Gold prices ended Thursday’s session up $9.34 an ounce, helped by the weakness in the dollar. XAU/USD initially fell yesterday but bounced up nicely from the anticipated support level at $1305, the confluence of a horizontal support and the bottom of the hourly cloud. The market climbed back above the $1317-$1316 area and ultimately reached the $1326 level. Prices are stalling in Asian session today as market players await non-farm payrolls from the United States. The Labor Department’s employment report is closely watched by the Federal Reserve.

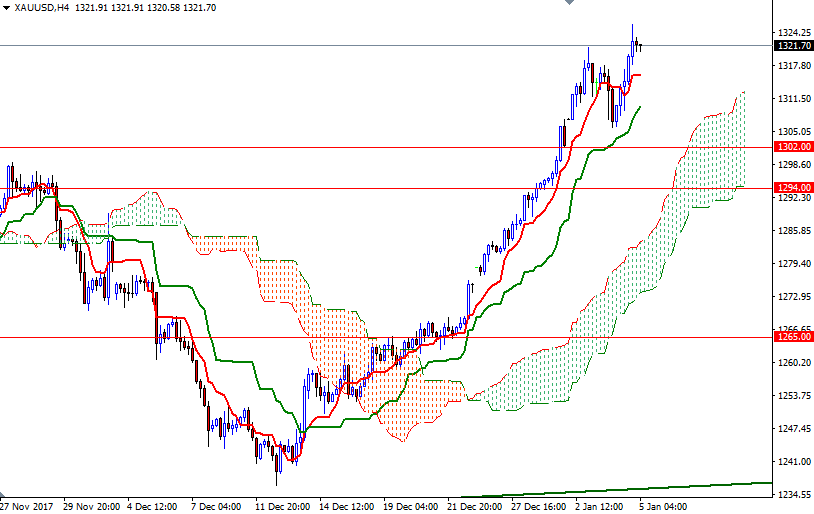

The bulls have the overall technical advantage, with the market trading above the Ichimoku clouds on the daily and the 4-hourly time frames. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, the market may remain range-bound ahead of the Labor Department’s employment report.

If XAU/USD falls below 1321-1320.50, we may test 1318 and 1316. A break below 1316 could trigger a fall to the 1313/2 area. The bears have to drag prices below 1312 to challenge the next support at 1309. To the upside, the initial resistance sits in the 1326.20-1323 area. If XAU/USD can successfully break through this barrier, prices will probably head to 1333/2. The bulls have to produce a close above 1333 in order to tackle 1340.