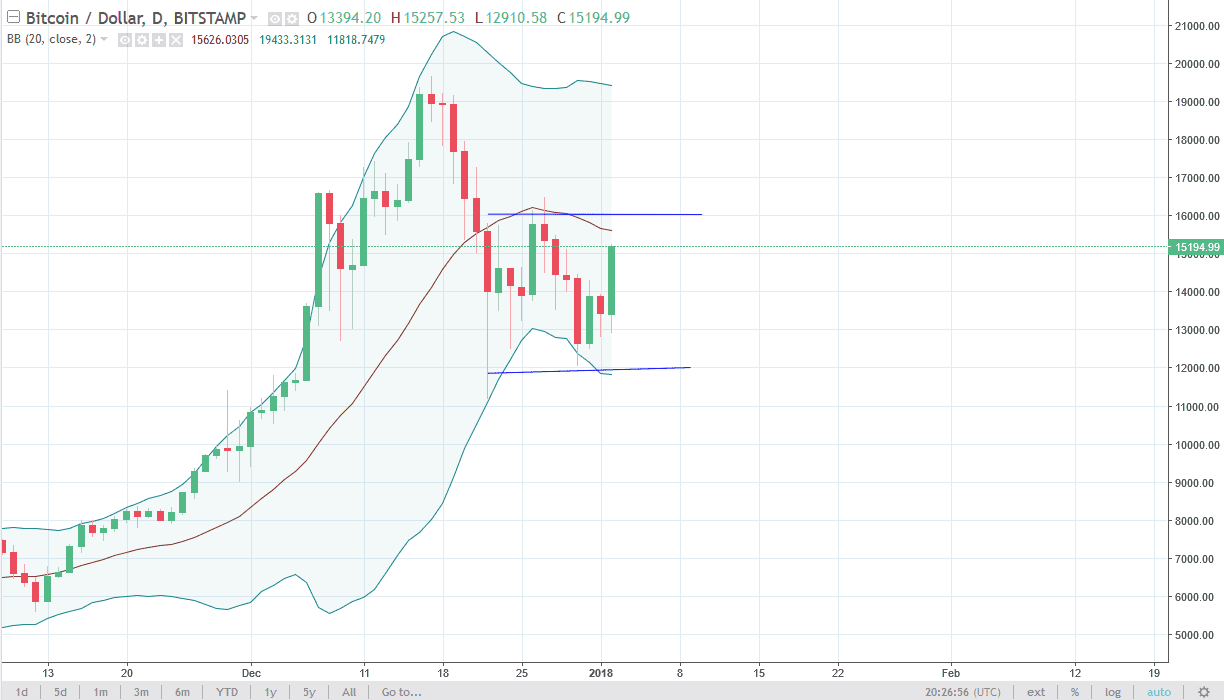

BTC/USD

Bitcoin initially fell during the trading session on Tuesday, but found enough support at the $13,000 level to rally significantly, gaining almost 13% by the time I record this. The $16,000 level above is resistance, as we continue to go sideways and in a back and forth manner. We are starting to see a bit of support in the market, but it’s not until we break above the 16,000 level that I think that the market is free to go higher for the longer-term move. We have had a significant pullback, so it’s perhaps of value hunting going on, and now the volume has picked up could be a sign of where we are ready to go next. If we were to break down below the $12,000 level, that would be extraordinarily bearish for the Bitcoin market, perhaps sending this down to the $8000 level.

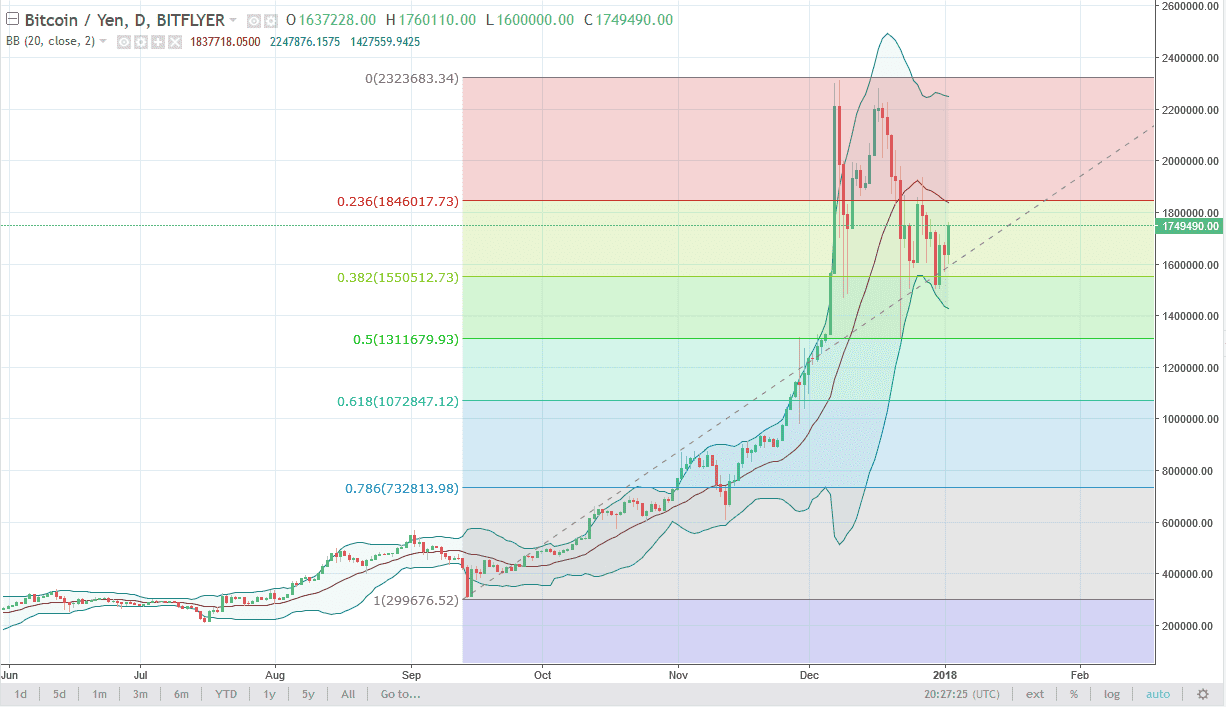

BTC/JPY

Bitcoin fell initially during the trading session against the Japanese yen but turned around to break above the ¥1.74 million level. I think that we are going to go looking towards the ¥1.9 million level, followed very closely by the ¥2 million level. If we were to break down below the ¥1.5 million level, we could break down significantly, but it appears as if the 38.2% Fibonacci retracement level is holding, and with Japan being 40% of the trading volume in the Bitcoin market, things look good for the crypto currency in the short term. Longer-term, I think we will try to reach the highs again, but we may need to bounce around a bit to build up enough momentum to continue the overall uptrend that we have seen.