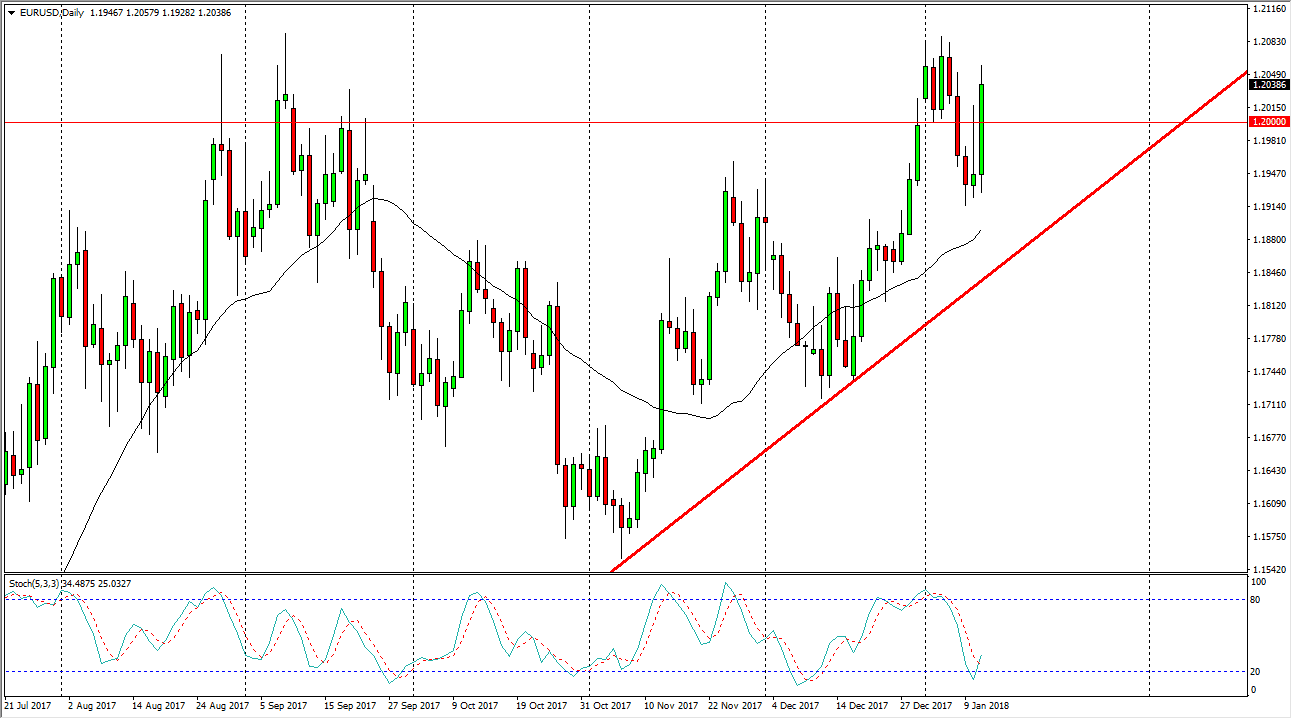

EUR/USD

The EUR/USD pair initially fell on Thursday, but found enough support near the 1.1925 level to bounce significantly, and break above the top of the shooting star from the previous session, which is always a very bullish sign in my estimation. We got less than anticipated economic numbers coming out of the United States, so this was a very negative day for the US dollar. However, I see a significant amount of resistance near the 1.21 level above, so it’s not until we break above that level that I am comfortable trying to put fresh money to work. I believe in buying dips, but I also believe in keeping your position size relatively small, at least until we can break above the major barrier. Once we do, I think that the market probably goes to the 1.25 level, which is something that I’m calling for later this year, perhaps early summer.

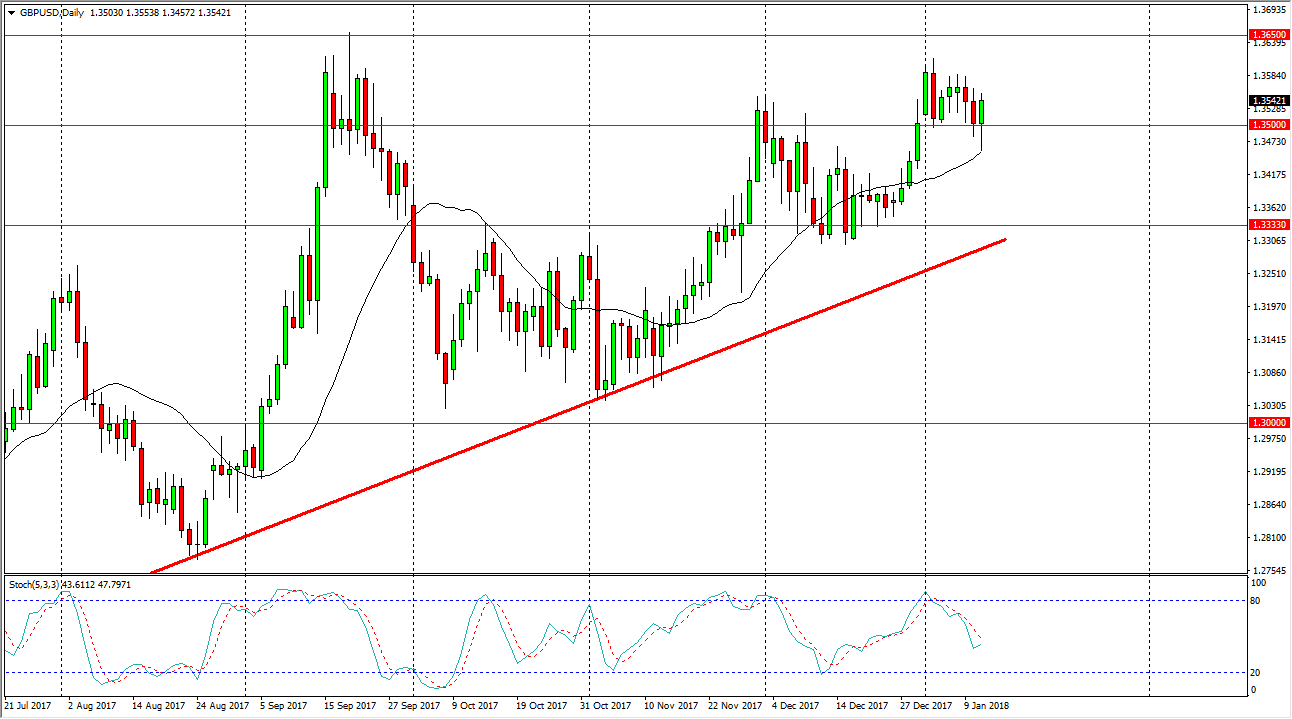

GBP/USD

The British pound fell against the US dollar during the trading session on Thursday, breaking below the 1.35 handle. By doing so, we ended up finding support, turning around to form a hammer, which of course is a very bullish sign. It looks as if the market is ready to wind up again and try to break above the all-important 1.3650 level above. If we can do that, that should send the market much higher, perhaps towards the 1.40 level next, and then eventually the 1.50 level. The US dollar is struggling in general, and the British pound is historically cheap, so this gives us a nice longer-term opportunity if you are patient enough. In the meantime, short-term pullback should offer value, and I believe that there is a hard “floor” in the market near the 1.3333 handle.