By: DailyForex

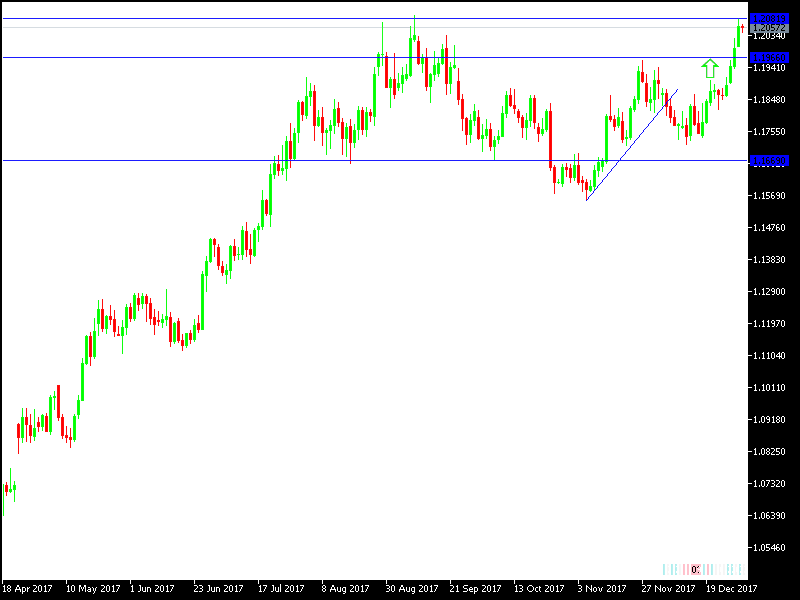

The EUR/USD is settling on top of the psychologically important resistance level at 1.2000 before the release of the minutes of the latest Federal Reserve meeting, during which, the Fed raised the interest rates for the 3rd time during 2017, and promised of more steps to raise the rates in 2018, under the leadership of the new head of the back, Jerome Bowel. Expectations are at 98% chance that the Federal Reserve will increase the interest rate as a first step in this month’s meeting. The pair moved upward towards resistance at 1.2080 during yesterday trading, which is the highest level in 3 months, before settling at 1.2050 at the time of writing. By doing that, the pair continues the upward move extending over 6 sessions in a row. Adding the pair’s gains was the continued pressure on the USD, with the Dollar Index reaching 91.75 DXY, the lowest level since September. The unemployment claims remained as is around 245K, with expectations that it would go down last week to 240K. The Chicago PMI reading was better at 67.6, the highest level since April 2011. The US stock markets retreated from record highs due to profit taking trades at the end of 2017.

Despite the positive US economic data recently, the passage of the US Tax Cut bill in a way that would stimulate the US economic power, the US dollar is still under pressure and it seems that the markets digested the content of this bill and its effects on the current US economy. The Euro ignored the victory of the pro-independence parties in the latest elections at the district of Catalonia, which brought back the political fears inside the Eurozone, after a calm pace within the largest economic power in the region, Germany, with Merkel closer to forming a coalition government. The EUR/USD will continue being affected by the directions of the US Federal Bank, with a hawkish policy including more steps to raise the US interest rates, and, the monetary policy of the European Central Bank, with worries of low inflation rates that have not reached 2%; the ECB’s inflation target. The US data yesterday showed a lower consumer confident, however, in 2017, it reached the highest level since 2000.

Technically:

The EUR/USD is enjoying a strong bullish momentum in case it is established above the psychologically important top at 1.2000. The next resistance levels will be around 1.2068 and the top at 1.2205, which are tops supporting the upward trend for the pair. On the bearish side, the nearest support levels for the pair are currently at 1.1985 and 1.1900 and 1.1845, and the overall trend for the pair is still bullish until signs of a trend shift.

On the economic data front:

Today’s agenda will focus on the unemployment change in Spain and Germany. From the US, there will be an announcement for the manufacturing ISM index, the Public Spending Index and the Minutes of the last Federal Reserve meeting.