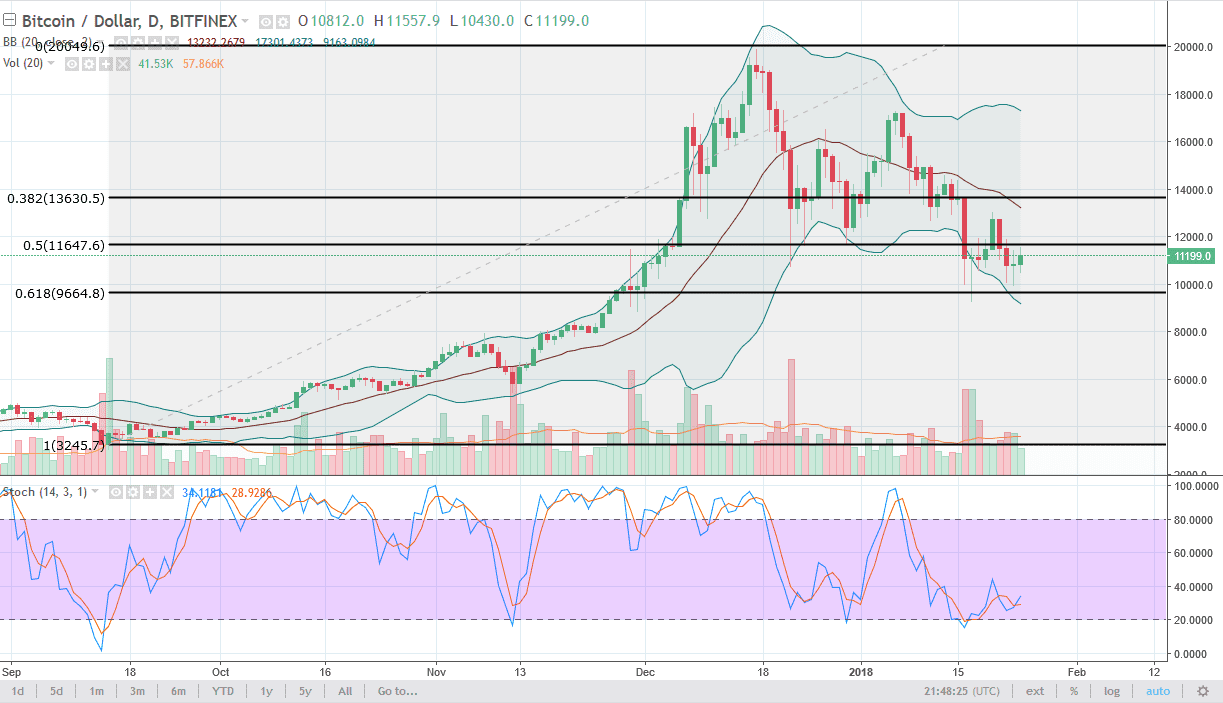

BTC/USD

Bitcoin had a slightly positive session during the day on Wednesday, as we continue to see support near the $10,000 level. What I find significant about this is that the $10,000 level also lines up quite nicely with the 61.8% Fibonacci retracement level, so therefore there are a couple of reasons to suspect there might be buying opportunities. However, I don’t see much in the way of volume, and that of course concerns me. Even though we are starting to see the market make a little bit of a stand in this area, the lack of volume is something that would keep me from getting overly excited. If we can break above the $12,000 level, I think we will go looking towards the $13,000 level. Once we get above there, then the market continues to go higher. This will be especially true if we get some type of volume, but right now it seems as if the volume is dropping, not gaining.

BTC/JPY

Bitcoin has gone back and forth during the trading session on Wednesday against the Japanese yen as well, and this is a market that I think is crucial for the health of the entire crypto currency space. This is because 40% of crypto currency trading is done in Japan, and of course Bitcoin is the “grandfather” of all of them. If we get volume picking up in this market, and a bullish candle, it’s likely that we will continue to go higher. Pullbacks at this point should be value, but only if we get more volume. If we don’t, I think we will break down below the ¥1 million level, and that should send this market to the ¥800,000 level, and possibly even lower. The 61.8% Fibonacci retracement level is crucial, and if you break down below there it’s almost always a catastrophic event. When it comes to the digital currency space, this is the most important chart you can follow.