish yet again. We broke above the top of the hammer from the Wednesday session, and more importantly in my estimation: the top of the shooting star from Tuesday. We have made a fresh, new high, and it looks as if the market continues to defy gravity overall. Money managers continue to come back out of hibernation after the holidays, and that has fresh, new money going to work on Wall Street. I think short-term pullbacks are buying opportunities, and the alpha rhythmic traders are certainly waiting to pick up any losses that do occur. Longer-term, I believe that we go looking towards the 2800 level above, as the S&P 500 continues to find reasons to go higher. I believe that the 2700 level underneath is the hard “floor” in the market currently as the uptrend is so strong. Beware though, the stochastic oscillator is crossing in the oversold area.

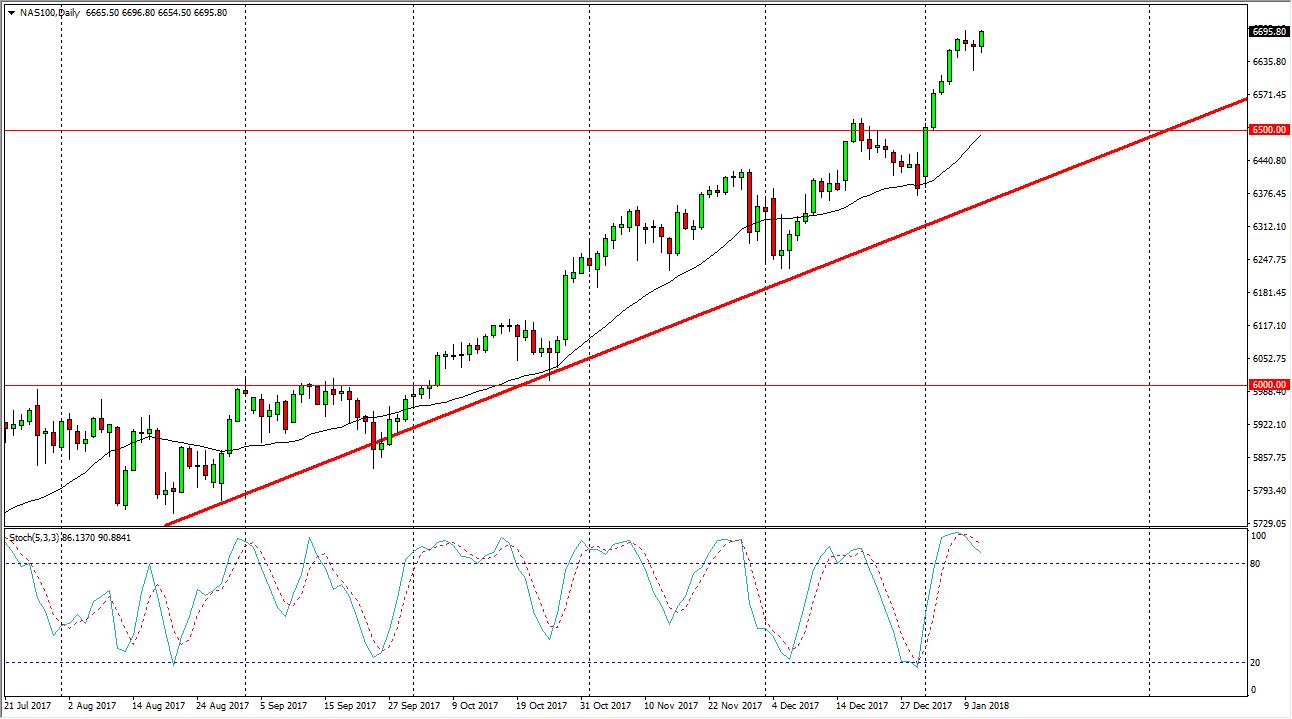

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Thursday, but then rallied to break the top of the hammer from the Wednesday session, making a fresh, new high again, as we press the 6700 level. If we can break above that level, the market is likely to continue to go toward 6750 and so on. I think this is a market that continues to be a “buy on the dips” scenario as well, but the NASDAQ 100 has been a bit of a laggard when it comes to US indices overall, so out of the 3 major ones that I follow, this is probably my least favorite. That doesn’t mean you can make profits in this market, it’s just that you should probably be looking for more of a longer-term trade.