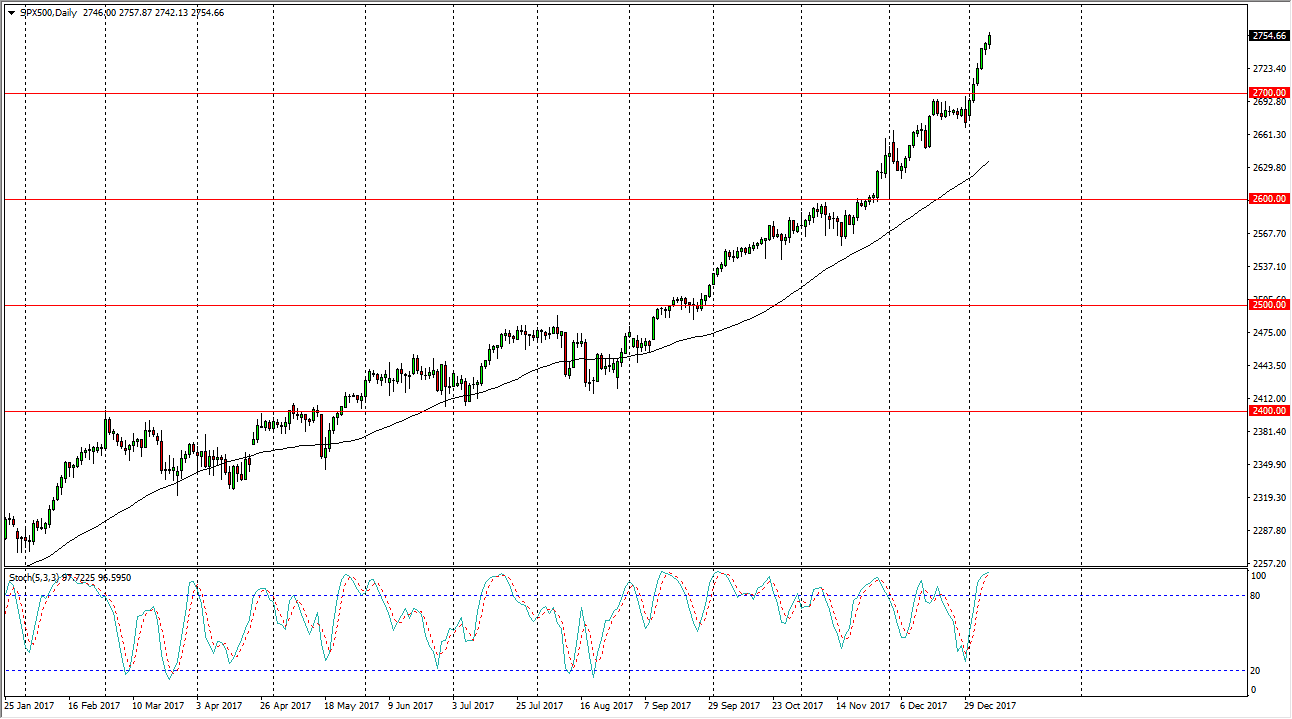

S&P 500

The S&P 500 rallied a bit during the trading session on Tuesday, but we are starting to get a bit overextended. On the daily chart, the stochastic oscillator is in an extreme oversold position, and looking likely a crossover on the moving averages. Because of this, I expect that we will probably see a pullback sooner rather than later, but I also recognize that the 2700 level should be massively supportive now. I certainly wouldn’t want to short this market, that’s a freight train that I have no interest in trying to step in front of. I think by waiting for a pullback, and therefore value, you can benefit from the longer-term uptrend. Longer-term, I still believe that the market goes looking towards the 3000 handle, but that’s going to take quite some time to get to.

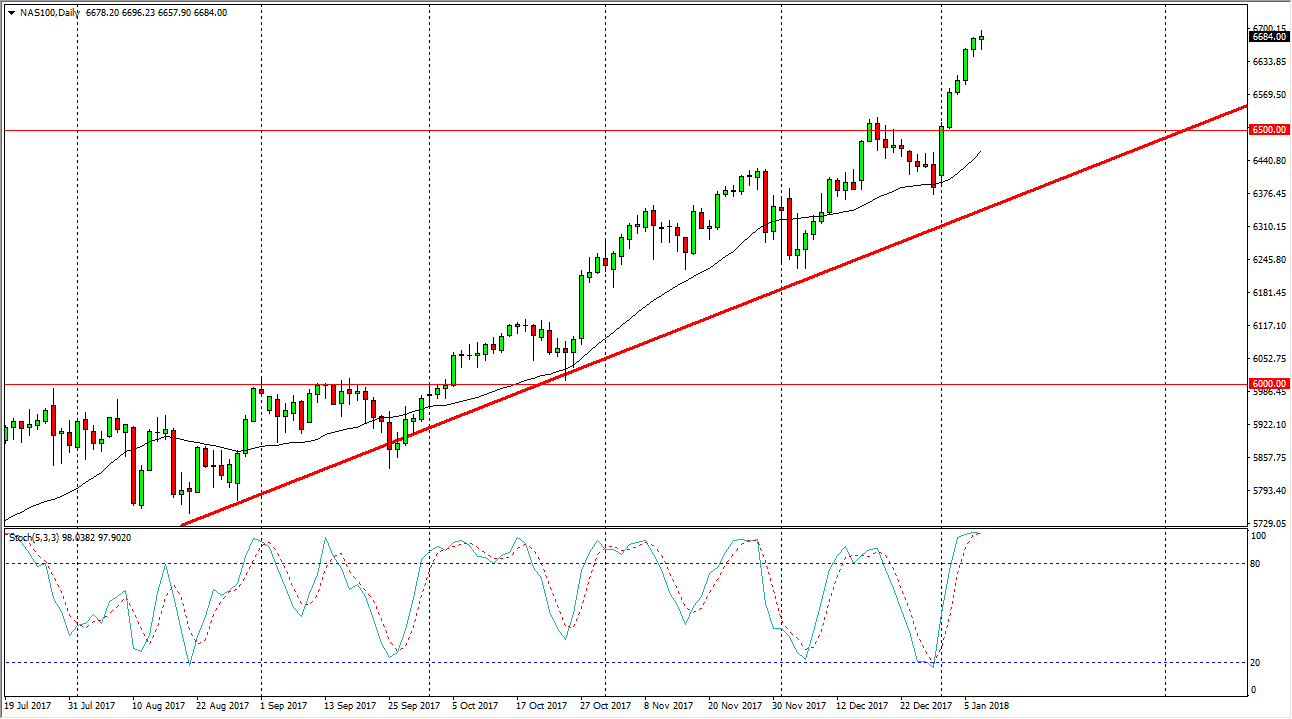

NASDAQ 100

The NASDAQ 100 broke out to the upside a little bit during the trading session on Tuesday, after initially dipping. It is forming a hammer, but the hammer looks very unlikely to signal that we are ready to start a fresh, strong search higher, but rather that the market is starting to see a little bit of doubt creep into the picture. I think if we break down below the bottom of this candle, it could be a bit of a “hanging man”, and that gives the signal to start selling. Having said that, I will not be selling this market as I think there is more than enough support underneath. I think you are better off by simply waiting to find value underneath, especially near the 6500 level. We are bit overextended, the stochastic oscillator is starting to cross over on the daily chart, so I have a couple of reasons to think that the pullback is imminent. Again, I’m not willing to sell this market, but there are plenty of short-term traders that would be.