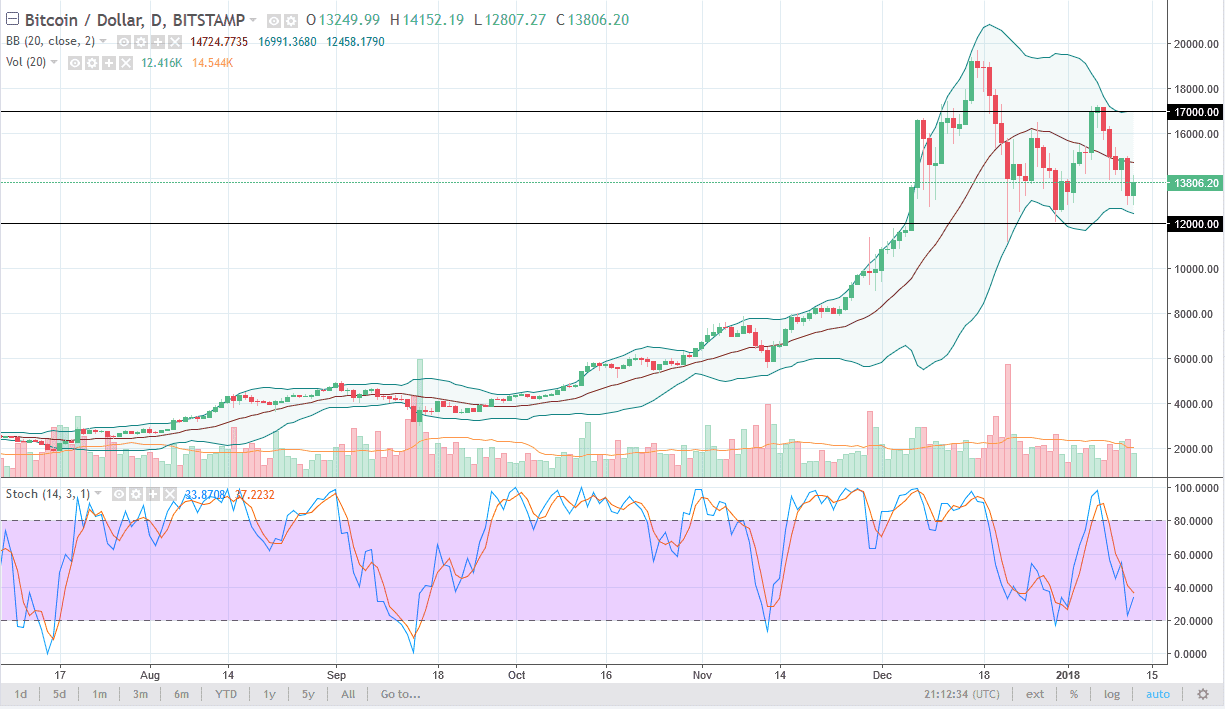

BTC/USD

Bitcoin had a slightly positive session on Friday, bouncing from the lows that we had put in on Thursday. Right now, it looks as if the market is going to continue to consolidate, and that means that the $12,000 level below is massive support. However, we don’t look like were ready to go anywhere anytime soon, so I think that a back and forth trading opportunity is presenting itself. We are simply going to bounce around in this general vicinity, offering range bound traders the opportunity to trade between the $12,000 level on the bottom, and the $17,000 level on the top. It is not until we break out of this range that we can put longer-term money to work. It seems as if the volatility has been sucked right out of this market after the futures markets opened in Chicago.

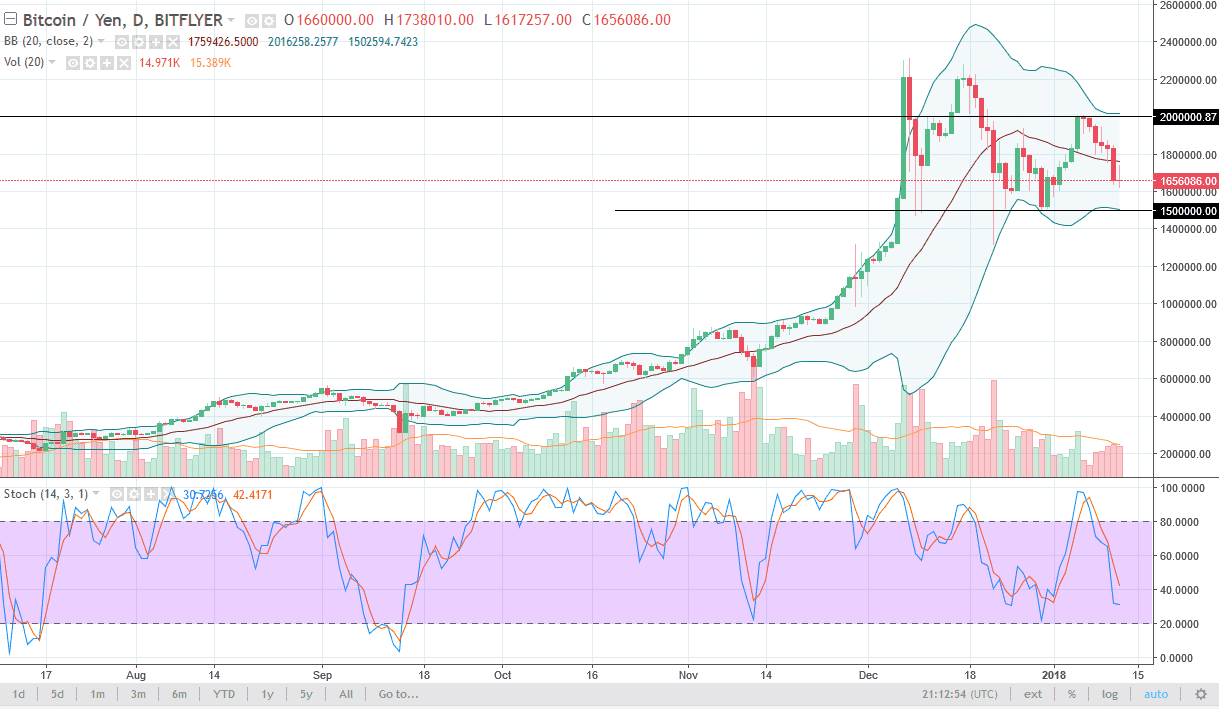

BTC/JPY

Bitcoin tried to rally against the Japanese yen during the trading session on Friday, but gave back most of the gains to in the day relatively unchanged. By forming a shooting star, it suggests that we are going to go looking towards the ¥1.5 million level on the bottom, which is the bottom of the overall range that we see in this market. I think there is a good chance that any bounce from there is going to struggle to gain rapidly, but could grind its way towards the ¥1.8 million level again, possibly the ¥2.0 million level. Expect consolidated action here as well, but it must be said that the market looks very limp at this point, and therefore I would not be putting a lot of money to work in Bitcoin right now. The Japanese yen has been strengthening against the US dollar, but it got pummeled in the Forex markets against other currencies. This could help this market eventually, but right now it isn’t.