By: DailyForex

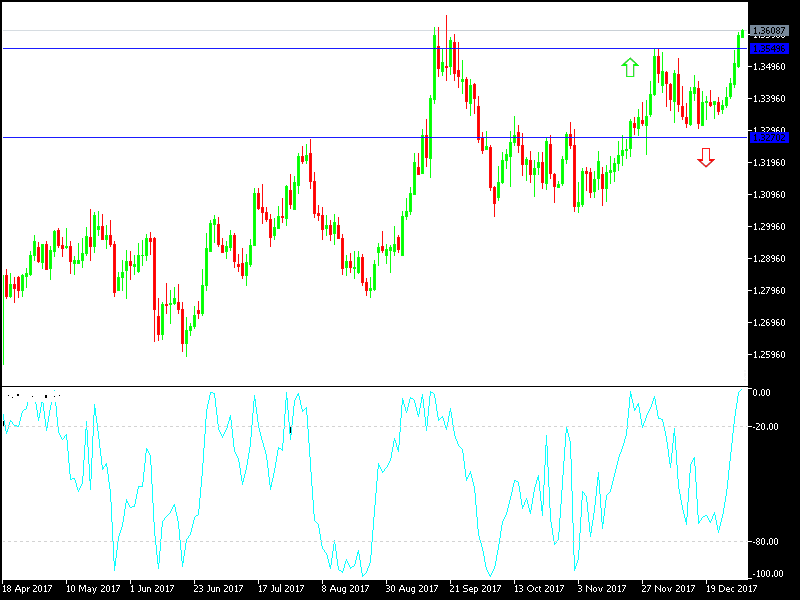

Over 5 trading sessions in a row, the gains of yesterday’s session were the strongest, as this pair moved strongly to the resistance level at 1.3600, the highest in 3 months, and at the beginning of Wednesday’s trading, the pair maintained this psychologically important resistant level and tested 1.3610. The daily chart for this pair shows that it is overbought and it will witness a bearish corrective move anytime, especially, if there were any new signs related to BREXIT negotiations. The recent gains for this pair took advantage from the US drop, as the Dollar Index reached its lowest level since September at 91.75 DXY, pressured by the drop in the US Treasuries amid fears that the passage of the US Tax Cut law will rapidly lead to a sudden raise in the inflation, and force the Federal Reserve board to increase the rates sharply in 2018. Federal rate raise expectations failed to provide momentum to the USD, as it usually does. The unemployment claims were at 245K last week, which is a historically low level. Separately, the US goods shortage raised by 2.3% in November, and the Chicago PMI reading increased to 67.6 in December, compared to the previous reading of 63.9. The last reading was the highest for the index since April 2011.

It clear that the pair is influenced strongly and effectively by the consequences and path of the BREXIT negotiations. The negotiations entered the second stage; the Trade Relations, after an almost done deal regarding the borders with Ireland. As wildly expected, Bank of England maintained by consensus of the monetary policy committee, led by Carney, the current monetary policy of the bank with interest rate at 0.50% and the asset purchase program worth 435 billion pound to support the UK economy which faced shocks since the country’s vote to leave the EU. Yesterday, there was an announcement about the US consumer confident, which retreated, but still around its highest levels for 17 years.

Technically:

The GBP/USD is in an upward corrective moves by settling above the 1.35 peak and the next resistance levels for this pair will be at 1.3635 and 1.3720. I still prefer selling the pair at each upward bounce, as the BREXIT fears are still standing and won’t be solved soon. On the bearish side, the nearest support levels for the pair are currently at 1.3445 and 1.3360, and will go down strongly in case it moved below 1.3300.

On the economic data front:

This pair will be awaiting an important announcement of the UK Construction PMI. And from the US, there will be an announcement of the manufacturing ISM and the Public Spending Index, then an announcement of the minutes of last Fed Reserve meeting. The market will monitor any updates regarding the BREXIT negotiations, as well as, Trumps internal and external policies.