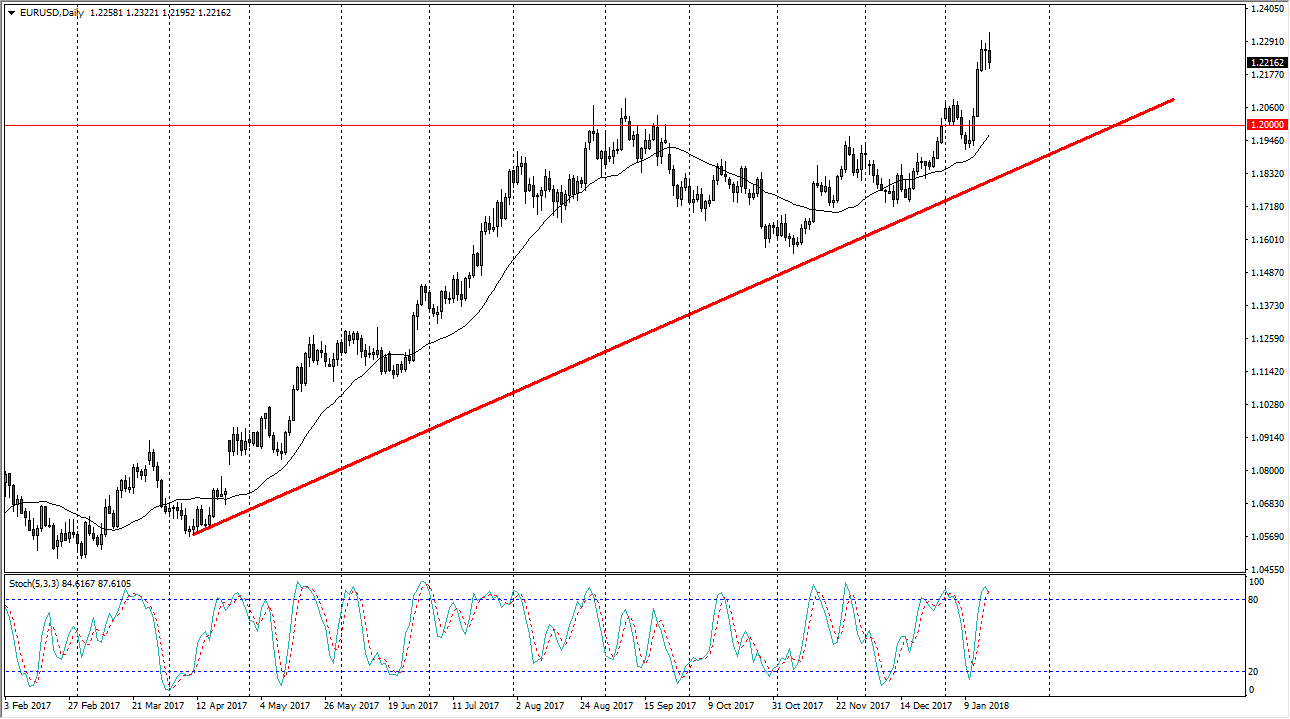

EUR/USD

The EUR/USD pair initially rally during the day on Wednesday, but found the area above a bit too exhaustive to continue going higher, and because of this when it up forming a shooting star. The shooting star like candle courses negative, and if we can break down below the hammer from the previous session, it should send this market down to the 1.21 level underneath, and then eventually the 1.20 level. The market breaking above the top of the candlestick for the day of course is very bullish, but on the other hand if we break down below the 1.20 level, the market should continue to go much lower. Volatility is the one thing we can probably count going forward, so I believe that being very careful with your trading position is probably the only way you can go. Pullbacks should attract attention though, and I think it should offer value.

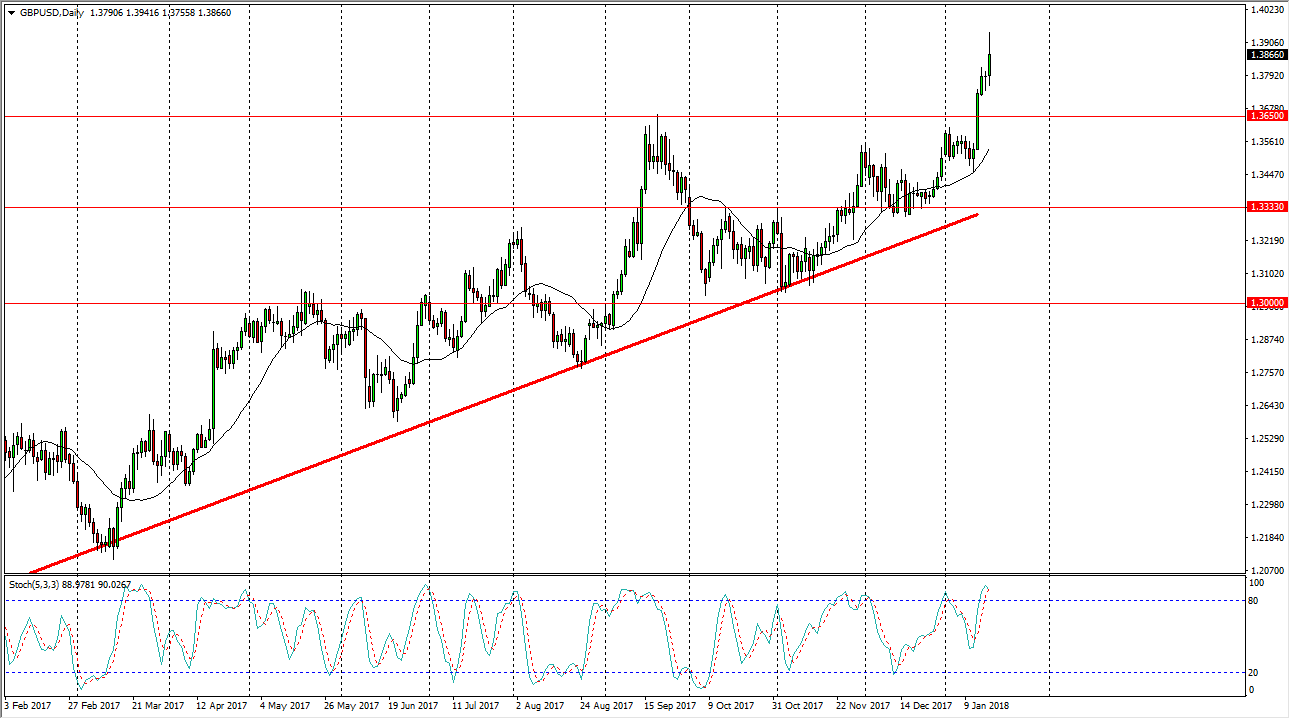

GBP/USD

The British pound initially fell during the day on Wednesday but then skyrocketed to break above the 1.39 level. However, by the end of the day we started to sell off again, so think we may get a short-term pullback. That short-term pullback should be a buying opportunity though, because clearing the 1.3650 level was a major breakout. In fact, I believe that level is essentially the “floor” in the market, and if we can stay above there I think dips should be thought of as buying opportunities. The 1.40 level above will be resistive, so it’s going to take a significant amount of momentum to finally break above there. Once we do, we could continue to go even higher, reaching towards the 1.45 level. Currently, I have no interest in shorting the British pound as it shows so much in the way of momentum.