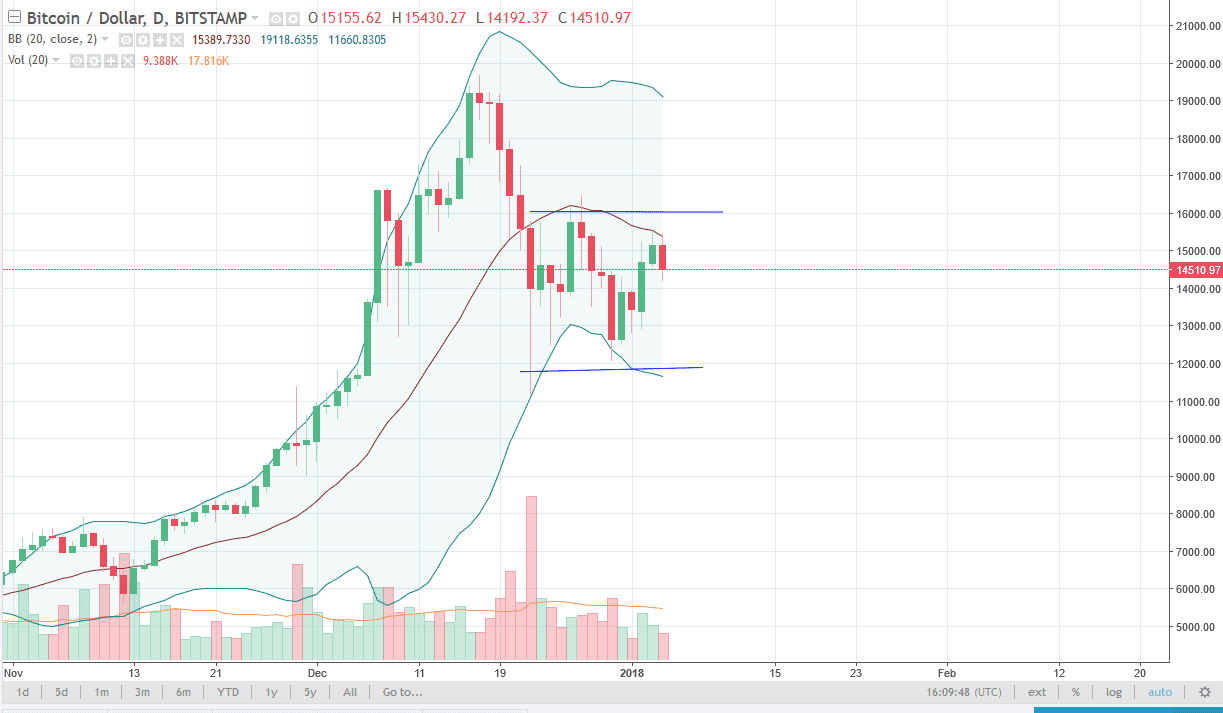

BTC/USD

Bitcoin tried to rally initially during the trading session on Thursday, but struggled above the $15,000 level. As I look at the chart, it’s easy to see a consolidation area between the $16,000 level above and the $12,000 level below there. I think that the market testing the 20 SMA and failing in the middle of the Bollinger bands suggests that we are going to continue to drop from here. I think that Bitcoin markets have struggled for clarity after the futures markets opened, and I think that we are currently looking for some type of value to place upon the crypto currency. I think that the malaise continues to be an issue with this market, as traders are trying to come to terms with whether the Bitcoin markets have entered a new phase. I believe that institutional investors in the market will probably make Bitcoin behave more like a chore market, and because of this it’s likely that the explosive gains are a thing of the past. Back and forth trading with an eye on the $12,000 level is how I look at Bitcoin currently against the US dollar.

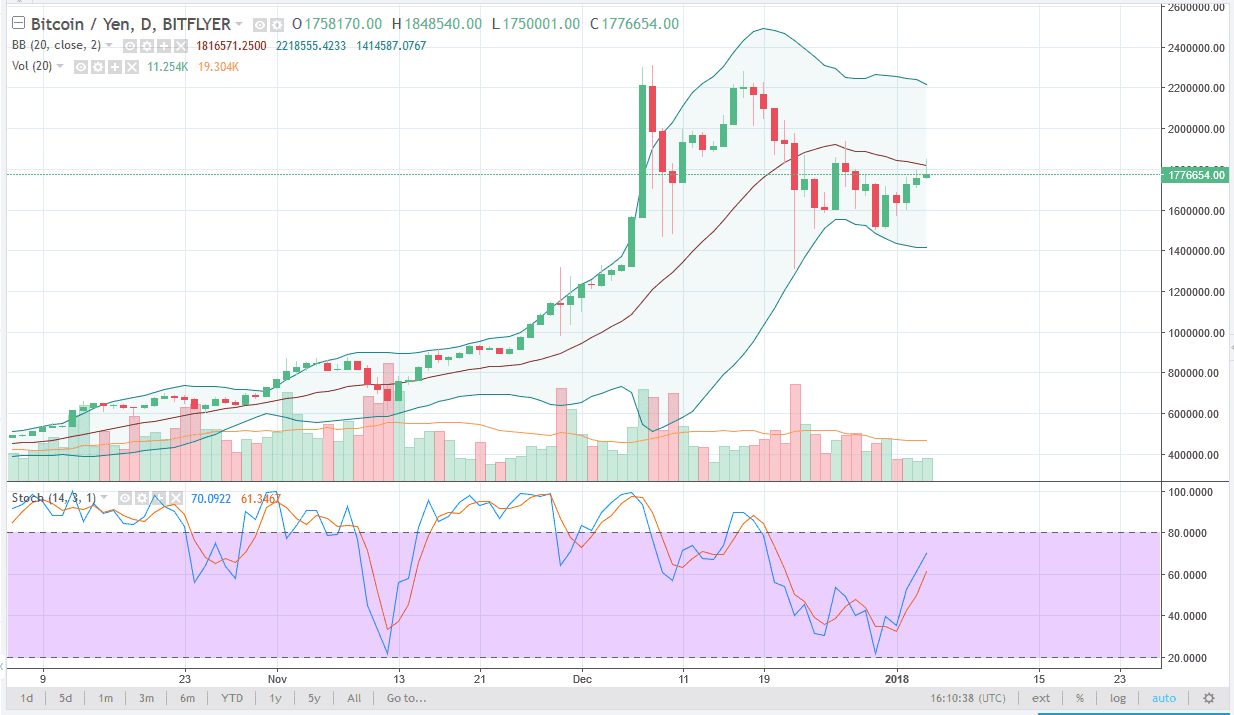

BTC/JPY

Bitcoin rallied a bit during the trading session against the Japanese yen, but struggled at the ¥1.8 million level, and more importantly for the design of this chart, the 20 SMA in the middle of the Bollinger bands. I believe that the market forming a bit of an exhaustive candle suggests that we are probably going to drop from here, perhaps reaching towards the ¥1.5 million level. If we do break above the shooting star for the day, I think it’s not until we clear the ¥2 million level that I am comfortable putting serious money to work. I believe in general though, Bitcoin is going to drift lower.