By: DailyForex.com

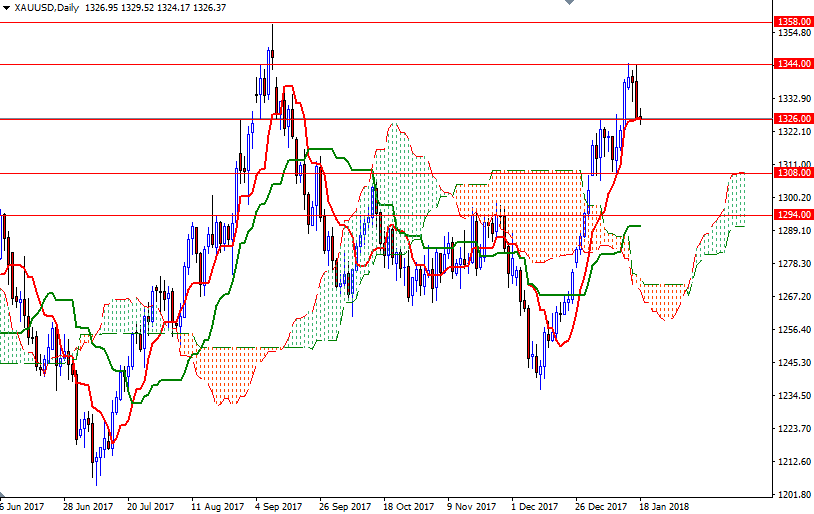

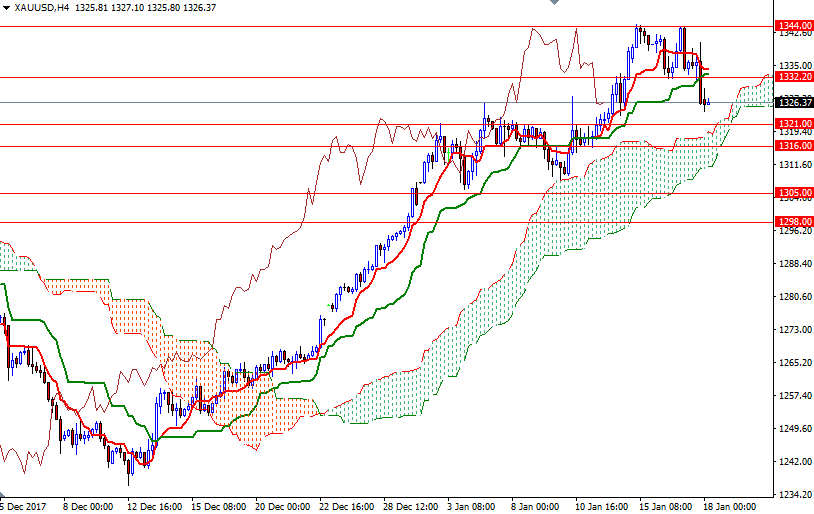

Gold prices fell $12.37 an ounce on Wednesday as a firmer dollar prompted investors to take profits from a recent rally to a four-month high. Technical selling was also behind gold’s 0.92% decline yesterday. XAU/USD tested the resistance at $1344 for the second time this week, but it was unable to break through. Consequently, prices fell below $1332 and headed back to the Ichimoku clouds on the 4-hourly chart.

Prices are still above the daily and the 4-hourly clouds, but the short-term charts suggest that a test of the 1316-1315.80 area is on the table unless prices can get back above the 1334/2 area. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) on the H4 chart converge in this area so the bulls will need to lift prices beyond there to revisit 1344. A daily close above 1344 indicates that the next stop will be 1350.80-1350.

To the downside, the initial support stands at 1326, followed by 1323/1. The bears have to drag the market below 1321 to challenge the aforementioned support in the 1316-1315.80 zone. If XAU/USD dives below 1315.80, then 1308/7 will be the next port of call.