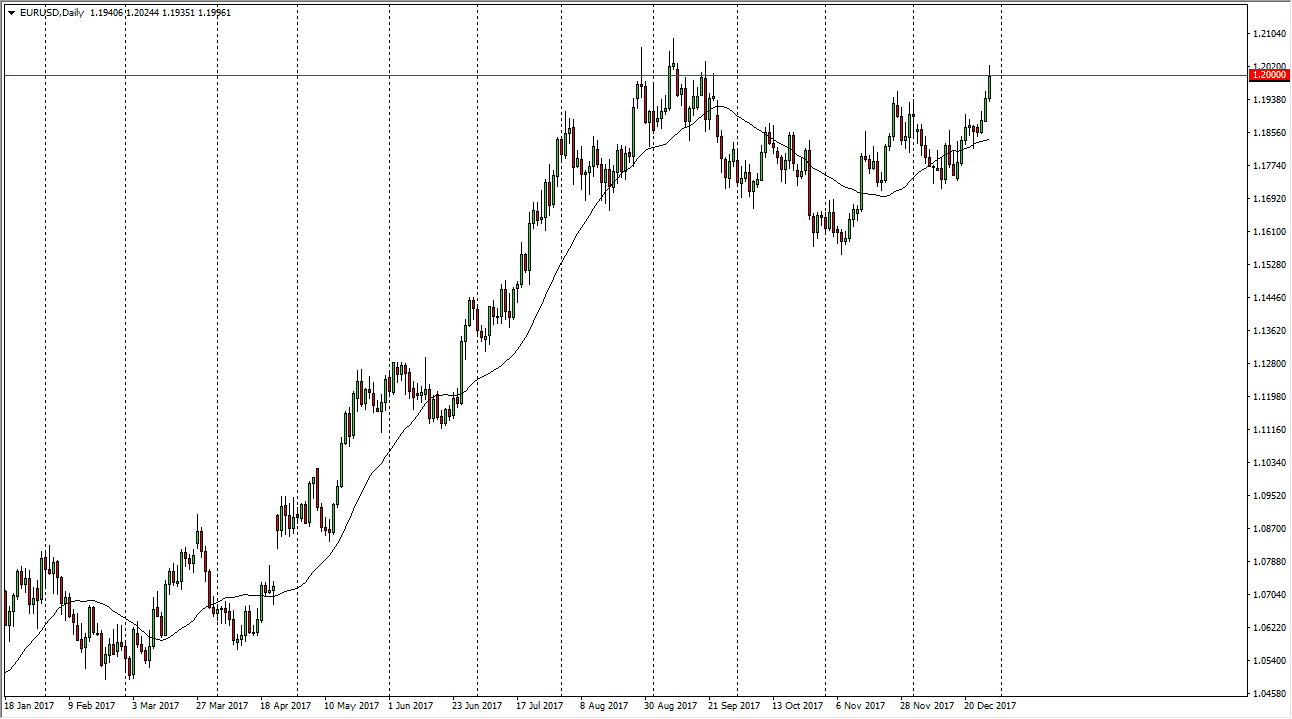

EUR/USD

The EUR/USD pair broke out to the upside during the trading session on Friday, slicing through the 1.20 level. We did get back some of the gains, which is not a huge surprise as traders closedown positions for the year. However, I think pullbacks at this point in time are going to offer value, and it’s only a matter of time before we break out above the 1.21 level. I can give you a couple of different reasons technically speaking why this market should go higher, not the least of which is a weekly bullish flag being broken to the upside, and now we have formed an inverted head and shoulders pattern on the daily chart. Either one of those suggest that were going to see several handles to the upside. I like buying dips and adding to a position that I have recently started as I think this pair is going to do quite well over the next several months.

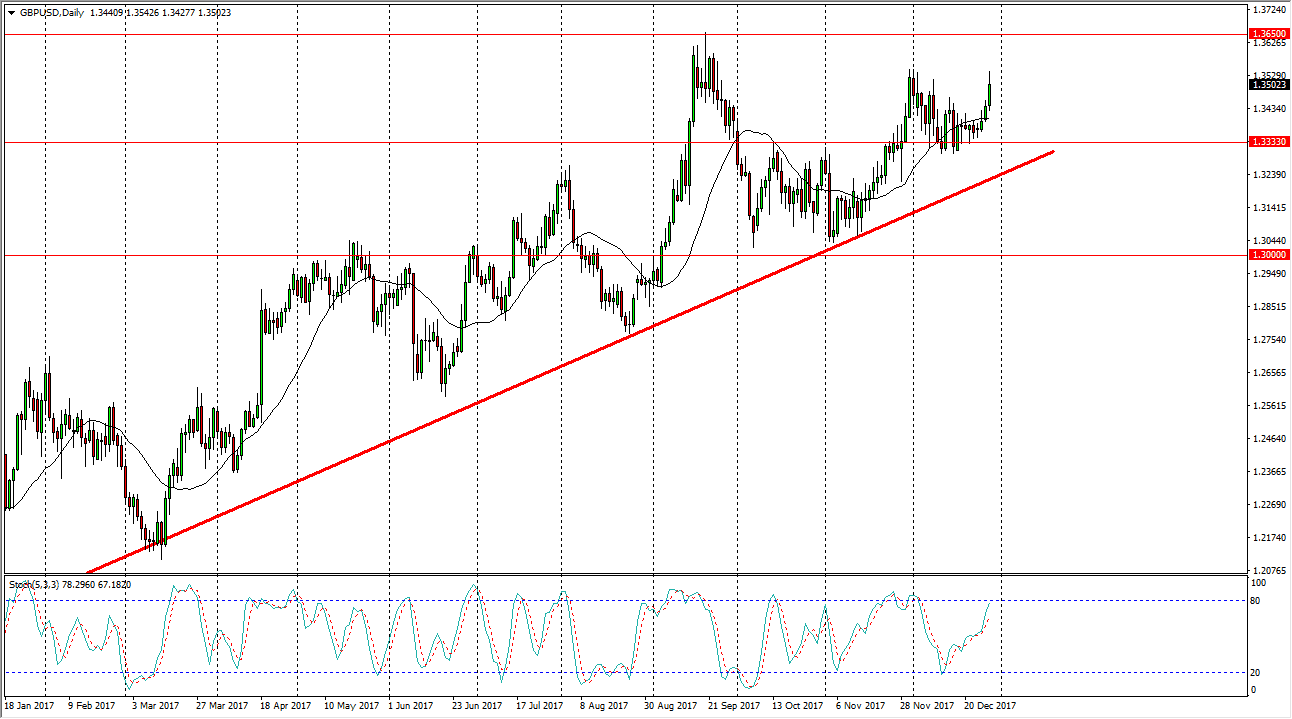

GBP/USD

The British pound rallied during the day as well, as the US dollar fell significantly. I believe that the 1.3333 handle underneath is support, and the pullbacks towards that area will attract value hunters. Given enough time, I think that the market should then go to the 1.3650 level above. Once that happens, we will have cleared a major gap on the longer-term charts that suggests that we could go towards the 1.50 level over the longer term. In the short term, I am a buyer of dips as I believe the British pound is starting to pick up steam, and of course the US dollar is falling against almost everything else. With this being the case, I do not have any interest in shorting this market until we break down below the bottom of the uptrend line at the very least.