BTC/USD

The traders sold off rather drastically during the trading session against the US dollar on Wednesday, but did get back much of the losses, forming a hammer on the daily chart. This is typically a bullish sign, as we have tested the 50% Fibonacci retracement level. However, the thing that concerns me is that we have seen so much in the way of heavy volume on the down days that I feel this rally is probably going to be looked at as an opportunity to sell at either higher levels, or to at least get back to breakeven. If we break down below the bottom of the candlestick for the session on Wednesday, we will go much lower. At this point, I don’t have much in the way of appetite for buying Bitcoin.

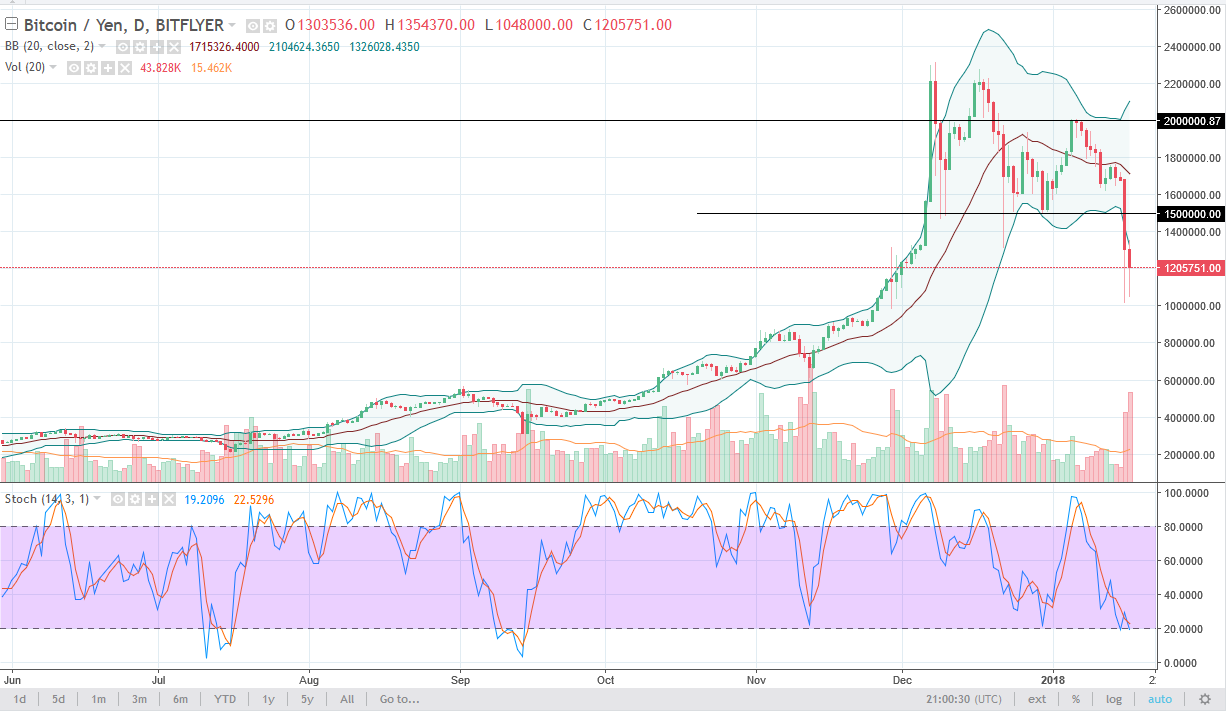

BTC/JPY

Depending on where you are the world, you may or may not pay attention to how Bitcoin trades against the Japanese yen. If you do not, that’s a huge mistake as the largest traders of Bitcoin are in Japan. In fact, some estimates are as high as 40% of global trade. Asia has lead the way for massive selling as of late, so the biggest problem that you will have is that a simple headline out of either South Korea or Japan, or even possibly China, could send this market right back down. We did test the vital ¥1 million level, and so far it has held, but at the end of the day I think there are a lot of nervous traders out there. A breakdown below the ¥1 million level is a significant break down, and could lead to an unwinding of the entire uptrend that the market had seen. At the very least, we have done massive amounts of damage to the psyche of the retail trader.