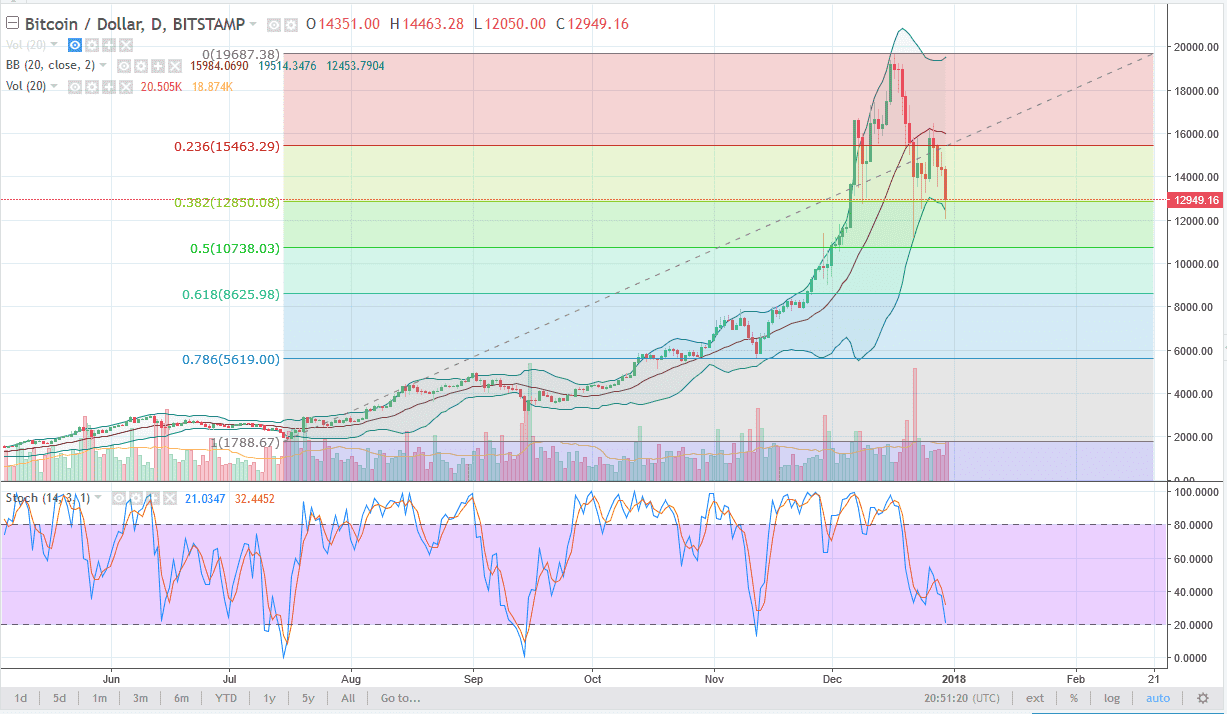

BTC/USD

Bitcoin traders have sold over the last couple of sessions, as we are below the $13,000 level at the time of this recording. It is the 38.2% Fibonacci retracement level of the recent move on the daily chart, but I think we are bound to go much lower. The 50% Fibonacci retracement is at the $10,700 region, and the 61.8% Fibonacci retracement level is closer to the $8700 level. I think that we are likely to see at the very least the 50% retracement level tested. The 20 SMA is starting to roll over, and it’s likely that we will continue to see selling pressure, at least in the short term. The stochastic oscillator is very negative, and I would be the first point out that the most recent heavy volume candle on the daily timeframe was decidedly negative.

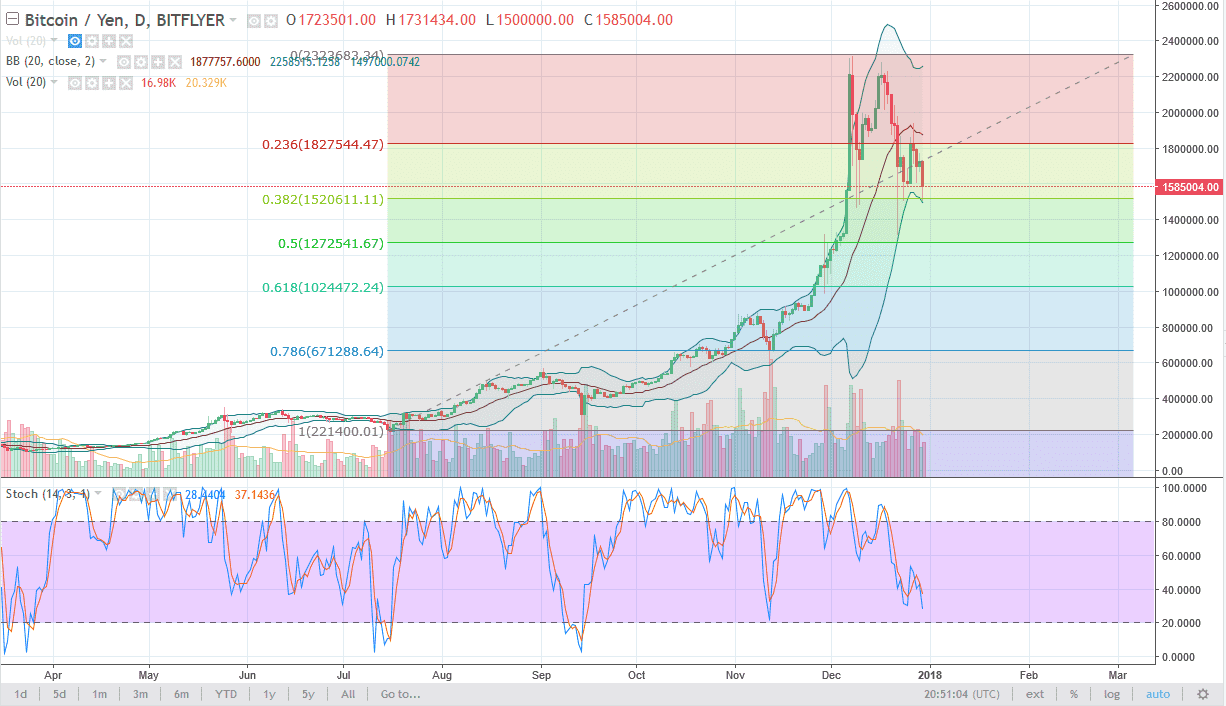

BTC/JPY

Bitcoin also is starting to roll over against the Japanese yen, which of course is a very negative sign as Japan is roughly 40% of all Bitcoin trading volume. Because of this, I think we are seeing a bit of a cooling off of the Bitcoin market, and I think it’s likely that we could go down to the ¥1.2 million level, or perhaps even the ¥1 million level. We really haven’t had much of a pullback after the massive rally, and you can see that we had most certainly gotten to be a bit parabolic. Because of that, this should be a healthy pullback that you can take advantage of. I would wait until we get a supportive candle underneath or better yet, and oversold condition on the stochastic oscillator and a cross, telling us that the buyers should come back into the market. When you do enter the market, do so slowly as you should have plenty of time.