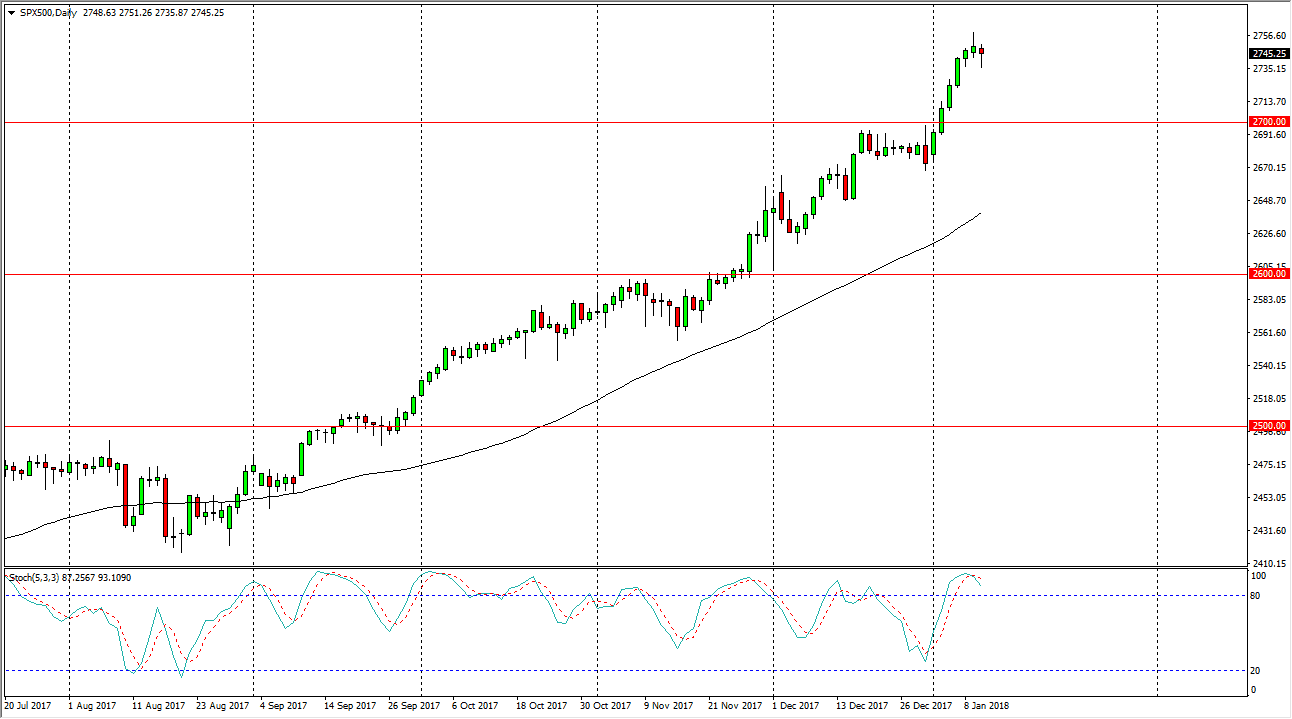

S&P 500

The S&P 500 has fallen during most of the trading session on Wednesday, but we did get back some of the losses towards the end of the day, and I am more impressed by that than anything else, mainly because it is the Americans that picked the market back up. The resulting hammer is a bullish sign, but if we were to break down below that hammer, then I think we could drift a bit lower, which I believe would be a very bullish sign longer-term, as the market has gotten a little bit ahead of itself. I think that the 2700 level underneath should continue to be the “floor” as far as I can see, and with this being the case I am a “buy on the dips” trader as algorithmic traders continue to pick up the S&P 500 on pullbacks based upon value.

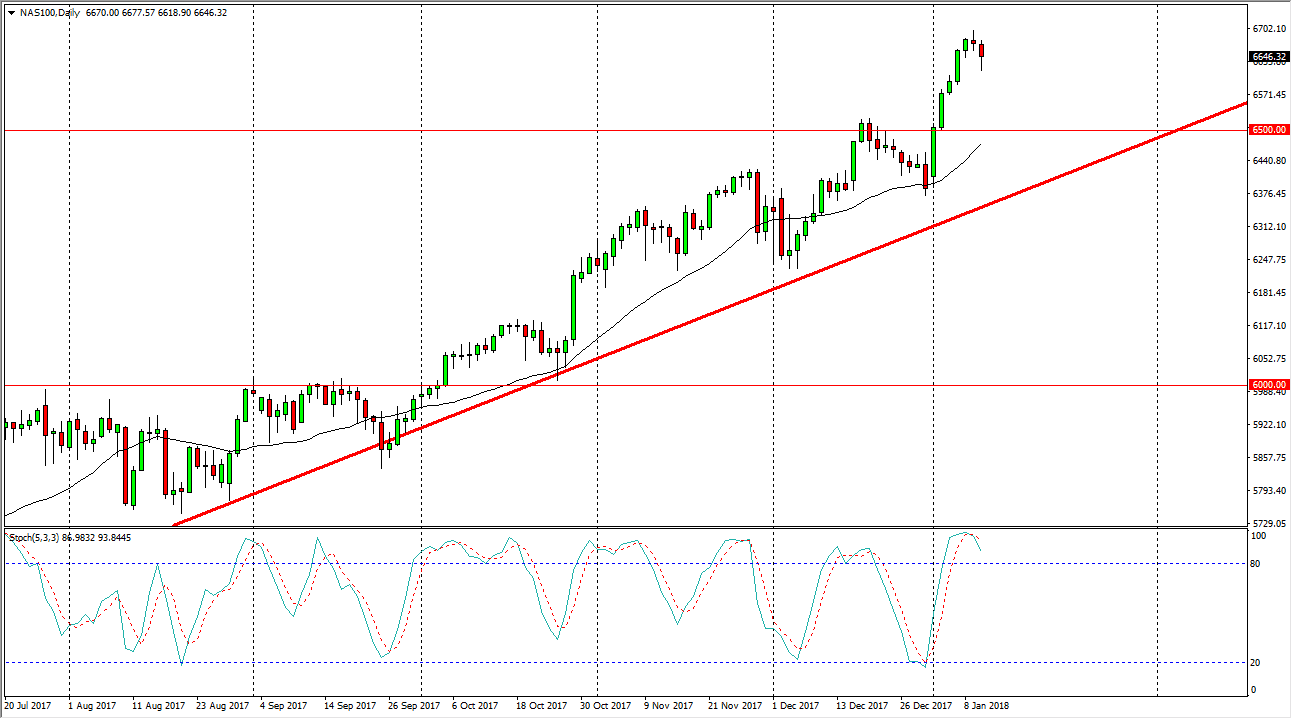

NASDAQ 100

The NASDAQ 100 fell significantly during the trading session on Wednesday, but turned around to form a hammer. By forming a hammer, we ended up showing signs of bullish pressure, and I think this shows that dips continue to offer value. I believe that the market should continue to be noisy and choppy, but positive over the longer term. I believe that the “floor” in the NASDAQ 100 is the 6500 level, so I don’t have any interest in trying to sell until we break down below that level at the very least. Longer-term, I fully anticipate seeing this market going to the 6700 level, and then much higher than that. The NASDAQ 100 is a bit overbought though, so I would love to see a pullback as it offers value in a market that I think will continue to attract a lot of attention.