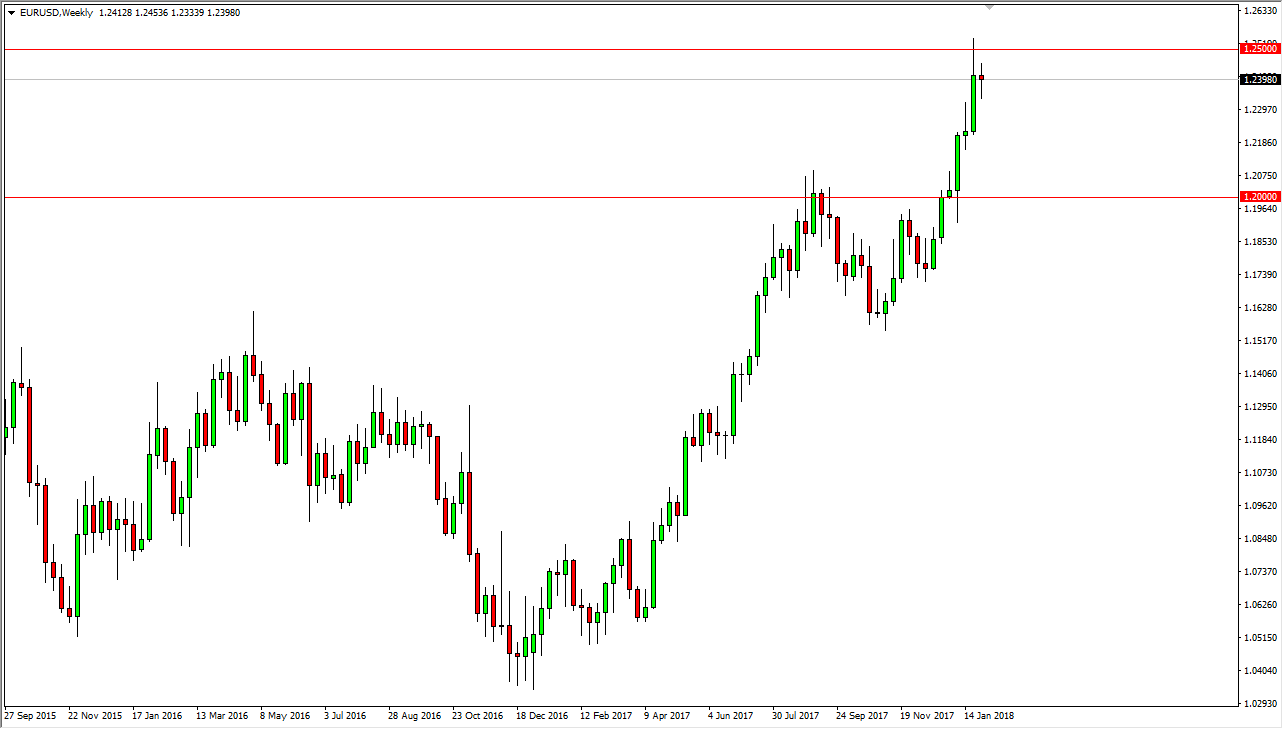

EUR/USD

The EUR/USD pair has been explosive to the upside over the last month or so, and more importantly, has broken above the top of a weekly bullish flag. By measuring this flag, I have a target of 1.32 over the longer term, and we have reached the 1.25 level so far. We have pulled back a little bit from there, which isn’t anything to worry about, because it makes sense to see resistance at these large, round, psychologically significant numbers. Going forward, I think the hard “floor” in the trend is at the 1.20 level, so I do not expect to see this market break down below there anytime soon. In fact, if it did I think the uptrend would be crushed.

In the meantime, I expect that these pullbacks are going to offer short-term value propositions, as we try to build up the necessary momentum to clear the 1.25 handle. Once we do, I think the market goes to the 1.30 level, and then the 1.32 handle. I don’t think we get that far this month, but certainly this will probably be a continuation of the “buy the dips” mentality that we have seen, as the US dollar continues to get pummeled. A lot of the momentum flowing towards the EUR at this point is money leaving the United States and going into foreign stocks. This is a trend I expect to see continue over the next several weeks.

I anticipate that the 1.23 level will be supportive, just as the 1.22 level will be. After that, there is a little bit of a “vacuum” down to the 1.20 level where everything hinges. Longer-term, I don’t see the reason for this market to turn around, it has quite plainly made its intentions known, and it looks like the buyers are already jumping back into the market after the slightest of pullbacks at the end of January.