GBP/USD

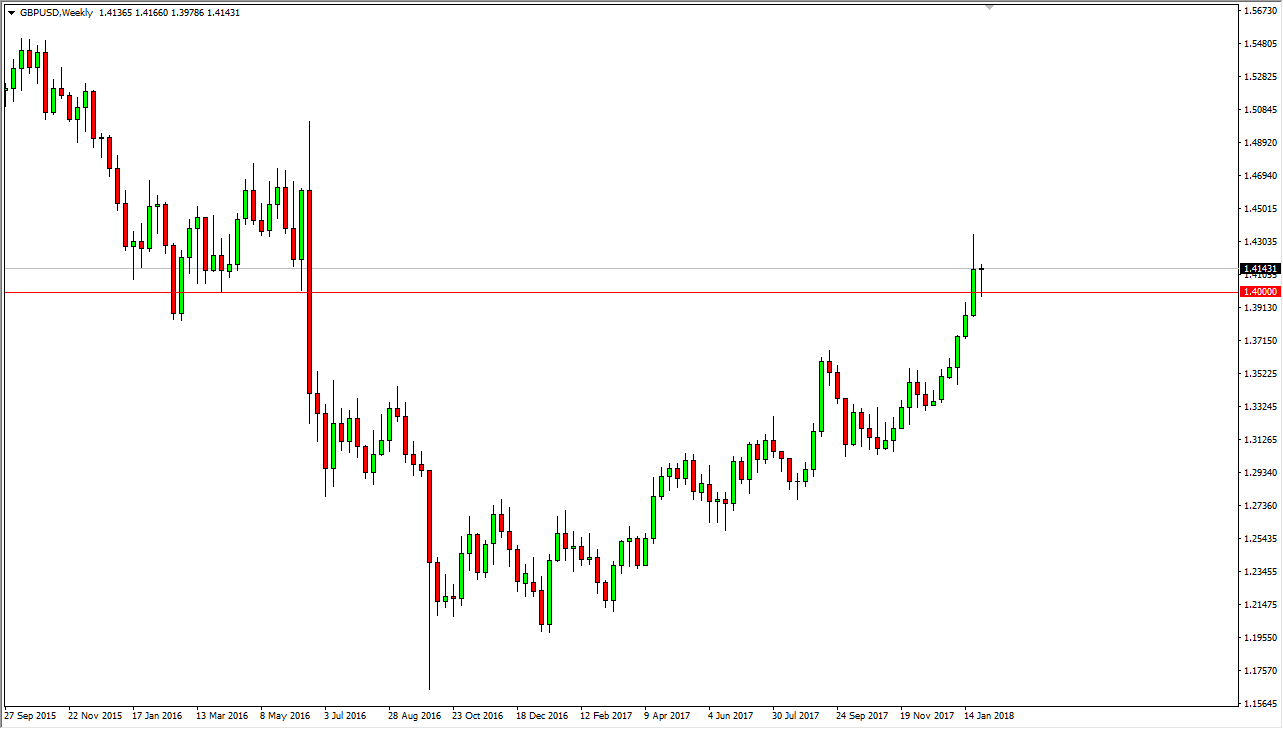

The British pound has been very noisy over the last couple of weeks, but the one thing it has been consistently is bullish. We have broken above the 1.40 level, an area that is significantly resistive, but by breaking above there, we turned around to find support at that level too, which is even more important. We are now in the middle of consolidation that extends to the 1.45 handle, so expect a lot of noise. I think that pullbacks should be buying opportunities, and I will look at them as such going forward. I think that selling is all but impossible as the markets have shown us just how bullish we are.

Keep in mind that the US dollar has been selling off rather significantly, and I believe that should continue to be the case most of this year. As the British pound was one of the most oversold currencies previously, it makes sense a lot of money is starting to flood back into it. I believe that will continue to be the case in February, and I look at short-term pullbacks on the daily chart is a nice opportunity to pick up value. If we can clear the 1.45 handle, the market is free to go to the 1.50 level after that, and perhaps offer more of a “buy-and-hold” scenario. Building a core position might be the way to go as well, giving you an opportunity to add to the market every time we do dip. If we were to break down below the 1.3750 level, at that point I would be, little bit more concerned about the uptrend, and might step on the sidelines. Based upon the candle for the last week of January, it looks like the buyers are very much into this market and will continue to push.