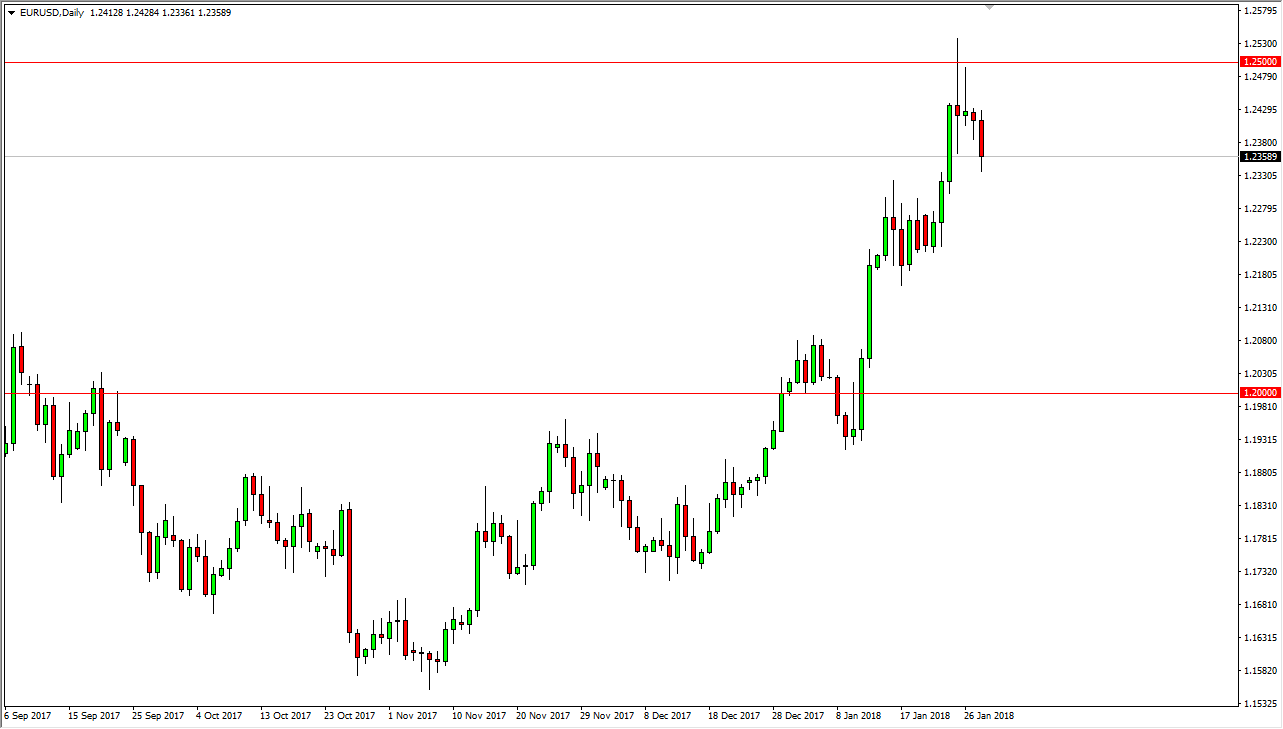

EUR/USD

The EUR/USD pair broke down a bit during the day on Monday, as traders came back from the weekend. We sliced through the 1.24 level, but when you look at the longer-term chart, you can see that there is clearly support below, especially near the 1.2275 level. Because of this, I’m going to let the market drift a little bit lower, and then perhaps start to nibble on long positions as it gives us an opportunity to build up momentum to break above the important 1.25 handle. If we break down below the 1.22 level, then I think we go down to the 1.20 handle, although I recognize that seems to be very unlikely at this point as the US dollar has fallen so dramatically against many other currencies, this looks like a bit of a reprieve in a longer-term rally.

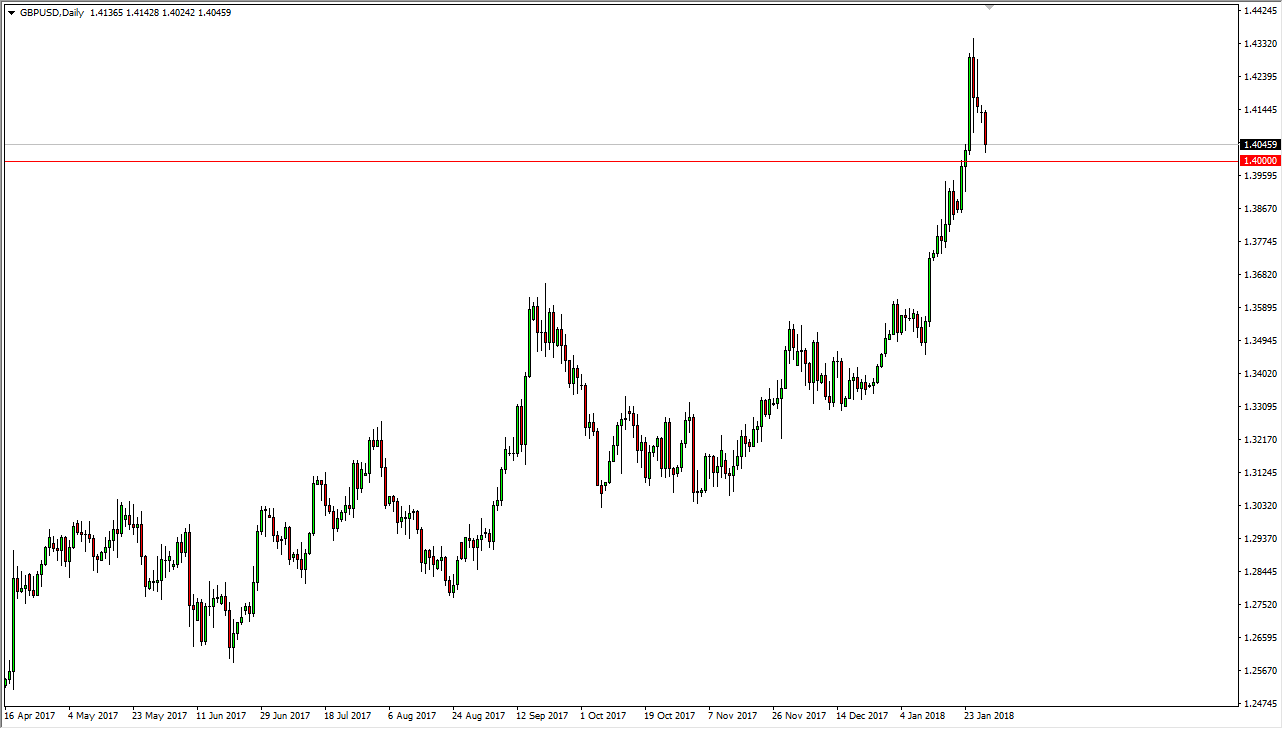

GBP/USD

If the EUR/USD pair is a little overbought, and the GBP/USD pair has gone a bit parabolic. That being said, I expect that the 1.40 level should be supportive, but I also recognize that we could drop as low as 1.37 before we start buying longer-term as well. I like the idea of the market going higher, over the longer term. I have a hard time believing that the market is going to break down significantly and for the long term, so is very unlikely that selling is possible at all. I think that the market continues to be bullish as the British pound has not only been oversold after the vote to leave the European Union, but the US dollar seems to be rolling over longer-term as well. Ultimately, I believe that the market goes higher, so be patient and wait for some type of bounce or supportive candle to take advantage of.