Despite the positive US economic data and the strong support from the interest rate hike expectations in the current year, as suggested in the Federal Reserve’s last minutes of meeting released yesterday, and the US stock markets achieving new record levels, the USD is still facing strong pressure against other major trading partners. The US dollar index resumes the downtrend towards 91.80, as it stopped advancing on Thursday at 92.26. The EUR/USD maintain its bullish settlement above the psychological resistance level at 1.2000, and reached to the peak at 1.2088, its highest level in 3 months.

The dollar didn’t enjoy the optimism from the minutes’ details, as the Federal Reserve maintained the plan of 3 interest rate raise for 2018. The minutes suggested that the low inflation level in the country is transitional and that the job market strength will support facing its implications. The decision makers at the Federal Reserve agreed largely last month that the US tax reform would benefit the economy, however, they split in terms of whether the resulting growth will lead to faster rate raise this year.

Economic data from the Eurozone will support demands to the ECB to abandon the quantitative easing policy and the begin tightening its policy.

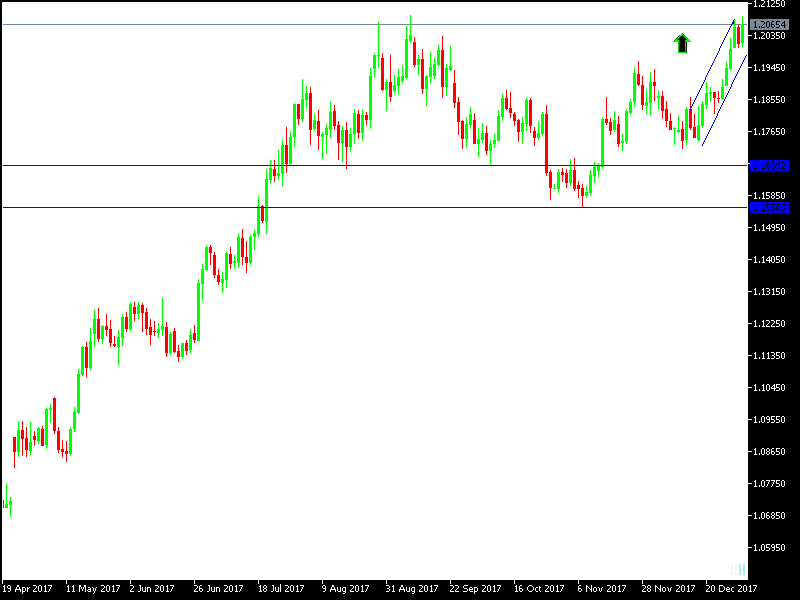

Technically: The EUR/USD is enjoying a strong bullish momentum in case it is established above the psychologically important top at 1.2000. The next resistance levels will be around 1.2068 and the top at 1.2205, which are tops supporting the upward trend for the pair. On the bearish side, the nearest support levels for the pair are currently at 1.1985 and 1.1900 and 1.1845, and the overall trend for the pair is still bullish until signs of a trend shift.

On the economic data front: Today’s agenda will focus on the inflation data from the Eurozone. From the US, there will be a release of the US job numbers, services ISM index and factory orders.